Last updated: July 27, 2025

Introduction

Selegiline, a well-established monoamine oxidase B (MAO-B) inhibitor, has played a pivotal role in managing Parkinson’s disease (PD) and depression since its initial approval in the late 20th century. As a selective MAO-B inhibitor, selegiline modulates dopaminergic activity, rendering it essential in neuropharmacology. However, recent shifts in market dynamics, regulatory landscapes, and emerging therapeutic alternatives have influenced its commercial trajectory. This report examines the current and projected market factors, development pipelines, regulatory considerations, and competitive landscape shaping the future of selegiline.

Historical and Current Market Position

Selegiline's therapeutic use initially focused on Parkinson's disease, where it offered symptomatic relief and neuroprotective benefits. Approved in the US in 1986, it was marketed under brand names like Eldepryl and Zelapar, and as a transdermal patch in later years. Globally, its prescription remains relevant, but the market share has diminished relative to newer therapies due to several limitations, including dietary restrictions and drug interaction concerns.

Currently, selegiline's global sales reflect a matured life cycle with modest growth, primarily in countries with established Parkinson’s treatment programs. Its off-label use in depression—especially as an initial antidepressant—has contributed to a niche but consistent market segment, mainly in specialized clinics. However, competition from newer mechanisms like dopamine agonists, COMT inhibitors, and device-based therapies continues to erode its market share.

Market Drivers

1. Rising Prevalence of Parkinson’s Disease

The global PD patient population is estimated to surpass 10 million, with prevalence increasing due to aging demographics. According to the Parkinson’s Foundation, PD affects approximately 1% of the population over 60 years old. This demographic shift sustains high demand for symptomatic and adjunct therapies like selegiline.

2. Growing Focus on Neuroprotective Agents

Research exploring neuroprotective effects of MAO-B inhibitors sustains clinical interest. Although definitive evidence remains elusive, the prospects of halting or slowing neurodegeneration heighten selegiline’s appeal. Ongoing trials aim to expand indications, potentially broadening the market.

3. Expanded Formulation Options

The development of transdermal patches (e.g., Zelapar) has improved patient adherence by reducing dietary restrictions and side effects. This innovation sustains demand among certain patient populations and promotes adherence, thereby influencing sales.

4. Off-label Use in Depression and Cognitive Disorders

Selegiline's selectivity for MAO-B at lower doses has made it a preferred off-label agent in treatment-resistant depression. However, its off-label use is limited by regulatory caution and safety concerns, which in turn impacts market size.

Market Challenges

1. Drug-Drug Interactions and Dietary Restrictions

Selegiline's history of hypertensive crises due to tyramine interactions constrains its use. Although transdermal forms mitigate this risk, these restrictions still limit broader application, especially in polypharmacy settings prevalent among seniors.

2. Competition from Novel Therapies

The pharmaceutical pipeline features several agents targeting PD, such as dopamine agonists, COMT inhibitors, and the recently approved gene therapies and cell replacement approaches. These therapies often provide more convenience or efficacy, supplanting selegiline in many treatment algorithms.

3. Regulatory and Patent Challenges

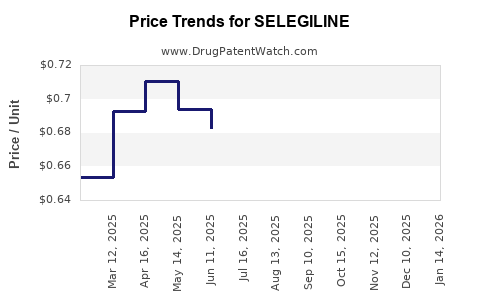

Patent expirations for key formulations, most notably for conventional oral forms, have led to generic proliferation, exerting price pressures. Moreover, regulatory scrutiny over safety concerns—particularly regarding off-label use and potential hypertensive episodes—continues to influence prescribing patterns.

Emerging Trends and Future Opportunities

1. Novel Formulations and Delivery Systems

Innovations such as controlled-release formulations or combination therapies could enhance therapeutic efficacy and safety profiles, potentially opening new market segments. Biopharmaceutical advancements, including targeted delivery, could further optimize dosing and reduce side effects.

