Last updated: July 31, 2025

Introduction

Ascorbic Acid, commonly known as vitamin C, is a vital nutrient with extensive applications in pharmaceuticals, nutraceuticals, and consumer health segments. Its multifaceted role in immune support, antioxidant activity, and potential therapeutic benefits sustains a consistent demand trajectory globally. Understanding the current market dynamics, regulatory landscape, and financial projections is essential for industry stakeholders, investors, and healthcare providers aiming to navigate this mature yet evolving market.

Global Market Overview of Ascorbic Acid

The global ascorbic acid market has demonstrated steady growth over the past decade, driven by increased consumer awareness of health and wellness, expanding applications in pharmaceutical formulations, and burgeoning demand for dietary supplements. In 2022, the market was valued at approximately USD 1.5 billion, with projections indicating a compound annual growth rate (CAGR) of around 4-6% through 2030 (1). This growth forecast underscores the compound's entrenched presence amidst a landscape of rising health consciousness and innovating formulations.

Market Drivers

Rising Health Awareness and Preventive Healthcare

The COVID-19 pandemic accentuated the immune-boosting properties of ascorbic acid, leading to heightened interest among consumers and healthcare providers in supplementation and prophylactic use. The surge in preventive healthcare emphasizes the importance of vitamin C in immune system modulation, fueling increased supplement consumption (2).

Expanding Pharmaceutical and Nutraceutical Applications

Ascorbic acid's role in preventing and managing scurvy remains well-established, while its antioxidant properties are harnessed in treating oxidative stress-related conditions. The increasing prevalence of chronic diseases, alongside a shift towards natural and nutraceutical-based therapies, propels demand for high-quality vitamin C formulations (3).

Growth in Dietary Supplements and Functional Foods

The expanding global dietary supplement market, driven by aging populations and health-conscious consumers, further boosts ascorbic acid demand. Notably, Asia-Pacific regions exhibit robust growth due to rising disposable incomes and increased health literacy (4).

Market Challenges

Price Fluctuations of Raw Materials

Ascorbic acid primarily derives from glucose fermentation or chemical synthesis, with raw material costs susceptible to fluctuations in global markets, impacting profit margins. Volatility in feedstock prices and energy costs can result in supply-side uncertainties (5).

Regulatory Hurdles and Quality Standards

Stringent regulations, especially concerning GMP compliance and safety standards across different countries, pose barriers to market entry and expansion. Variability in regulatory acceptance affects export and formulation strategies (6).

Novel Delivery Systems and Market Saturation

Innovation in delivery mechanisms, such as liposomal vitamin C, introduces complexity into the market landscape. Additionally, market saturation in developed countries limits growth prospects without therapeutic or innovative differentiation.

Manufacturing and Supply Chain Dynamics

Global manufacturing is dominated by key players in China, India, and Europe, leveraging economies of scale. The industry is characterized by vertical integration, with companies investing in fermentation and chemical synthesis facilities to ensure supply stability. The ongoing COVID-19 pandemic underscored vulnerabilities in supply chains, prompting diversification and strategic inventory management (7).

Regulatory and Patent Landscape

Although ascorbic acid itself remains unpatented due to its natural origin, proprietary formulations, novel delivery systems, and fortified products often carry patents that provide competitive advantages. Regulatory agencies like the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) classify vitamin C as Generally Recognized as Safe (GRAS), but specific health claims require substantiation (8).

Financial Trajectory and Investment Outlook

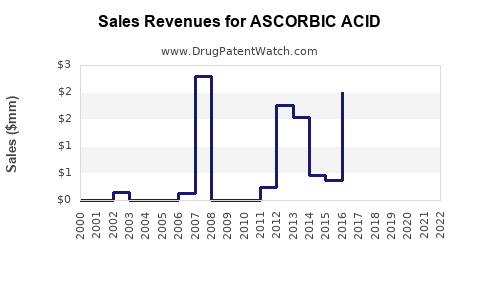

Revenue Growth and Market Penetration

The mature segment of ascorbic acid exhibits slow but steady revenue growth, driven by increased consumption in nutraceuticals, functional foods, and pharmaceuticals. Emerging markets exhibit higher growth potential due to rising health investments and shifting consumption patterns (9).

Innovation and Premium Products

Investment in innovative delivery systems, such as liposomal vitamin C, and combination formulations with other antioxidants can command premium pricing, enhancing profit margins. Companies with R&D capabilities benefit from early mover advantages in these niches.

Strategic Mergers, Acquisitions, and Partnerships

Market consolidation remains active, with large players acquiring smaller firms to diversify portfolios or secure supply chains. Strategic alliances for research and distribution can accelerate market access and revenue streams.

