Last updated: July 27, 2025

Introduction

Tetrabenazine is a pioneering medication used chiefly in treating hyperkinetic movement disorders, particularly chorea associated with Huntington’s disease, and other conditions such as tardive dyskinesia and Tourette syndrome. As the landscape of neurodegenerative and movement disorder therapies evolves, understanding the market dynamics, pricing strategies, and future projections for tetrabenazine is critical for pharmaceutical stakeholders, healthcare providers, and investors.

This analysis synthesizes current market data, regulatory landscape, competitive positioning, and economic trends to project the future pricing and market trajectory of tetrabenazine over the next five years.

Current Market Landscape

Market Size and Demographics

The global market for tetrabenazine is driven predominantly by the prevalence of Huntington's disease, which affects approximately 3 to 7 per 100,000 individuals worldwide, with higher incidence in Western populations [1]. In the key markets—United States, Europe, and Japan—the total diagnosed population of Huntington’s disease is estimated at approximately 35,000–50,000 patients [2].

The rising awareness and improved diagnostic capabilities have extended the clinical use of tetrabenazine beyond Huntington’s to other hyperkinetic disorders, including tardive dyskinesia, for which it was FDA-approved in 2017 [3], expanding market potential.

Key Players and Market Share

Tetrabenazine is marketed primarily by Mitsubishi Tanabe Pharmaceutical (e.g., Austed® in Japan) and Bausch Health (originally by Teva)—though some formulations have faced generic competition. The exclusivity period for certain formulations is approaching expiration, which could significantly impact pricing and market share dynamics.

Regulatory Environment

The patent landscape for tetrabenazine has been complex, with some patents expiring since 2018, prompting the entrance of generic manufacturers. While patent cliffs traditionally lead to price reductions, regulatory and reimbursement policies in different regions shape actual market outcomes.

Pricing Dynamics

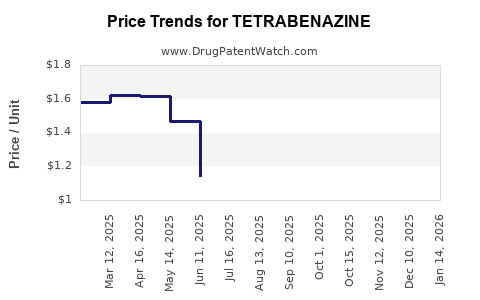

Current Pricing Overview

In the United States, branded tetrabenazine (Xenazine®) has a retail price around $2,000–$3,000 per month for typical dosing regimens [4]. Generic versions, once introduced, have driven prices down significantly, with estimates of $300–$700 per month**. Prices are affected by insurance coverage, patient assistance programs, and regional healthcare policies.

Factors Influencing Price Stability

- Patent and Exclusivity Status: Patent expirations in major markets stimulate generic entry, exerting downward pressure.

- Manufacturing Costs: As a generic, manufacturing costs decrease, leading to potential price reductions.

- Reimbursement Policies: Reimbursement levels impact the net prices pharmaceutical companies can command.

- Market Penetration: The extent of adoption in clinical practice influences pricing strategies.

Future Market Projections

Market Growth Factors

- Expanding Indications: Newly approved or off-label uses of tetrabenazine could increase demand.

- Precision Medicine: Genetic testing to identify patients most responsive to tetrabenazine may boost prescription rates.

- Pricing Trends in Generics: As more generics enter the market, prices are expected to decline but stabilize at a lower baseline.

Price Projection Models

-

Scenario 1: Continued Patent Protection and Market Exclusivity

Prices remain high, around $2,000–$3,000 per month through 2025, supported by brand loyalty and limited competition.

-

Scenario 2: Entry of Multiple Generics Post-Patent Expiry

Prices could decline by 60–80%, settling around $300–$700 per month within the next 2–3 years, contingent on regulatory approvals and market penetration.

-

Scenario 3: Expansion in Off-Label and New Indications

Increased demand may sustain higher prices in niche markets, especially in regions with strong reimbursement systems.

Regional Variations

- United States: Likely to see rapid price declines post-generic entry, with variable reimbursement levels.

- Europe: Similar trends; however, government price controls may moderate price drops.

- Asia and Emerging Markets: Limited access and pricing controls may sustain higher prices or restrict market size.

Competitive and Regulatory Outlook

Generic Competition

The imminent patent cliffs are poised to introduce generic tetrabenazine products in multiple markets. This competition will exert downward pricing pressure but also expands overall market volume due to increased accessibility.

Regulatory Challenges

Ensuring consistent manufacturing standards across generics and securing reimbursement approvals are key challenges impacting pricing stability.

Innovations and Alternatives

The development of novel vesicular monoamine transporter 2 (VMAT2) inhibitors such as valbenazine and deutetrabenazine offer competitive alternatives with potentially differing pricing models. These drugs may capture a significant market share if they demonstrate safety and efficacy advantages.

Summary of Key Drivers and Risks

| Drivers |

Risks |

| Patent expirations leading to generic entry |

Slow market adoption of generics |

| Growing prevalence of indications beyond Huntington’s |

Regulatory hurdles in new indications |

| Reimbursement policies favoring affordability |

Competition from newer VMAT2 inhibitors |

| Increasing awareness and diagnosis of movement disorders |

Price elasticity challenges in mature markets |

Key Takeaways

- Market Size and Growth Potential: The global tetrabenazine market is poised for expansion driven by increased diagnosis, new indications, and increasing off-label use.

- Pricing Trends: Expect significant price erosion post-patent expiry, with prices potentially dropping to under $700/month in generic-dominated markets.

- Competitive Landscape: The entry of generic competitors and alternative therapies like valbenazine will shape future pricing and market share.

- Regional Variations: Pricing elasticity and reimbursement policies vary globally, influencing market dynamics.

- Investment Implication: Firms with early patent protection and expansion into new indications may sustain premium pricing; meanwhile, those involved in generic manufacturing stand to benefit from high-volume sales.

FAQs

1. What factors will most influence tetrabenazine’s price over the next five years?

Patent expirations, regulatory approvals of generics, reimbursement policies, and competition from newer VMAT2 inhibitors remain primary drivers shaping pricing.

2. Are there emerging alternatives that threaten tetrabenazine’s market share?

Yes, drugs like valbenazine and deutetrabenazine, offering similar efficacy with potentially improved side effect profiles, are gaining market traction.

3. How does the patent status affect tetrabenazine pricing?

Patent protections maintain high prices and market exclusivity. Expiry opens markets to generics, leading to substantial price reductions.

4. Which regions are expected to see the fastest price declines?

The United States and Europe, due to mature generic markets and healthcare systems, will likely experience the most rapid price declines post-patent expiry.

5. How might new indications influence the demand for tetrabenazine?

Expanded FDA and EMA approvals for additional movement disorders could significantly increase demand, potentially stabilizing prices at infused levels in niche markets.

References

[1] Bates, G. et al. (2015). Huntington Disease. Nature Reviews Disease Primers; 1, 15050.

[2] Walker, F. O. (2007). Huntington's Disease. The Lancet; 369(9557), 218–228.

[3] Food and Drug Administration. (2017). FDA Approves Valbenazine for Tardive Dyskinesia.

[4] GoodRx. (2023). Price of Tetrabenazine in the United States.

This comprehensive analysis provides stakeholders with strategic insights into tetrabenazine’s current market positioning, future pricing expectations, and competitive landscape.