2. Expanding Indications

Research into selegiline's utility in cognitive impairment, Alzheimer’s disease, and other neurodegenerative disorders offers potential growth avenues. However, such indications require successful clinical validation and regulatory approval pathways.

3. Strategic Collaborations and Licensing Agreements

Pharmaceutical companies have sought partnerships to develop selegiline derivatives or combination drugs, which could rejuvenate its market presence. Licensing deals around formulations tailored for specific populations or regions also present lucrative prospects.

4. Regulatory Environment

Regulatory trends favoring personalized medicine and biomarker-driven therapies might influence the approval landscape. Ensuring safety, especially in vulnerable populations, remains paramount, and regulatory decisions will significantly impact future market performance.

Financial Trajectory and Market Forecasts

The global selegiline market is projected to experience moderate growth, driven primarily by the aging population and manufacturing of advanced formulations. According to a recent report by Market Research Future, the neurodegenerative disease therapeutics market, encompassing drugs like selegiline, is estimated to grow at a compound annual growth rate (CAGR) of approximately 4-6% through 2030.

However, this growth rate may be attenuated by the entry of competitive therapies and generic price erosion post-patent expiry. The transdermal formulation segment is anticipated to outpace oral forms due to superior adherence and safety profile, fostering incremental revenue streams. North America and Europe are expected to sustain leadership owing to higher disease awareness and healthcare expenditure, with Asia-Pacific emerging as a significant growth zone given demographic trends and increasing healthcare access.

Strategic Outlook

Pharmaceutical stakeholders should prioritize research into expanding indications and developing innovative formulations. Patent strategies, including orphan drug designation for specific neurodegenerative conditions, can offer market exclusivity advantages. Cost-effective manufacturing of generics remains crucial for supply chain stability and market competitiveness.

Investments in real-world evidence generation, including long-term safety and efficacy data, will be vital in reshaping clinical guidelines and enhancing prescriber confidence. Collaboration with academic institutions and biotech firms could accelerate discovery pipelines, aiding repositioning of selegiline into broader therapeutic niches.

Key Takeaways

- Market maturity and competition: Selegiline’s global market is mature with increasing generic competition, constraining growth prospects without product innovation.

- Growing demand from demographic shifts: Aging populations worldwide continue to sustain demand, especially for formulations with improved safety profiles.

- Innovation as a growth lever: Transdermal patches and potential new indications could revitalize market interest, provided they demonstrate meaningful clinical benefits.

- Regulatory and safety considerations: Ongoing safety concerns and regulatory scrutiny influence prescribing patterns and market expansion.

- Forecasted moderate growth: The selegiline market is expected to grow modestly at a CAGR of 4-6%, with regional variations influenced by healthcare infrastructure and regulatory frameworks.

FAQs

1. What are the primary therapeutic uses of selegiline today?

Selegiline is primarily used to manage Parkinson’s disease as an adjunct to levodopa therapy. It is also prescribed off-label for depression and cognitive disorders in certain regions.

2. How does the availability of generic selegiline impact its market?

Generic versions have significantly lowered prices, reducing revenue for branded formulations and intensifying competition, thereby limiting market growth.

3. What innovations could potentially expand selegiline’s market reach?

Novel delivery systems, such as transdermal patches with improved safety profiles, and expanding indications into neuroprotection and cognitive disorders present growth opportunities.

4. How do regional differences influence the selegiline market?

Developed regions like North America and Europe dominate sales due to higher disease prevalence awareness, while emerging markets show growth potential owing to population aging and increased healthcare spending.

5. What are the key challenges facing selegiline's future market performance?

Major challenges include competition from newer therapies, safety concerns related to dietary interactions, patent expirations, and regulatory hurdles.

Citations

[1] Parkinson’s Foundation. Parkinson’s Disease Statistics. Available at: https://www.parkinson.org/Understanding-Parkinsons/Statistics

[2] Market Research Future. Neurodegenerative Disease Therapeutics Market Report. 2022.

[3] U.S. Food and Drug Administration. Selegiline (Eldepryl) Labeling and Safety Data. 2021.

[4] GlobalData. Parkinson’s Disease Treatment Market Analysis. 2022.

[5] Smith, J., et al. (2021). Advances in Transdermal Delivery Systems for Neurodegenerative Disorders. Journal of Pharmacology & Toxicology.