Last updated: July 30, 2025

Introduction

Innocoll Pharmaceuticals stands out as a niche player within the highly competitive pharmaceutical landscape, primarily focusing on innovative drug delivery platforms and specialty therapeutics. Its strategic positioning is characterized by specialized products, targeted markets, and a commitment to addressing unmet medical needs. This analysis evaluates Innocoll’s market stance, core strengths, competitive advantages, and future strategic directions, providing key insights into its role amid industry giants and emergent rivals.

Market Position of Innocoll Pharmaceuticals

Specialization in Niche Therapeutics

Innocoll operates at the intersection of medical devices and pharmaceuticals, leveraging proprietary drug delivery technologies such as CollaGUARD, BioCor, and XaraColl. Its portfolio emphasizes postoperative pain management, antimicrobial sealing, and tissue regeneration. Such focus enables the company to carve out a segment within analgesics, surgical adjuncts, and wound care products.

Geographic Footprint and Regulatory Landscape

While Innocoll initially concentrated on North American markets, its expansion into Europe and Asia signifies a strategic push to diversify revenue streams and expand its global footprint. The company's ability to navigate complex regulatory environments—demonstrated by successful approvals of key products—affirms its market positioning as a reliable innovator in specialized therapies.

Market Share and Competitive Scope

Compared to pharmaceutical titans like Johnson & Johnson or Pfizer, Innocoll operates in a narrow but lucrative segment. Its targeted approach grants it a competitive advantage in customer loyalty among healthcare providers seeking tailored solutions, despite limited overall market share. The company's recent licensing agreements and strategic collaborations reflect its intent to bolster market access and accelerate growth.

Core Strengths of Innocoll Pharmaceuticals

Innovative Proprietary Technologies

At the heart of Innocoll’s competitive edge are its patented drug delivery platforms, notably CollaGUARD, designed for sustained, localized drug release. These technologies enable enhanced therapeutic outcomes with reduced systemic side effects—an attractive proposition for clinicians and patients alike.

Specialized Product Portfolio

Innocoll’s focus on niche therapeutic areas, including surgical sealants, antimicrobial barriers, and local analgesic formulations, allows it to avoid direct competition with mass-market pharmaceutical companies. Its products often address critical unmet needs, enabling premium pricing and negotiations with health authorities.

Agility and Focused R&D

As a smaller enterprise, Innocoll benefits from nimbleness in product development cycles and rapid regulatory submissions. Its targeted R&D efforts concentrate on maximizing technology utility across indication expansions, thus efficiently leveraging its IP assets.

Partnerships and Strategic Alliances

Strategic collaborations with healthcare and distribution partners strengthen Innocoll's market access, especially in geographic regions where it lacks direct footprint. These alliances foster infrastructure for clinical trials, commercialization, and regulatory navigation.

Regulatory Experience and Market Access

Innocoll’s successful product approvals exemplify robust regulatory expertise, crucial for entering demanding markets like the U.S. and Europe. This competence reduces time-to-market and minimizes compliance risks.

Strategic Insights and Competitive Analysis

Market Dynamics and Competition

The landscape features entrenched global pharmaceutical corporations, emerging biotech firms, and specialty therapeutics startups. Innocoll faces competition primarily from companies offering similar surgical or wound care solutions, such as Baxter International or Ethicon. However, its proprietary technologies offer differentiation, and its focus on localized, controlled-release formulations positions it uniquely within the surgery and postoperative pain niche.

Threats and Challenges

Despite its strengths, Innocoll grapples with funding limitations typical of smaller biotech firms, potentially constraining R&D and commercialization initiatives. Competitive pressure from larger entities with broader portfolios and extensive distribution networks poses a sustained threat, especially if larger firms develop or acquire similar technology platforms.

Opportunities for Strategic Growth

- Product Line Expansion: Expanding indications for existing products or developing combo therapies can broaden revenue streams.

- Geographic Penetration: Entry into emerging markets with increasing healthcare infrastructure investment offers significant growth prospects.

- Acquisition and Licensing: Pursuing strategic acquisitions or licensing agreements could fast-track technological diversification and increase market reach.

- Technological Innovation: Investing in next-generation drug delivery systems remains vital for maintaining differentiation and relevance.

Risks and Mitigation Strategies

Innocoll must manage regulatory hurdles, integration complexities of collaborations, and financial sustainability. Robust patent protection, proactive regulatory engagement, and diversified R&D investments are vital for risk mitigation.

Future Outlook and Strategic Recommendations

Enhance Market Visibility

Innocoll should focus on bolstering brand recognition among healthcare professionals through targeted educational initiatives, clinical data dissemination, and participation in key medical conferences.

Accelerate Product Development

Prioritize pipelines targeting broader indications such as chronic pain or inflammatory conditions, leveraging proprietary tech assets.

Expand Strategic Collaborations

Forge partnerships with global healthcare distributors and regional players to chart new markets, especially within Asia and Latin America.

Invest in Digital and Data Analytics

Implement digital tools for clinical data collection, post-market surveillance, and customer engagement, ensuring evidence-based positioning and responsive adaptation to market needs.

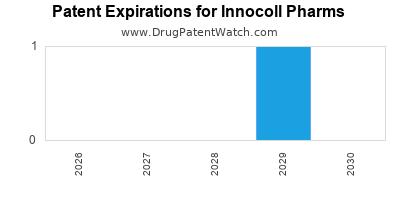

Strengthen Intellectual Property Portfolio

Secure patents around newer formulations and delivery mechanisms to protect competitive advantage and attract investment.

Key Takeaways

- Innocoll’s market position hinges on niche specialization, proprietary drug delivery innovations, and strategic regional expansion.

- Its core strengths—technological innovation, focused portfolio, regulatory expertise—differentiates it from larger competitors.

- The company’s growth depends heavily on expanding indications, geographic penetration, and strategic collaborations.

- Challenges include limited scale, funding constraints, and competition from entrenched pharmaceutical giants.

- Future success requires proactive innovation, strategic diversification, and operational agility to sustain competitive edge.

FAQs

1. What distinguishes Innocoll Pharmaceuticals from its competitors?

Innocoll’s proprietary drug delivery platforms, such as CollaGUARD, provide tailored, sustained-release therapies targeting niche markets like postoperative pain and tissue sealing—differentiating it from broader pharma companies that offer more generic solutions.

2. How does Innocoll navigate regulatory challenges across different regions?

The company leverages an experienced regulatory team and strategic collaborations with local partners to ensure timely approvals, adhering to regional standards such as FDA in the U.S., EMA in Europe, and equivalent agencies in emerging markets.

3. What are the primary markets for Innocoll’s products?

Initially focused on North America and Europe, Innocoll is expanding into Asian markets, where increasing healthcare expenditure and surgical procedures create substantial demand for its specialized products.

4. What strategic opportunities exist for Innocoll to accelerate growth?

Potential avenues include expanding indications through clinical trials, forming additional regional partnerships, investing in R&D for next-gen delivery systems, and pursuing acquisitions to diversify its product offerings.

5. What are the main risks facing Innocoll’s future?

Key risks involve funding limitations, competitive encroachment from larger firms, regulatory delays, and dependence on the success of limited product lines.

References

- Innocoll Pharmaceuticals Official Website

- Industry Reports on Niche Drug Delivery Technologies, 2022

- Market Analysis of Surgical Sealants and Wound care, Global Pharma Reports, 2023

- Regulatory Pathways for Medical Devices, U.S. FDA and EMA Guidelines, 2022

- Strategic Alliance Case Studies in Specialty Pharmaceuticals, Journal of Pharma Business, 2021