REPATHA Drug Profile

✉ Email this page to a colleague

Summary for Tradename: REPATHA

| High Confidence Patents: | 15 |

| Applicants: | 1 |

| BLAs: | 1 |

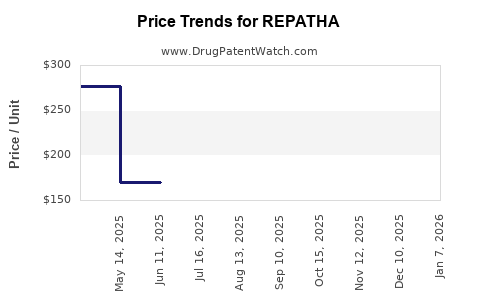

| Drug Prices: | Drug price information for REPATHA |

| Recent Clinical Trials: | See clinical trials for REPATHA |

Recent Clinical Trials for REPATHA

Identify potential brand extensions & biosimilar entrants

| Sponsor | Phase |

|---|---|

| NewAmsterdam Pharma | PHASE2 |

| National Heart, Lung, and Blood Institute (NHLBI) | Phase 4 |

| Hamad Medical Corporation | Phase 4 |

Pharmacology for REPATHA

| Mechanism of Action | PCSK9 Inhibitors |

| Established Pharmacologic Class | PCSK9 Inhibitor |

| Chemical Structure | Antibodies, Monoclonal |

Note on Biologic Patents

Matching patents to biologic drugs is far more complicated than for small-molecule drugs.

DrugPatentWatch employs three methods to identify biologic patents:

- Brand-side disclosures in response to biosimilar applications

- DrugPatentWatch analysis and company disclosures

- Patents from broad patent text search

These patents were identified from disclosures by the brand-side company, in response to a potential biosimilar seeking to launch. They have a high certainty of blocking biosimilar entry. The expiration dates listed are not estimates — they're expiration dates as indicated by the brand-side company.

These patents were identified from searching various sources, including drug labels and other general disclosures from the brand-side company. This list may exclude some of the patents which block biosimilar launch, and some of these patents listed may not actually block biosimilar launch. The expiration dates listed for these patents are estimates, based on the grant date of the patent.

For completeness, these patents were identified by searching the patent literature for mentions of the branded or ingredient name of the drug. Some of these patents protect the original drug, whereas others may protect follow-on inventions or even inventions casually mentioning the drug. The expiration dates listed for these patents are estimates, based on the grant date of the patent.

1) High Certainty: US Patents for REPATHA Derived from Brand-Side Litigation

No patents found based on brand-side litigation

2) High Certainty: US Patents for REPATHA Derived from DrugPatentWatch Analysis and Company Disclosures

| Applicant | Tradename | Biologic Ingredient | Dosage Form | BLA | Patent No. | Estimated Patent Expiration | Source |

|---|---|---|---|---|---|---|---|

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 8,030,457 | 2028-08-22 | DrugPatentWatch analysis and company disclosures |

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 8,563,698 | 2029-05-28 | DrugPatentWatch analysis and company disclosures |

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 8,829,165 | 2033-04-10 | DrugPatentWatch analysis and company disclosures |

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 8,859,741 | 2034-04-24 | DrugPatentWatch analysis and company disclosures |

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 8,871,914 | 2034-04-24 | DrugPatentWatch analysis and company disclosures |

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 8,883,983 | 2034-04-24 | DrugPatentWatch analysis and company disclosures |

| >Applicant | >Tradename | >Biologic Ingredient | >Dosage Form | >BLA | >Patent No. | >Estimated Patent Expiration | >Source |

3) Low Certainty: US Patents for REPATHA Derived from Patent Text Search

| Applicant | Tradename | Biologic Ingredient | Dosage Form | BLA | Patent No. | Estimated Patent Expiration | Source |

|---|---|---|---|---|---|---|---|

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 10,058,630 | 2037-05-22 | Patent claims search |

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 10,154,813 | 2038-06-21 | Patent claims search |

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 10,253,102 | 2038-06-13 | Patent claims search |

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 10,337,070 | 2037-07-13 | Patent claims search |

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 10,357,476 | 2038-11-10 | Patent claims search |

| Amgen Inc. | REPATHA | evolocumab | Injection | 125522 | 10,369,114 | 2037-05-24 | Patent claims search |

| >Applicant | >Tradename | >Biologic Ingredient | >Dosage Form | >BLA | >Patent No. | >Estimated Patent Expiration | >Source |

International Patents for REPATHA

| Country | Patent Number | Estimated Expiration |

|---|---|---|

| Slovenia | 2215124 | ⤷ Get Started Free |

| Japan | 2018118974 | ⤷ Get Started Free |

| Taiwan | I675846 | ⤷ Get Started Free |

| Denmark | 2215124 | ⤷ Get Started Free |

| Eurasian Patent Organization | 032106 | ⤷ Get Started Free |

| Germany | 19207796 | ⤷ Get Started Free |

| >Country | >Patent Number | >Estimated Expiration |

Supplementary Protection Certificates for REPATHA

| Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|

| 2016010 | Norway | ⤷ Get Started Free | PRODUCT NAME: EVOLOCUMAB; REG. NO/DATE: EU/1/15/1016 20150805 |

| C20160021 | Estonia | ⤷ Get Started Free | ;REG NO/DATE: EU/1/15/1016 21.07.2015; NATIONAL AUTHORISATION NUMBER: EMA/690314/2022 15.09.2022 |

| 2016C/030 | Belgium | ⤷ Get Started Free | PRODUCT NAME: EVOLOCUMAB; AUTHORISATION NUMBER AND DATE: EU/1/15/1016 20150721 |

| C20160021 00417 | Estonia | ⤷ Get Started Free | PRODUCT NAME: EVOLOKUMAB;REG NO/DATE: EU/1/15/1016 21.07.2015 |

| C02215124/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: EVOLOCUMAB; REGISTRATION NO/DATE: SWISSMEDIC-ZULASSUNG 65260 05.02.2016 |

| 122016000059 | Germany | ⤷ Get Started Free | PRODUCT NAME: ALIROCUMAB; REGISTRATION NO/DATE: EU/1/15/1031 20150923 |

| >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for the Biologic Drug REPATHA (Evolocumab)

More… ↓