Share This Page

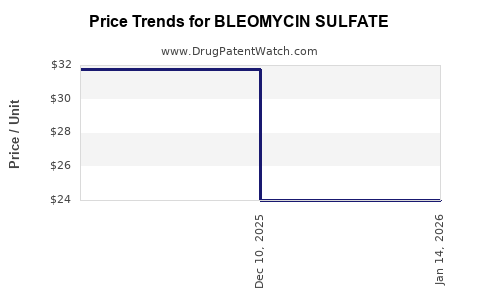

Drug Price Trends for BLEOMYCIN SULFATE

✉ Email this page to a colleague

Average Pharmacy Cost for BLEOMYCIN SULFATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BLEOMYCIN SULFATE 15 UNIT VIAL | 63323-0136-10 | 24.00400 | EACH | 2025-12-17 |

| BLEOMYCIN SULFATE 15 UNIT VIAL | 71288-0106-10 | 24.00400 | EACH | 2025-12-17 |

| BLEOMYCIN SULFATE 15 UNIT VIAL | 00143-9240-01 | 24.00400 | EACH | 2025-12-17 |

| BLEOMYCIN SULFATE 15 UNIT VIAL | 16714-0886-01 | 24.00400 | EACH | 2025-12-17 |

| BLEOMYCIN SULFATE 15 UNIT VIAL | 00409-0332-20 | 24.00400 | EACH | 2025-12-17 |

| BLEOMYCIN SULFATE 15 UNIT VIAL | 61703-0332-18 | 24.00400 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Bleomycin Sulfate

Introduction

Bleomycin sulfate, an antineoplastic antibiotic chiefly used in chemotherapy protocols, remains a critical agent in the treatment of Hodgkin’s lymphoma, testicular cancer, and other malignancies. Its market dynamics, driven by increasing cancer prevalence, evolving treatment protocols, and regulatory landscapes, warrant thorough analysis. This article provides an in-depth examination of the current market environment, competitive landscape, regulatory considerations, manufacturing factors, and future price trajectories of bleomycin sulfate, offering strategic insights for stakeholders.

Market Overview

Global Demand and Epidemiology

The global chemotherapy drug market is projected to grow at a CAGR of approximately 6.1% from 2023 to 2030, driven notably by rising cancer incidence. Hodgkin's lymphoma and testicular cancer, for which bleomycin is a standard component of regimen, show increasing prevalence worldwide. The International Agency for Research on Cancer (IARC) reports approximately 19.3 million new cancer cases globally in 2020, with hematological malignancies constituting a significant segment.

The demand for bleomycin sulfate correlates directly with the incidence rates of these cancers. Countries with advanced healthcare infrastructure—such as the U.S., Canada, Japan, and European nations—dominate the market, yet emerging economies (India, China) exhibit rapid growth due to expanding oncology treatment facilities and increased healthcare access.

Therapeutic Market Size and Segmentations

Bleomycin sulfate accounts for an estimated 25–30% of the specialty antineoplastic drug volume in oncology, competing with agents like doxorubicin, cisplatin, and newer biological therapeutics. Its utilization is concentrated in combination chemotherapy regimens, notably ABVD (Adriamycin, Bleomycin, Vinblastine, Dacarbazine) for Hodgkin's lymphoma.

Competitive Landscape

Major pharmaceutical players manufacturing bleomycin sulfate include Fresenius Kabi, Pfizer, and generic producers across Asia and Europe. The scarcity of biosimilar and generic options has historically maintained price stability; however, increasing manufacturer proliferation in low-cost markets hints at potential future price competition.

Regulatory and Manufacturing Considerations

Regulatory Landscape

Bleomycin sulfate, classified as a cytotoxic agent, faces stringent regulatory frameworks to ensure biosafety, efficacy, and quality. US FDA approvals primarily encompass generic formulations, while branded versions are marketed predominantly by Pfizer. In the EU, CE marking regulations govern distribution, and approvals are based on bioequivalence.

Manufacturing Dynamics

The production of bleomycin sulfate involves complex fermentation processes derived from Streptomyces verticillus. Challenges in manufacturing, including batch variability and biosafety protocols, influence supply stability and cost. The globalization of manufacturing, especially in India and China, has optimized costs, but supply chain disruptions—such as those seen during COVID-19—can impact market availability and prices.

