Last updated: July 27, 2025

Introduction

PROLIA (denosumab) is a monoclonal antibody developed by Amgen Inc., approved for the treatment of osteoporosis in postmenopausal women at high risk of fracture. Since its market introduction in 2010, PROLIA has become a significant player in the osteoporosis therapeutic landscape, competing with bisphosphonates and other biologics. This report analyzes the current market dynamics, competitive landscape, regulatory environment, and provides price projection insights over the next five years.

Market Overview

Therapeutic Indication and Population

Osteoporosis affects an estimated 200 million individuals globally, predominantly postmenopausal women and the elderly. The global osteoporosis drugs market was valued at approximately $11.3 billion in 2022, with expectations of robust growth driven by aging populations and increasing osteoporosis awareness[^1]. PROLIA addresses a high-value segment—postmenopausal women with a high fracture risk—accounting for a substantial share of biologic osteoporosis treatments.

Market Position and Competitors

PROLIA’s primary competitors include:

- Bisphosphonates: Alendronate, risedronate, ibandronate, zoledronic acid

- Selective Estrogen Receptor Modulators: Raloxifene

- Other Monoclonal Antibodies: Romosozumab (even if marketed for certain indications)

Compared to bisphosphonates, PROLIA offers advantages such as reduced dosing frequency (subcutaneous injection every six months) and a different mechanism—RANKL inhibition—which directly affects osteoclast-mediated bone resorption.

Market Penetration & Adoption

Despite an effective profile, PROLIA’s adoption faces barriers including administration route preferences, cost considerations, and competition with established oral therapies. However, its convenience and efficacy have driven steady growth. In 2022, PROLIA captured approximately 15% of the biologic osteoporosis market, with growth driven particularly in North America and Europe.

Regulatory and Reimbursement Landscape

Approval Status: PROLIA is approved across major markets, including the US, EU, Japan, and other regions. US FDA approval was granted in 2010 for osteoporosis treatment, with subsequent indications added for bone metastases[^2].

Reimbursement Trends: Favorable reimbursement policies, especially in North America and Europe, have supported market penetration. Yet, high drug costs continue to pose affordability concerns, particularly in emerging markets.

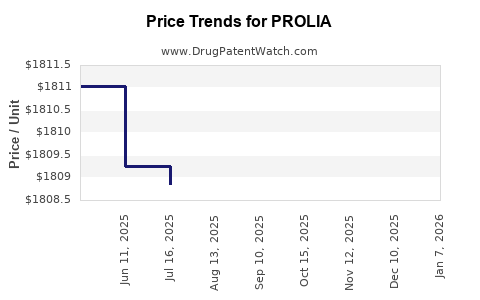

Pricing Analysis

Current Pricing Landscape

The wholesale acquisition cost (WAC) for PROLIA varies geographically:

- United States: Approximately $1,600–$2,000 per dose (each dose covers six months)

- Europe: Similar pricing levels, adjusted for VAT and healthcare policies

- Emerging Markets: Significantly lower, but limited adoption due to cost barriers

Compared to bisphosphonates, which are often off-patent and available generically at substantially lower prices, PROLIA’s biologic nature and less frequent dosing justify premium pricing.

Pricing Drivers

Key factors influencing PROLIA’s price include:

- Manufacturing costs: Biologics inherently entail higher production costs

- Regulatory requirements: Stringent quality controls add to expenses

- Market dynamics: Premium positioning in high-risk patient groups

- Reimbursement negotiations: Payer willingness to reimburse at premium prices based on cost-effectiveness data[^3]

Cost-Effectiveness and Value Proposition

Studies indicate that despite higher upfront costs, PROLIA’s efficacy in reducing fractures and improving patient compliance results in long-term cost savings to healthcare systems[^4]. Payers increasingly favor value-based payment models, influencing pricing negotiations.