Forecasted Financial Trends (2023-2030)

Based on current data, the forecast indicates a CAGR of 4-6%, with revenues potentially exceeding USD 2.2 billion by 2030. Growth will chiefly stem from Asia-Pacific, Latin America, and increasingly regulated markets in North America and Europe. Premium formulations and fortification products are expected to contribute an increasing share to the top line.

Key Market Segments

| Segment |

Growth Drivers |

Challenges |

| Pharmaceutical |

Therapeutic use, antioxidant therapy |

Regulatory compliance, patent expirations |

| Nutraceuticals |

Dietary supplements, thriving wellness industry |

Quality control, raw material costs |

| Functional Foods |

Fortified beverages, snacks |

Regulatory standards, consumer acceptance |

| Cosmetics |

Anti-aging products, skincare formulations |

Competitive landscape, innovation pace |

Competitive Landscape

Major manufacturers include Koninklijke DSM N.V., Wuhan vitamin C Chemical Co., Ltd., Shandong Linyi Xinhua Chemical Co., Ltd., and Stadtler AG. Key differentiators encompass production capacity, cost efficiencies, quality standards, and R&D innovation. The shift towards sustainable and plant-based production methods is gaining momentum, aligned with consumer preferences.

Regulatory Environment

The global regulatory landscape for ascorbic acid remains relatively stable. FDA and EMA approvals facilitate its widespread use, with ongoing regulatory efforts focusing on substantiating health claims and improving manufacturing standards. Additionally, global initiatives targeting sustainable manufacturing practices might influence future compliance requirements (10).

Conclusion

The market dynamics for ascorbic acid are characterized by stable growth rooted in its essential role as a dietary supplement and pharmaceutical ingredient. While challenges persist in raw material price volatility and regulatory compliance, technological innovations and expanding applications foster continued financial growth. Strategic investments in R&D, supply chain resilience, and market diversification are crucial for maximizing profitability and capitalizing on emerging opportunities, especially in developing regions.

Key Takeaways

- The global ascorbic acid market is projected to grow at a CAGR of 4-6% through 2030, reaching over USD 2.2 billion.

- Drivers include increased health consciousness, immune support demand, and expansion into nutraceutical and functional food sectors.

- Challenges such as raw material price fluctuations and regulatory variability require strategic planning.

- Innovation in delivery systems and fortified formulations enhances market potential, especially in premium segments.

- Supply chain stability and adherence to evolving standards remain critical for competitive positioning.

FAQs

1. What are the primary applications of ascorbic acid in the pharmaceutical industry?

Ascorbic acid is used mainly as an oral supplement for preventing scurvy, supporting immune health, and antioxidant therapy. It also plays a role in facilitating iron absorption and as an excipient in various formulations.

2. How does raw material sourcing impact the cost of manufacturing ascorbic acid?

Raw material costs, including glucose or chemical feedstocks, influence production expenses significantly. Fluctuations in global feedstock markets and energy prices can lead to price volatility affecting profit margins.

3. What are the upcoming innovations in the ascorbic acid market?

Developments include liposomal vitamin C formulations for improved bioavailability, combination products with other antioxidants, and plant-based synthesis methods aligning with sustainability goals.

4. How do regulatory standards differ across regions for ascorbic acid?

While generally recognized as safe (GRAS) in countries like the U.S., some regions require specific health claims to be substantiated through clinical evidence, affecting marketing and formulation strategies.

5. What strategies should companies adopt to succeed in the growing Asia-Pacific vitamin C market?

Localization of manufacturing, compliance with regional regulations, investment in R&D for innovative products, and establishing strategic partnerships with local distributors are key success factors.

References

[1] Market Research Future, "Vitamin C Market Analysis," 2022.

[2] Global Industry Analysts, "Nutraceuticals and Dietary Supplements," 2021.

[3] Research and Markets, "Functional Food Ingredients Outlook," 2022.

[4] Asia-Pacific Food & Beverage Report, 2021.

[5] Grand View Research, "Vitamin C Market Size & Trends," 2022.

[6] U.S. FDA, "Guidelines on Dietary Supplements," 2022.

[7] Statista, "Supply Chain Disruptions in Pharmaceutical Manufacturing," 2022.

[8] EMA, "Guidelines for Vitamin and Mineral Supplements," 2021.

[9] Bloomberg Intelligence, "Investment Trends in the Nutraceuticals Sector," 2022.

[10] World Health Organization, "Sustainable Manufacturing Practices in Pharmaceuticals," 2021.