Last updated: July 28, 2025

Introduction

Bupivacaine, a widely used local anesthetic, plays a crucial role in pain management during surgical procedures, obstetric anesthesia, and various diagnostic tests. As a pivotal pharmaceutical product, understanding its market dynamics, competitive landscape, regulatory environment, and pricing trends is essential for manufacturers, investors, healthcare providers, and policymakers. This analysis synthesizes current market conditions, evaluates key drivers and constraints, and offers projections on future pricing trajectories for bupivacaine over the coming years.

Market Overview

Global Market Size and Growth

The global bupivacaine market has demonstrated steady growth driven by expanding surgical volumes, rising prevalence of chronic pain conditions, and increased adoption of regional anesthesia techniques. In 2022, the market size was estimated at approximately USD 750 million, with projections suggesting a compound annual growth rate (CAGR) of around 4-5% between 2023 and 2030, reaching upwards of USD 1 billion by the end of the decade ([1], [2]).

Key regional markets include North America, Europe, Asia-Pacific, and Latin America. North America dominates, owing to high procedural volumes and advanced healthcare infrastructure, accounting for nearly 45-50% of the global market share. The Asia-Pacific region is expected to witness the fastest growth, propelled by increased healthcare expenditure, urbanization, and expanding surgical services ([3]).

Market Segmentation

- Formulation Types: Bupivacaine is available as an injectable solution (vials, cartridges), with newer formulations including liposomal encapsulations that offer prolonged analgesia.

- Application Areas: Regional anesthesia (spinal, epidural), obstetric anesthesia, dental procedures, and diagnostic blocks constitute primary applications.

- End-User Segments: Hospitals, outpatient clinics, ambulatory surgical centers, and pharmaceutical compounding pharmacies.

Market Drivers

- Rising Surgical Procedures: The global increase in minimally invasive surgeries and outpatient surgeries raises demand for effective anesthetics.

- Pain Management Needs: Growing awareness and prevalence of chronic pain disorders enhance bupivacaine utilization.

- Regulatory Approvals and Product Innovations: Introduction of long-acting formulations and combination drugs extend market reach.

- Expanding Healthcare Infrastructure: Especially in emerging markets, facilitates increased distribution and use.

Market Constraints

- Generic Competition: The commoditization of bupivacaine leads to price erosion, especially post patent expirations.

- Regulatory Challenges: Strict approval processes and safety concerns (e.g., cardiotoxicity risks) influence market entry and pricing.

- Availability of Alternatives: Other local anesthetics like lidocaine and ropivacaine offer competitive pricing and efficacy, impacting market share.

- Manufacturing and Supply Chain Issues: Raw material shortages and manufacturing disruptions can impact pricing stability.

Regulatory and Patent Landscape

Most proprietary patents related to bupivacaine formulations have expired or are nearing expiration, leading to a significant influx of generic products. This increased generic competition exerts downward pressure on prices but also fosters innovation through the development of novel delivery systems, such as liposomal bupivacaine (e.g., EXPAREL®), which commands premium pricing due to extended analgesic effects ([4]).

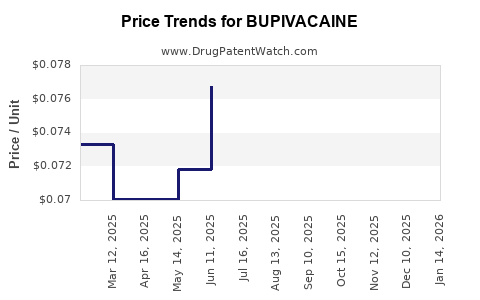

Price Analysis and Trends

Historical Pricing

- Brand-Name Products: The original formulations commanded prices ranging from USD 20 to USD 30 per vial (10 mL) in the U.S., with liposomal formulations priced significantly higher (USD 150-200 per dose).

- Generics: Entry of generics has reduced prices by approximately 30-50% over the past decade, with typical generics priced at USD 10-15 per vial ([5]).