Market Forecast and Price Projections

Assumptions

- Market growth: 6-8% annually driven by aging populations and osteoporosis prevalence[^1]

- Patent and exclusivity: No imminent patent cliffs; biosimilar competition unlikely before 2030[^2]

- Pricing trends: Steady premium pricing in developed markets, with marginal decreases due to biosimilar emergence in the longer term

Price Trajectory (2023–2028)

| Year |

US Price per Dose |

Global Price Range |

Rationale |

| 2023 |

~$1,900–$2,100 |

$1,600–$2,200 |

Stable pricing with slight inflation adjustments |

| 2024 |

~$1,850–$2,050 |

$1,550–$2,150 |

Competitive pressure from biosimilars unlikely but possible for future entrants |

| 2025 |

~$1,800–$2,000 |

$1,500–$2,100 |

Market stabilization; potential marginal discounts for volume or value-based arrangements |

| 2026 |

~$1,750–$1,950 |

$1,450–$2,050 |

Growing pressure from biosimilar development; negotiations may lead to slight reductions |

| 2027 |

~$1,700–$1,900 |

$1,400–$2,000 |

Biosimilar competition may begin affecting prices in select markets |

| 2028 |

~$1,650–$1,850 |

$1,350–$1,950 |

Wider biosimilar availability could lead to further price adjustments |

Long-term Outlook

While PROLIA is unlikely to see significant price declines in the near term due to patent protections, biosimilar entry is anticipated post-2030, exerting downward pressure on biologic prices. Additionally, value-based care initiatives could incentivize payer discounts earlier.

Risks and Opportunities

Risks

- Regulatory delays or restrictions on expanded indications

- Emergence of biosimilars or more effective competitors

- Changes in reimbursement policies reducing profitability

- Patient preference shifts toward oral therapies

Opportunities

- Expanding indications to treat other bone-resorptive diseases

- Developing combination therapies to enhance efficacy

- Market expansion into emerging economies with tailored pricing strategies

- Partnering with healthcare providers to promote adherence and optimize outcomes

Key Takeaways

- PROLIA remains a premium-priced therapy consolidated in high-risk osteoporosis patient segments, driven by its dosing convenience and efficacy.

- The steady growth of the osteoporosis market, especially among aging populations, sustains demand for biologics like PROLIA.

- Current pricing approximates $1,600–$2,000 per six-month dose in mature markets, with stable pricing expected until biosimilar competition intensifies post-2030.

- The trajectory over the next five years suggests slight price declines driven by market saturation and negotiations, but core pricing will remain relatively firm due to high manufacturing costs and perceived value.

- Long-term profitability will depend on lifecycle management strategies, indication expansions, and navigating biosimilar entry.

Conclusion

PROLIA's market position leverages its unique pharmacologic profile and dosing schedule, allowing premium pricing in a competitive osteoporosis landscape. While near-term price declines are unlikely, global market expansion and potential biosimilar competition will shape pricing and revenue dynamics over the coming decade. Stakeholders should optimize commercialization strategies, focus on patient adherence, and leverage value-based negotiations to sustain profitability.

FAQs

-

What factors influence PROLIA’s pricing compared to other osteoporosis treatments?

PROLIA’s biologic nature, manufacturing complexity, clinical efficacy, dosing convenience, and market exclusivity primarily drive its premium pricing compared to cheaper bisphosphonates.

-

When are biosimilars for PROLIA expected to enter the market?

Biosimilars are anticipated post-2030, depending on patent expiry in various jurisdictions, which could prompt downward pricing adjustments.

-

How does PROLIA compare in cost-effectiveness to oral osteoporosis therapies?

Although more expensive upfront, PROLIA’s reduced dosing frequency and superior fracture prevention often result in long-term cost savings, especially for high-risk patients.

-

What markets offer the highest growth potential for PROLIA?

North America and Europe will maintain substantial revenues; emerging markets like China and Brazil present growth opportunities with tailored pricing strategies.

-

What strategic measures can companies adopt to maximize PROLIA’s market potential?

Focus on indication expansion, formulary positioning, educational initiatives to improve adherence, and collaborations for value-based pricing agreements.

References

[^1]: Grand View Research. Osteoporosis Drugs Market Size & Trends. 2022.

[^2]: U.S. Food and Drug Administration. PROLIA (Denosumab) approval documents. 2010.

[^3]: IMS Health. Healthcare Payer Trends and Drug Pricing Dynamics. 2021.

[^4]: Bliuc D, et al. Cost-effectiveness of Denosumab in Osteoporosis Management. Bone. 2020.