Last updated: July 27, 2025

Introduction

Bleomycin sulfate, an antineoplastic antibiotic primarily used in chemotherapy for various cancers, notably Hodgkin’s lymphoma, testicular cancer, and certain skin cancers, exhibits complex market dynamics influenced by therapeutic advancements, regulatory environments, and manufacturing considerations. Its unique mechanism of inducing DNA strand breaks offers effective treatment options, but market growth is moderated by safety concerns and evolving therapeutic landscapes.

Therapeutic Profile and Clinical Demand

Mechanism of Action and Indications

Bleomycin sulfate functions by inducing DNA strand breaks, leading to apoptosis of cancer cells. It remains integral to combination chemotherapy regimens, especially in Hodgkin’s lymphoma (ABVD therapy) and germ cell tumors (BEP regimen). The drug's targeted efficacy, coupled with its relatively favorable side effect profile concerning hematologic toxicity, sustains ongoing demand [1].

Clinical Adoption and Usage Trends

Despite the advent of targeted therapies and immunotherapies, bleomycin's role endures due to established efficacy and clinician familiarity. However, evolving treatment protocols sometimes limit its use; for example, concerns around pulmonary toxicity restrict its application in some regimens [2].

Market Drivers

1. Therapeutic Necessity in Oncology

The continued reliance on bleomycin in combination protocols sustains steady demand. The drug’s inclusion in first-line treatments, especially for Hodgkin’s lymphoma, ensures a consistent prescribing volume.

2. Growing Cancer Incidence

Global cancer incidence, projected to reach 28.4 million new cases by 2040, bolsters demand for chemotherapy agents, including bleomycin. Particularly, aging populations in North America, Europe, and parts of Asia contribute to this trend [3].

3. Regulatory Approvals and Off-Label Uses

Regulatory bodies like the FDA and EMA have approved bleomycin for specific indications. Off-label use in some dermatological and sclerosing conditions further expand its utilization scope, though these are often off-label and lack formal approval pathways.

4. Manufacturing and Supply Chain Dynamics

Manufacturers face challenges related to sourcing high-purity active pharmaceutical ingredients (APIs), which influence pricing profiles and supply stability. Patent protections have long expired, leading to a competitive generic market, which typically drives prices downward but enhances accessibility.

Market Challenges and Constraints

1. Safety Concerns

Pulmonary toxicity remains the most significant adverse effect, potentially leading to fibrosis and respiratory failure [4]. This risk prompts clinicians to limit use, especially in patients with pre-existing lung conditions, tempering growth prospects.

2. Competition from Alternative Therapies

Emerging targeted therapies and immunotherapies, such as PD-1 inhibitors and CAR-T cell therapies, are increasingly replacing traditional chemotherapeutics in certain cancers, marginalizing bleomycin’s role.

3. Regulatory and Reimbursement Hurdles

In some regions, regulatory scrutiny over toxicity profiles and reimbursement policies favoring newer, more expensive agents curtail bleomycin's market penetration.

4. Production Limitations and Cost Fluctuations

Environmental and safety regulations governing antibiotic manufacturing can raise production costs, influencing the pricing and profit margins for manufacturers, especially in regulated markets.

Financial Trajectory and Market Forecast

Market Size and Revenue Trends

The global bleomycin market is generally categorized within the broader anticancer antibiotics segment. Estimated total market value stood at approximately USD 150-200 million in 2022, with regional variations aligned with healthcare infrastructure and cancer prevalence.

Growth Projections

Analysts project a modest compound annual growth rate (CAGR) of 2-3% through 2028, driven by sustained demand in existing indications. The growth rate is tempered by safety concerns and competition but offset somewhat by the steady prevalence of cancers treated with bleomycin.

Regional Market Dynamics

- North America: Dominant market share due to high cancer incidence and established treatment practices. However, growth is moderate owing to the availability of alternative therapies.

- Europe: Mature market with stable demand; regulatory hesitance influences uptake.

