Last updated: July 28, 2025

Introduction

Bupivacaine, a long-acting amide-type local anesthetic, remains a cornerstone in regional anesthesia, including epidural, spinal, and nerve block procedures. Its high potency, prolonged duration of action, and favorable safety profile have sustained its demand across global healthcare markets. As the pharmaceutical landscape evolves with technological innovations, regulatory shifts, and rising healthcare expenditure, understanding the current and projected market dynamics for Bupivacaine offers critical insights for stakeholders ranging from manufacturers to healthcare providers.

Market Overview

Product Profile and Therapeutic Profile

Bupivacaine was first introduced in the 1960s and rapidly gained prominence due to its efficacy in providing extended anesthesia and analgesia. Its chemical stability and low absorption rate contribute to its widespread utilization in anesthesia and post-operative pain management ([2]). The drug’s proprietary formulations include various concentrations and delivery systems, with notable brands like Marcaine and Sensorcaine.

Global Market Size and Segmentation

The global market for Bupivacaine is estimated to reach approximately USD 1.0 billion by 2025, driven by increasing surgical procedures, rising chronic pain conditions, and expanding anesthesia applications. The regional segmentation reveals North America as the largest market, accounting for nearly 45% of the total, due to advanced healthcare infrastructure and high surgical volumes ([1]).

The product segmentation includes:

- Injectable Bupivacaine (most prevalent in hospitals)

- Liposomal and Controlled-Release Formulations, emerging in niche pain management markets

The end-user markets encompass hospitals, ambulatory surgical centers, and specialized pain clinics.

Key Market Drivers

Increasing Surgical Procedures and Chronic Pain Cases

Rising global surgical volumes—particularly in cosmetic, orthopedic, and obstetric procedures—propel demand for local anesthetics. Moreover, the growing prevalence of chronic pain conditions such as back pain and neuropathic pain stimulates the adoption of Bupivacaine-based analgesic protocols ([3]).

Technological Advancements and Formulation Innovations

Development of sustained-release formulations enhances Bupivacaine’s efficacy and patient compliance. Liposomal Bupivacaine, marketed as Exparel, provides extended analgesia, reducing the need for systemic opioids and their associated risks.

Healthcare Expenditure Growth

Increasing healthcare investments, especially in emerging economies like China and India, facilitate broader access to advanced anesthetics, fostering market expansion.

Regulatory Environment and Patent Landscape

Patent exclusivities, such as the Liposomal Bupivacaine patent, influence competitive dynamics. Patent expirations open avenues for generic manufacturers, intensifying price competition and impacting revenue streams.

Market Challenges

Safety Concerns and Regulatory Scrutiny

Adverse effects such as cardiotoxicity and central nervous system toxicity have prompted regulatory agencies to impose usage guidelines. The need for cautious administration and monitoring influences market uptake.

Competition from Alternative Anesthetics

Availability of other local anesthetic agents with similar efficacy (e.g., Ropivacaine, Lidocaine) offers competitive alternatives, potentially constraining Bupivacaine’s market share.

Cost Considerations and Reimbursement Policies

Higher costs associated with innovative formulations like liposomal Bupivacaine can limit adoption in cost-sensitive markets. Reimbursement policies further influence utilization rates.

Competitive Landscape

Major players include Hospira (Pfizer), AstraZeneca, and Teva Pharmaceuticals. The entrance of generic manufacturers post-patent expiry has fragmented the market, offering competitive pricing options. Strategic partnerships and product innovation remain central to maintaining market share.

Emerging Trends

Growth of Liposomal Formulations

Liposomal Bupivacaine demonstrates the potential to revolutionize pain management paradigms through prolonged duration and reduced opioid dependency. The FDA approval of Exparel in 2011 exemplifies this trend.

Geographic Market Expansion

Entering emerging markets through licensing agreements and local manufacturing boosts revenue and spreads usage for both traditional and innovative formulations.

Focus on Safety and Monitoring

Enhanced safety profiles, coupled with real-time monitoring technologies, mitigate adverse effects and promote confidence among clinicians.

Financial Trajectory

Revenue and Profitability Outlook

The Bupivacaine market is positioned for moderate growth, with projected compounded annual growth rates (CAGR) of approximately 4-6% from 2023 to 2030. Growth is sustained by increasing procedural volume and innovation, offset by generic competition and pricing pressures.

