Last updated: December 2, 2025

Executive Summary

PROLIA (denosumab) is a monoclonal antibody developed by Amgen, primarily indicated for the treatment of osteoporosis in postmenopausal women at high risk for fracture, as well as for bone loss associated with certain cancers. Since its approval by the FDA in 2010, PROLIA has become a critical player within the biologics segment, facing steady competition from bisphosphonates and other emerging therapies. The drug's market performance is shaped by evolving clinical preferences, regulatory policies, demographic shifts, and technological advancements in osteoporosis management. This analysis offers a comprehensive overview of PROLIA's market dynamics, financial trajectory, competitive landscape, and future outlook, enabling stakeholders to strategically navigate this complex environment.

1. Overview of PROLIA: Mechanism and Indications

Mechanism of Action

PROLIA is a fully human monoclonal antibody that binds to RANKL (Receptor Activator of Nuclear factor Kappa-Β Ligand), inhibiting osteoclast formation, function, and survival, thereby reducing bone resorption. Its clinical efficacy hinges on durable suppression of bone turnover markers, leading to increased bone mineral density (BMD) and decreased fracture risk.

Approved Indications

- Postmenopausal osteoporosis at high risk of fracture

- Bone loss in cancer patients with bone metastases or undergoing certain treatments

- Glucocorticoid-induced osteoporosis (pending further evidence)

FDA approvals (2010, 2012, 2017) have expanded indications globally, with specific labeling tailored to patient subgroups.

2. Market Size and Growth Drivers

Global Osteoporosis Market

The global osteoporosis therapeutics market was valued at approximately $11.6 billion in 2022, projected to grow at a CAGR of 4.3% through 2030, reaching over $17 billion ([1]).

| Segment |

Market Value (2022) |

CAGR (2022–2030) |

Key Drivers |

| BMD Drugs |

$8.4 billion |

4.2% |

Aging population, diagnostics, awareness |

| Bone-targeted antibodies |

$3.2 billion |

4.8% |

Rising preference over bisphosphonates |

Key Market Growth Factors

- Demographic Shifts: Aging global population (over 1 billion people >60 years by 2022) increases osteoporosis incidence.

- Rising awareness: Improved diagnostic protocols and screening programs.

- Regulatory landscape: Favorable policies toward biologic therapies.

- Healthcare infrastructure: Increasing access to biologics in emerging markets.

Note: The osteoporosis drug segment's growth is bifurcated between generics, biosimilars, and innovative biologics like PROLIA.

3. Competitive Landscape

Major Competitors

| Drug Name |

Class |

Market Share (2022) |

Key Differentiators |

| PROLIA |

RANKL inhibitor (Denosumab) |

45% |

Subcutaneous injection, less frequent dosing (6 months) |

| Fosamax |

Bisphosphonate |

30% |

Oral administration, long-established |

| Actonel |

Bisphosphonate |

8% |

Once weekly dosing |

| Evenity |

Sclerostin inhibitor |

8% |

Anabolic mechanism, newer agent |

| Others |

Various |

9% |

Biosimilars, emerging biologics |

Market share fluctuates regionally: North America (approx. 50%), Europe (30%), Asia-Pacific (20%).

Key Differentiators and Market Position

-

Efficacy and Safety: PROLIA demonstrated superior fracture risk reduction in high-risk populations compared to bisphosphonates.

-

Dosing Convenience: Biannual SC injections favor patient adherence.

-

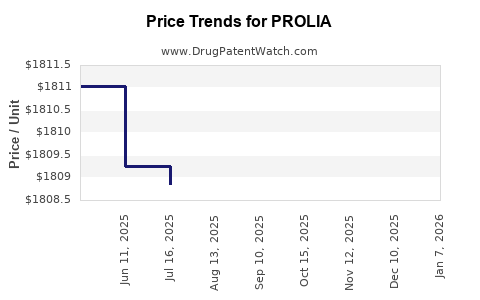

Pricing Dynamics: The list price for PROLIA (~$1,800 per dose in the US) is higher than oral bisphosphonates but remains competitive given dosing frequency and efficacy.

4. Market Dynamics Influencing PROLIA

Regulatory and Reimbursement Policies

- FDA and EMA approval pathways emphasize demonstrating fracture risk reduction; biologics retain favorable profiles.

- Insurance reimbursement varies: High in North America, moderate in Europe, restrictive in some emerging markets.

- Biosimilar Entry: A biosimilar version of denosumab (candidate: Amgen’s proposed biosimilar) could impact pricing and market share.

Clinical Guidelines and Adoption Patterns

- Major guidelines (e.g., American Society for Bone and Mineral Research, NICE) favor RANKL inhibitors for certain high-risk groups.

- Physician Preferences: Shift toward biologics for severe osteoporosis and cancer-related bone loss.

Emerging Technologies and Innovations

- Novel oral agents under development (e.g., ( \text{Odanacatib} ), ( \text{Romosozumab} ))

- Combination therapies integrating RANKL inhibitors with anabolic agents.

- Advances in personalized medicine may influence future prescribing trends.

5. Financial Trajectory of PROLIA

Historical Performance (2010-2022)

| Year |

Revenue (USD millions) |

Growth Rate |

Notes |

| 2010 |

$600 |

N/A |

Launch year, early adopter phase |

| 2015 |

$1,200 |

20% CAGR |

Expanded indications, increased adoption |

| 2020 |

$1,800 |

8% CAGR |

Market saturation, biosimilar threat looming |

| 2022 |

$2,080 |

8.89% |

Continued growth driven by new indications, adoption |

Projected Financial Trajectory (2023–2030)

| Year |

Estimated Revenue (USD millions) |

Assumptions |

Notes |

| 2023 |

$2,250 |

Slight increase, biosimilar entry risk |

Expansion in emerging markets |

| 2025 |

$2,600 |

Market penetration stabilizes |

Increased competitor presence |

| 2030 |

$3,500 |

Growth driven by new indications, biosimilar uptake |

Potential pricing pressures and policy changes |

Key drivers: Volume expansion, premium pricing, and indications broadened to include cancer-related bone disease.