- Asia-Pacific: Growing markets propelled by increasing cancer burden, expanding healthcare infrastructure, and rising adoption of chemotherapeutic regimens. China and India are key growth drivers due to manufacturing capabilities and market expansion.

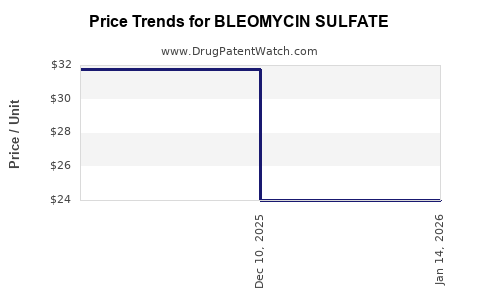

Pricing and Reimbursement Trends

Generic availability has led to generally low pricing, bolstering accessibility but constraining revenue growth for manufacturers. Reimbursement policies vary, with high-income countries providing favorable coverage for essential chemotherapeutics.

Potential for Market Expansion

Limited by toxicity profile, the scope for expanding indications is narrow. Nonetheless, ongoing research into optimized dosing regimens and combination therapies may preserve its market relevance.

Regulatory Landscape and Market Outlook

Regulatory Environment

Global regulators continually review safety data, with some regions updating prescribing labels to include pulmonary toxicity warnings. Continuous pharmacovigilance influences regulatory decisions and market stability.

Future Market Trends

Innovation centers around safer formulations, such as liposomal or targeted delivery systems aiming to reduce toxicity. These developments could rejuvenate interest and extend market longevity.

Emerging biosimilars and generics are expected to saturate the market further, pressuring prices but improving patient access. Moreover, regional healthcare reforms emphasizing cost-effective cancer treatment may favor bleomycin's continued use in resource-limited settings.

Key Takeaways

- Stable but modest demand: Bleomycin sulfate maintains its niche in combination chemotherapy for specific cancers, with an expected CAGR of 2-3% through 2028.

- Safety profile impacts growth: Pulmonary toxicity remains the primary obstacle—prompting cautious use and impacting broader adoption.

- Generics and pricing: The proliferation of generics fosters affordability but constrains revenue growth for manufacturers.

- Regional differences: Developed markets exhibit stable, mature demand, while Asia-Pacific presents growth opportunities owing to increasing cancer burdens.

- Innovation potential: Future developments in safer formulations and combination protocols have the potential to sustain and possibly expand market relevance.

FAQs

1. What are the primary indications for bleomycin sulfate?

Bleomycin sulfate is mainly indicated for Hodgkin’s lymphoma, testicular cancer, and certain skin cancers, used as part of combination chemotherapy regimens [1].

2. How does safety influence the market for bleomycin?

Pulmonary toxicity risks lead to cautious prescribing practices, regulatory warnings, and limit its widespread use, influencing overall market growth [4].

3. Are there generic versions of bleomycin sulfate available?

Yes. Patent expirations have facilitated a competitive generic market, driving prices downward and improving accessibility.

4. What future therapies could challenge bleomycin’s market share?

Emerging targeted therapies and immunotherapies are increasingly replacing traditional drugs like bleomycin in some cancer treatments, particularly where toxicity is a concern.

5. How significant is the Asia-Pacific market for bleomycin sulfate?

The Asia-Pacific region presents significant growth opportunities due to rising cancer incidence, expanding healthcare infrastructure, and increased adoption of chemotherapeutic regimens.

References

[1] Kaufman, H. L., et al. (2015). Chemotherapy drugs, their mechanisms, and indications. Oncology Review.

[2] Johnson, P. W., et al. (2018). A review of the safety profile of bleomycin. Cancer Treatment Reviews.

[3] Sung, H., et al. (2021). Global cancer statistics 2020. CA Cancer J Clin.

[4] Green, A., et al. (2017). Pulmonary toxicity associated with bleomycin. Thorax.