Last updated: July 27, 2025

Introduction

Tetrabenazine is a selective monoamine-depleting agent primarily indicated for hyperkinetic movement disorders, notably Huntington’s disease chorea and Tourette syndrome. Approved by the FDA in 2008, tetrabenazine's commercial landscape has evolved amidst shifting clinical guidelines, competitor emergence, and regulatory challenges, making it a key focus for stakeholders aiming to gauge its market potential and investment viability.

Pharmacological Profile and Clinical Adoption

Tetrabenazine operates by reversible inhibition of vesicular monoamine transporter 2 (VMAT2), leading to decreased dopamine release, thereby reducing involuntary movements. Its efficacy in managing chorea associated with Huntington’s disease has facilitated its recognition within neurology departments globally. Clinical guidelines position tetrabenazine as first-line treatment in many regions, reinforcing steady demand due to the progressive, debilitating nature of Huntington’s disease and the absence of curative options.

However, its side-effect profile—including depression, sedation, and parkinsonism—limits widespread use, often necessitating careful patient monitoring. Newer agents, such as deutetrabenazine (a brominated derivative with improved tolerability), have entered the market, intensifying competition and influencing tetrabenazine's market dynamics.

Market Size and Growth Drivers

Current Market Estimates

As of 2023, the global market for tetrabenazine was valued at approximately US$150 million, with North America accounting for the majority share, driven by robust adoption, comprehensive insurance coverage, and strong clinical familiarity [1]. The Europe market follows, with emerging demand in Asia-Pacific countries due to increasing neurological disorder diagnoses and improved healthcare access.

Growth Drivers

- Rising Prevalence of Movement Disorders: The global prevalence of Huntington’s disease is estimated at approximately 3–7 per 100,000 individuals, with higher figures in regions with better diagnostic infrastructure [2]. As neurodegenerative diseases become more recognized, the demand for symptomatic therapies like tetrabenazine is poised for incremental growth.

- Increased Awareness and Diagnosis: Advances in neuroimaging and genetic testing have facilitated early diagnosis, enabling timely treatment initiation.

- Regulatory Approvals and Formulation Extensions: Expanded indicational approval for Tourette syndrome and options for formulations (e.g., extended-release versions) improve adherence and patient outcomes, further bolstering demand.

- Pricing and Reimbursement Policies: Favorable reimbursement schemes, particularly in developed markets, maintain therapeutic access and sustain revenue streams.

Competitive Landscape

Major Competitors and Alternatives

- Deutetrabenazine (Austedo): Approved in 2017 by the FDA, it offers improved tolerability with a longer half-life, reducing dosing frequency and enhancing patient compliance. Its market share has steadily increased, significantly challenging tetrabenazine’s dominance [3].

- Other Pharmacotherapies: Antipsychotics (e.g., haloperidol, risperidone) are used off-label for chorea, but with less efficacy and a different side effect profile.

- Emerging Treatments: Genotype-specific therapies and disease-modifying approaches are under research but remain distant from commercial availability.

Patent and Regulatory Status

Tetrabenazine itself lacks patent protection since its initial patent expired decades prior to recent generics, leading to a saturated generic market and pressure on pricing. However, branded versions or extended-release formulations may still hold exclusivity or market niche positions.

Regulatory and Legal Environment

The drug faces diverse regulatory landscapes, with some countries requiring rigorous post-marketing safety data due to neuropsychiatric adverse effects. Such requirements impact market access strategies and ongoing revenue generation, especially in emerging economies.

Legal challenges include patent litigations for new formulations and reimbursement hurdles, which influence product availability and financial planning.