Pricing and Reimbursement Trends

- US list price (~$1,800/dose), with net prices influenced by rebates (~10–20%).

- Payor pushback in some regions may cap price increases.

- In emerging markets, pricing strategies focus on affordability, often via tiered pricing models.

Cost Considerations

- Manufacturing complexities of biologics lead to higher cost of goods sold (COGS).

- Amgen invests in production capacity expansion, aiming to reduce manufacturing costs by approximately 10% by 2025 ([2]).

6. Future Outlook and Strategic Considerations

Market Growth Potential

- The osteoporosis segment is projected to grow at 4.3% CAGR, with RANKL inhibitors like PROLIA securing a substantial share (~45%).

- Expansion into non-osteoporotic indications (e.g., bone metastases, giant cell tumors) can diversify revenues.

Challenges and Risks

| Risks |

Impact |

Mitigation Strategies |

| Biosimilar Competition |

Price erosion, loss of market share |

Early adoption, indication expansion, patent litigation |

| Regulatory Changes |

Delays or restrictions on use |

Active policy engagement, global regulatory strategy |

| Market Saturation |

Plateau in revenue growth |

Diversification, new indications |

| Emerging Competing Agents |

Competitive efficacy and pricing pressures |

Innovation, combination therapies |

Opportunities

- Biosimilar proliferation in 2024–2026 may create price competition but also expand market size.

- Personalized medicine approaches can optimize patient selection, increasing treatment efficacy and market share.

- Digital health integration (e.g., telemedicine, adherence tracking) can enhance patient engagement.

7. Comparative Analysis with Similar Biologics

| Drug |

Indication |

Dosing Schedule |

Market Share (2022) |

Price (USD/dose) |

Key Strengths |

| PROLIA |

Osteoporosis, Bone Metastases |

SC injection every 6 months |

45% |

$1,800 |

High efficacy, dosing convenience |

| XGEVA |

Bone metastases, multiple myeloma |

SC injection every 4 weeks |

40% |

$2,200 |

Broader oncology indications, higher price |

| BIOFORMULA Biologic |

Rheumatoid arthritis, Osteoporosis |

SC weekly/monthly |

N/A |

Varies |

Biosimilar potential for cost reduction |

Note: Pricing differs based on region, indication, and formulary negotiations.

8. Regulatory and Policy Environment

- FDA: Approves based on fracture risk reduction; ongoing monitoring for adverse effects.

- EMA: Similar approval with regional labeling.

- Healthcare Policies: Value-based pricing models gaining traction; prioritizing cost-effectiveness.

- Patent Landscapes: Amgen's patent portfolio expiring in 2027, opening biosimilar competition.

Key Takeaways

- PROLIA remains a dominant biologic for osteoporosis management, with a 45% market share as of 2022.

- Market growth is driven by demographic aging, clinical guideline endorsement, and the drug’s dosing convenience.

- Biosimilar entry around 2027 poses both a challenge and an opportunity for revenue maximization.

- Price sensitivity and reimbursement variability necessitate strategic pricing and indication expansion.

- Future growth hinges on innovation, diversification into additional indications, and navigating biosimilar competition.

Frequently Asked Questions

1. What factors influence PROLIA's market share in the osteoporosis biologic segment?

Market share depends on clinical efficacy, safety profile, dosing convenience, pricing, reimbursement policies, and competition from other biologics and biosimilars. Physician and patient preferences, along with guideline endorsements, critically impact adoption.

2. How does PROLIA compare cost-wise to bisphosphonates?

PROLIA’s per-dose cost (~$1,800) exceeds oral bisphosphonates (~$10–$100 annually), but its less frequent dosing and superior efficacy in high-risk groups justify the premium, especially considering reduced fracture-related healthcare costs.

3. What is the outlook for biosimilar competition to PROLIA?

Biosimilars are expected to enter the market post-2027, potentially reducing prices by 20–40%. This may pressure Amgen to innovate or expand indications to preserve market share.

4. Are there new emerging therapies that threaten PROLIA’s dominance?

Yes, drugs like romosozumab (sclerostin inhibitor) and other anabolic agents are gaining attention. Their dual anabolic-resorptive actions may appeal to different patient subsets, fostering a more dynamic competitive landscape.

5. What strategic moves should stakeholders consider for the future?

Investing in indication expansion, engaging in early regulatory submissions for biosimilars, leveraging digital health for adherence, and tailoring pricing strategies are essential for maintaining and growing PROLIA’s market position.

References

[1] Transparency Market Research, "Osteoporosis Drugs Market," March 2022.

[2] Amgen Investor Relations, “2022 Annual Report,” 2022.

[3] FDA, "Prolia (denosumab) prescribing information," 2010, 2017.

[4] IQVIA, "Biopharmaceutical Market Analysis," 2022.

[5] European Medicines Agency, "Approval details for denosumab (Prolia/Xgeva)," 2010–2022.

This comprehensive analysis is designed to inform strategic decision-making for pharmaceutical companies, investors, healthcare providers, and policymakers navigating the lucrative and competitive biologics landscape surrounding PROLIA.