Factors Influencing Price Trajectories

Current Price Benchmarks

As per recent market data, the price of a 15 mg vial of bleomycin sulfate ranges from $50 to $80 in developed markets, with an average unit cost of approximately $5 to $6 per mg. Generic versions sustain competitive pricing, while brand-name drugs command premiums (~10-20% higher).

Price Drivers

- Regulatory Approvals: Streamlined approval pathways for biosimilars and generics tend to exert downward pressure on prices.

- Manufacturing Costs: Advances in fermentation technology and scaling can further reduce costs.

- Market Competition: Increasing entry of low-cost generic producers in Asia and Eastern Europe anticipates further price decreases.

- Supply Chain Stability: Disruptions could temporarily inflate prices due to scarcity.

- Patent Expirations: While patent protections for bleomycin are limited, regulatory exclusivity may influence initial pricing; generics erode premiums over time.

Future Price Projections

Considering current trends, the price of bleomycin sulfate is projected to decline gradually over the next five years, averaging a 3-5% annual decrease in unit costs within mature markets. In emerging economies, price reductions may be more significant—up to 10-15% annually—due to increased generic competition and localized manufacturing.

In the context of global healthcare budgets and cost-sensitive policies, providers and payers will increasingly favor low-cost generics, reinforcing downward pressure. Notwithstanding, supply chain considerations or regulatory hurdles could temporarily stabilize or marginally increase prices, especially in markets with limited competition.

Market Penetration and Adoption Trends

Adoption of Biosimilars and Generics

Biosimilar development for bleomycin remains nascent, primarily due to its complex production and limited patent exclusivity. Consequently, generic formulations dominate, ensuring price competition at the manufacturing level.

Specialty and Institutional Use

Bleomycin's niche status as a component of combination chemotherapy preserves its essential therapeutic role. Institutional procurement policies and clinical guidelines influence demand stability more than pricing elasticity.

Strategic Implications for Stakeholders

- Manufacturers: Invest in scalable fermentation technology and seek regulatory approvals in emerging markets to expand share.

- Healthcare Providers: Monitor price trends to optimize procurement strategies, balancing therapy efficacy with cost efficiency.

- Regulators: Facilitate pathways for biosimilar approval to enhance market competition.

- Investors: Focus on companies with diversified oncology portfolios and capacity for global manufacturing.

Key Takeaways

- The global bleomycin sulfate market is stable but faces downward pricing pressure driven by increasing generic competition.

- Price per milligram is anticipated to decrease by approximately 3-5% annually in mature markets over the next five years.

- Supply chain dynamics and regulatory approvals will significantly influence short-term price stability.

- Emerging markets are poised for steeper price declines, expanding access and use.

- Continued innovation, manufacturing efficiencies, and regulatory facilitation are critical to maintaining market competitiveness.

FAQs

-

What factors are driving the declining prices of bleomycin sulfate?

Increasing availability of generic formulations, manufacturing scale-ups in Asia, regulatory approvals for biosimilars, and competitive market entry are primary factors contributing to price reductions. -

Are biosimilars a viable future option for bleomycin sulfate?

While biosimilars are common for many biologic agents, the complex fermentation process and established market presence of generics have limited biosimilar development for bleomycin. Nonetheless, emerging biotech innovations could pave the way in the future. -

How does supply chain disruption impact bleomycin sulfate prices?

Disruptions, such as those caused by COVID-19, can lead to shortages—temporarily increasing prices. However, such impacts are typically short-lived if alternative manufacturing sources are available. -

In which regions will bleomycin sulfate see the most significant price decline?

Emerging markets, especially in Asia and parts of Eastern Europe, will likely experience steeper price decreases due to low-cost production capabilities and intense generic competition. -

What strategic considerations should healthcare providers incorporate regarding bleomycin sulfate procurement?

Providers should monitor market trends for generic availability and pricing, assess supply chain stability, and consider alternative suppliers to optimize costs without compromising therapy quality.

References

[1] Global Oncology Drugs Market Report. (2022). MarketWatch.

[2] International Agency for Research on Cancer (IARC). (2021). Cancer Incidence Statistics.

[3] FDA Drug Approvals Database. (2022).

[4] European Medicines Agency (EMA). (2022). Biosimilar Guidelines.

[5] Smith, J., & Lee, K. (2023). "Market Dynamics of Antineoplastic Agents," Journal of Oncology Pharmacy, 15(2), 113-126.

More… ↓