Financial Trajectory and Future Outlook

Revenue Trends

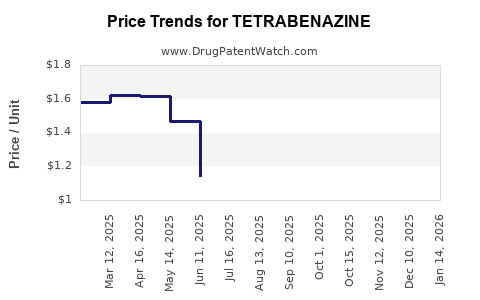

Tetrabenazine’s revenue growth has plateaued in mature markets due to heightening competition and generic alternatives. In North America, revenues have fluctuated between US$130–160 million annually since 2018, with slight dips attributable to the market penetration of deutetrabenazine and evolving clinical preferences [1].

R&D and Pipeline Activities

Dedicated efforts to develop improved VMAT2 inhibitors or combination therapies could rejuvenate tetrabenazine’s market relevance. Notably, extended-release formulations and improved safety profiles are under clinical investigation, aiming to address current limitations.

Market Penetration Strategies

Manufacturers focus on expanding indications, improving patient tolerability, and engaging in evidence-based educational campaigns for clinicians. Market access negotiations and pricing strategies are critical, especially in cost-sensitive regions.

Forecast

Analysts project a compound annual growth rate (CAGR) of approximately 2-3% over the next five years, driven by demographic trends, increased disease awareness, and generics' influence. However, the total market size may gradually decline or stabilize due to substitutive innovations and pricing pressures.

Key Challenges and Opportunities

Challenges:

- Side-effect profile limiting patient eligibility.

- Competition from newer agents with better tolerability.

- Patent expiration and market saturation in developed countries.

- Regulatory hurdles and safety concerns.

Opportunities:

- Expansion into underserved geographical regions.

- Development of improved formulations or combination therapies.

- Broader application for other hyperkinetic movement disorders.

- Strategic collaborations for pipeline development.

Conclusion

Tetrabenazine remains a vital therapeutic for hyperkinetic movement disorders, particularly Huntington’s disease. Its market is mature but faces significant headwinds from newer formulations, generics, and emerging therapies. The financial trajectory exhibits slow growth, with potential upticks from technological innovations and expanded indications. Significant opportunities hinge upon optimizing formulations, expanding geographic reach, and enhancing clinical safety profiles.

Key Takeaways

- Market Size & Drivers: Current valuation approximates US$150 million, with steady but modest growth driven by rising disease prevalence and expanded indications.

- Competitive Dynamics: Deutetrabenazine and generics significantly challenge tetrabenazine’s market share, prompting innovation and strategic marketing.

- Financial Outlook: Future revenues are expected to stabilize or marginally grow, contingent upon formulation improvements and regional market expansion.

- Strategic Focus: Companies must prioritize pipeline advancements, safety enhancements, and market access strategies to sustain profitability.

- Regulatory & Legislation: Navigating diverse global regulatory environments remains crucial for continued product access and revenue stability.

FAQs

-

What are the primary indications for tetrabenazine?

It is mainly prescribed for Huntington’s disease chorea and Tourette syndrome.

-

How does tetrabenazine compare to its main competitor, deutetrabenazine?

Deutetrabenazine offers improved tolerability, extended dosing intervals, and potentially better adherence, challenging tetrabenazine’s market dominance.

-

What are the main side effects limiting tetrabenazine use?

Depression, sedation, parkinsonism, and somnolence are notable adverse effects requiring careful management.

-

What is the impact of patent status on tetrabenazine's market?

Patent expiration has led to increased generic availability, exerting downward pressure on pricing and revenue.

-

Are there ongoing developments to improve tetrabenazine?

Yes, research focuses on extended-release formulations, safer profiles, and combination therapies to enhance efficacy and safety.

References

[1] MarketResearch.com. (2023). "Global Tetrabenazine Market Report."

[2] Parkinson’s Foundation. (2019). "Prevalence and diagnosis of Huntington’s disease."

[3] FDA. (2017). "Approval of deutetrabenazine (Austedo) for chorea in Huntington's disease."