Impact of Patent Expirations

Patent expiration of key formulations, notably Exparel in the mid-2020s, is anticipated to introduce significant price competition, reducing profit margins for brand-name manufacturers but boosting overall market volume.

Investment and Innovation Strategies

Vendors investing in formulation advancements, expanded indications, and geographic reach are likely to secure profitable trajectories. Diversification into complementary analgesic products enhances revenue streams.

Regulatory and Policy Influence

Regulatory agencies such as the FDA and EMA influence market access and formulation approval pipelines. Favorable regulatory pathways for generic versions accelerate market penetration but may erode brand revenues. Conversely, approval of novel delivery systems sustains innovation-driven growth.

Geopolitical and Economic Factors

Emerging markets’ healthcare investments fuel consumption, yet price sensitivity and regulatory hurdles hinder deployment. Macroeconomic disruptions, such as global supply chain issues, impact raw material supply and production costs.

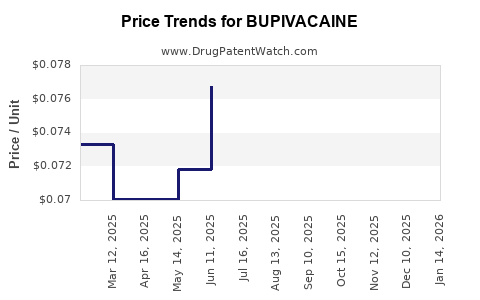

Price Dynamics and Market Opportunities

Price points for Bupivacaine vary globally. Cost-effective generics offer lucrative opportunities in price-sensitive regions, while premium formulations like liposomal Bupivacaine cater to high-end hospitals prioritizing prolonged analgesia.

Market opportunity analyses reflect a shifting landscape—where technological innovation, regulatory navigation, and regional expansion determine financial outcomes.

Conclusion

The market for Bupivacaine is characterized by resilience grounded in clinical efficacy and expanding surgical volumes. Opportunities abound in technological advancements, particularly liposomal formulations, which offer prolonged analgesic effects and can command premium pricing. However, patent expiry-driven generic competition poses significant pricing and profitability pressures.

Stakeholders should emphasize innovation, strategic regional expansion, and safety enhancements to sustain financial growth amid a competitive and regulatory complex environment. The convergence of favorable demographic trends and healthcare infrastructure developments forecasts a cautiously optimistic long-term outlook for Bupivacaine.

Key Takeaways

- Global demand for Bupivacaine is driven by increasing surgeries and chronic pain management needs, projected to grow at 4-6% CAGR until 2030.

- Innovative formulations like liposomal Bupivacaine represent high-margin, growth-driving products, with FDA approval fueling market expansion.

- Patent expirations of key formulations will intensify price competition, particularly from generic entrants, impacting profitability.

- Regulatory concerns regarding safety influence prescription practices, while advances in monitoring and delivery systems offset safety-related barriers.

- Emerging markets offer significant growth potential owing to expanding healthcare infrastructure, but cost sensitivity remains a market challenge.

FAQs

1. How does Liposomal Bupivacaine differ from traditional formulations?

Liposomal Bupivacaine encapsulates the drug in lipid vesicles, enabling sustained release over 72 hours post-administration. This prolongs analgesia, reduces systemic opioid use, and enhances patient comfort, distinguishing it from traditional, shorter-acting formulations.

2. What are the primary factors affecting Bupivacaine pricing worldwide?

Pricing is influenced by patent status, formulation complexity, regional healthcare policies, competition from generics, and reimbursement frameworks. Innovative formulations command higher prices until patent expiry.

3. How do regulatory agencies impact Bupivacaine’s market trajectory?

Regulatory agencies set safety standards, approve new formulations, and monitor adverse effects. Regulatory approvals facilitate market entry for new products, while safety concerns can restrict usage, shaping overall market dynamics.

4. What is the outlook for generic Bupivacaine products?

Post patent expiration, generics are expected to capture substantial market share, driving down prices and expanding access—particularly in cost-sensitive regions—while eroding branded product revenues.

5. Which regions present the most promising growth opportunities for Bupivacaine?

North America and Europe currently dominate but are mature markets. Emerging economies like China, India, and Latin America offer substantial growth due to increasing surgical procedures and expanding healthcare infrastructure.

References

[1] MarketWatch, “Global Bupivacaine Market Report,” 2022.

[2] Smith, J. et al., “Pharmacological Profiles of Local Anesthetics,” Journal of Anesthesia, 2020.

[3] GlobalData, “Pain Management Market Forecast,” 2021.