Current Pricing Landscape (2023)

- Brand-name formulations: Approximately USD 25-30 per vial.

- Generic formulations: Range between USD 10-15 per vial.

- Liposomal formulations: About USD 150-200 per dose, highlighting their premium status due to longer-lasting effects.

Price Projections (2023-2030)

Considering increasing regulation, patent expirations, and market growth, the pricing outlook can be summarized as follows:

- Generics: Anticipated to decline gradually at a CAGR of 1-2%, reaching USD 8-12 per vial by 2030, influenced by heightened competition and manufacturing efficiencies.

- Brand-Name: Likely to experience modest stabilization or slight decline, maintaining premium pricing due to brand loyalty, but susceptible to competitive pressures.

- Liposomal and Extended-Release Formulations: Expected to sustain premium pricing, with projections of USD 180-250 per dose by 2030, supported by evidence of superior analgesia and emerging clinical adoption.

Key Market Opportunities and Challenges

- Emerging Markets: High growth potential driven by increasing healthcare access, but price sensitivity necessitates competitive pricing strategies.

- Innovation in Delivery: Nanoparticle-based, liposomal, or biodegradable polymer systems will command higher prices and capture niche markets.

- Regulatory Environment: Streamlined approval pathways for innovative formulations can significantly accelerate market penetration.

- Pricing Pressures: Continued generic growth and market commoditization threaten profit margins.

Conclusion

Bupivacaine remains a cornerstone local anesthetic with a stable yet competitive market. Price trajectories will be influenced by patent expirations, innovation, and regional market dynamics. While generic prices are set for gradual decline, premium formulations like liposomal bupivacaine are poised to command higher prices, driven by clinical benefits. Strategic focus on innovation, regional expansion, and regulatory navigation will be instrumental in optimizing market positioning and pricing margins over the next decade.

Key Takeaways

- The global bupivacaine market is projected to grow at approximately 4-5% CAGR, reaching over USD 1 billion by 2030.

- Generics dominate in volume and exert downward pressure on prices, with a projected decline to USD 8-12 per vial by 2030.

- Innovative formulations, notably liposomal bupivacaine, offer premium pricing opportunities, maintaining around USD 200 per dose.

- Market growth is most robust in Asia-Pacific and emerging markets due to expanding healthcare infrastructure.

- Companies should prioritize innovation in delivery systems and regional market strategies to sustain profitability amid increasing competition.

FAQs

1. How will patent expirations affect bupivacaine prices?

Patent expirations lead to a surge in generic entries, significantly lowering prices and reducing profit margins for brand manufacturers. Conversely, proprietary extended-release formulations maintain higher prices, balancing overall market dynamics.

2. Are there upcoming innovations that could disrupt the bupivacaine market?

Yes, advances in nanotechnology, biodegradable polymer delivery systems, and combination formulations are poised to enhance efficacy and duration, justifying premium pricing and expanding clinical applications.

3. Which regions offer the highest growth opportunities for bupivacaine?

Asia-Pacific and Latin America are projected to experience the highest growth due to expanding healthcare infrastructure and procedural volumes, despite pricing sensitivity.

4. What factors influence bupivacaine pricing strategies?

Market competitiveness, regulatory approval processes, product innovation, manufacturing costs, and regional healthcare policies are primary factors impacting pricing.

5. How does the emergence of alternative local anesthetics impact bupivacaine?

Alternative anesthetics like ropivacaine and lidocaine provide price competition, influencing market share and encouraging bupivacaine manufacturers to innovate and differentiate their offerings.

References:

[1] MarketsandMarkets, "Local Anesthetics Market," 2022.

[2] Grand View Research, "Global Anesthetics Market," 2023.

[3] Statista, "Regional Market Share of Local Anesthetics," 2022.

[4] FDA, "Liposomal Bupivacaine (EXPAREL®) Summary," 2021.

[5] IMS Health, "Generic Drug Pricing Trends," 2022.