Last updated: September 23, 2025

Introduction

ADMELOG (insulin lispro), a rapid-acting insulin analog, has carved a significant niche within the diabetes management landscape since its FDA approval in 2010. As a biosimilar to Eli Lilly’s Humalog (insulin lispro), ADMELOG offers a cost-effective alternative aimed at improving patient access and adherence. Understanding its market dynamics and financial trajectory involves dissecting factors such as patent lifecycles, competitive landscape, healthcare policies, and evolving market demands.

Market Overview

Global Diabetes Burden and Therapeutic Demand

The global prevalence of diabetes mellitus exceeds 537 million adults, projected to rise to 643 million by 2030 [1]. Insulin therapies like ADMELOG serve as critical management options, especially for type 1 and advanced type 2 diabetes. The increasing diabetic population underpins sustained demand, but market growth is moderated by factors such as biosimilar penetration, formulary positioning, and pricing strategies.

Biologics and Biosimilars Climate

Biologics account for a substantial portion of big pharma revenues, with insulin comprising a significant segment. The entry of biosimilars like ADMELOG has intensified competition, leading to downward pressure on prices. Regulatory pathways, primarily governed by the FDA and EMA, facilitate biosimilar approvals, catalyzing market entry and driving price competition.

Market Dynamics

Patents and Exclusivity

ADMELOG's initial exclusivity periods, aligned with Lilly's patent protections, delayed biosimilar entry. Patent cliffs typically occur around 2025-2027, opening market share for biosimilar formulations. Patent litigation and strategies for extending exclusivity through secondary patents influence market access timelines significantly [2].

Competitive Landscape

Initially, ADMELOG faced minimal competition as a biosimilar. However, recent approvals of multiple insulin biosimilars (e.g., SAR441902 by Samsung Bioepis, LY011 by Biocon) intensify competition. Price undercutting and formulary preferences favor biosimilars, pressuring original biologics' revenues.

Pricing and Reimbursement

Reimbursement policies shaped by national health agencies and pharmacy benefit managers (PBMs) substantially influence adoption. Countries like the U.S. exhibit favorable coverage for biosimilars, but supply chain dynamics, physician prescribing habits, and patient acceptance play pivotal roles. Price cuts—often up to 30-50% compared to branded insulins—make biosimilars like ADMELOG more attractive to payers.

Market Penetration and Adoption

Physician familiarity, clinical inertia, and patient preference influence biosimilar uptake. Education initiatives and incentive programs drive adoption, with some markets demonstrating rapid transition to biosimilars. However, brand loyalty and perceptions of efficacy impact speed and scope of penetration.

Financial Trajectory

Revenue Projections

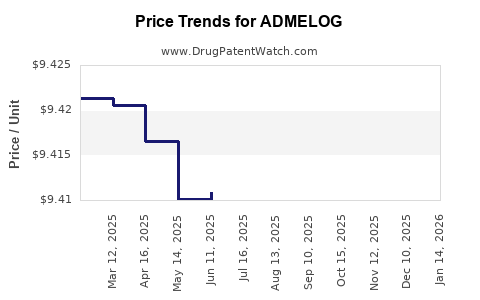

Pre-patent expiry, ADMELOG's revenues ranged between \$400 million to \$600 million annually, maintaining a steady growth attributable to increasing diabetes prevalence. Post-patent expiry, projections indicate gradual revenue decline coupled with biosimilar market share gains.

Based on industry estimates, biosimilars like ADMELOG could capture between 30-50% of the insulin lispro market within five years of entry [3]. This translates into a revenue decrease of approximately 30-50% for original biologics, assuming pricing remains competitive.

Cost Dynamics

Cost reductions are driven by manufacturing efficiencies, supply chain optimization, and declining R&D expenditure per new biosimilar approvals. However, marketing and legal costs for patent challenges and market defense can offset savings.

Market Share Evolution

Initial biosimilar launches typically achieve low single-digit market shares but can surge to over 50% within a decade, contingent on pricing strategies, formulary inclusion, and physician acceptance [4].

Factors Influencing Future Financial Trajectory

- Patent Expirations: Key patent cliffs forecasted around 2025-2027 will open market access.

- Regulatory Environment: Accelerated pathways or patent challenge reforms could influence timing and volume of biosimilar introductions.

- Market Acceptance: Clinical confidence and physician education will determine biosimilar uptake rates.

- Pricing Strategies: Affordability initiatives and competitive pricing will shape revenue trajectories.

- Market Consolidation: Strategic mergers and acquisitions may impact distribution channels and market dynamics.

Emerging Trends and Opportunities

- Personalized Insulin Delivery: Integration with digital health platforms may transform usage patterns.

- Enhanced Biosimilar Portfolio: Competitors developing next-generation insulin analogs could reshape therapeutic options.

- Global Market Expansion: Emerging markets with large diabetic populations present growth opportunities, especially with affordable biosimilars.

Regulatory and Policy Impacts

Policy shifts favoring biosimilar substitution, such as in the European Union and select U.S. states, bolster market penetration. Conversely, stringent regulatory hurdles or patent litigations can delay biosimilar commercialization, affecting financial prospects.

Key Takeaways

- The expiration of key patents around 2025-2027 will significantly accelerate biosimilar competition, including ADMELOG.

- Competitive pricing and strategic formulary placements are critical for sustaining revenue streams.

- Increasing global diabetic populations will support consistent demand, but biosimilar market share gains will challenge initial revenues.

- Physician and patient acceptance remain pivotal—educational initiatives can catalyze adoption.

- Regulatory policies and patent strategies will continue to influence market timing, access, and profitability.

Conclusion

ADMELOG's market and financial outlook hinges on the intersection of patent protections, biosimilar competition, healthcare policies, and market acceptance. While immediate revenues face pressure from evolving biosimilar entrants, long-term growth opportunities stem from expanding diabetic populations and strategic market positioning. Proactive adaptation in pricing, stakeholder engagement, and technological advancements will determine the drug’s financial trajectory in this dynamic landscape.

FAQs

1. When do patents for ADMELOG expire, enabling biosimilar competition?

Patent protections for ADMELOG are expected to expire around 2025-2027, after which biosimilars can rapidly penetrate the market, impacting revenue streams.

2. How does biosimilar entry affect the pricing of ADMELOG?

Biosimilar entry typically results in significant price reductions—often 30-50%—through increased competition, pressuring original biologics to decrease prices to maintain market share.

3. What factors influence biosimilar adoption in the diabetes market?

Physician familiarity, formulary coverage, patient acceptance, education, and pricing strategies are primary drivers of biosimilar adoption.

4. How might healthcare policies impact ADMELOG’s future market share?

Policies favoring biosimilar substitution and reimbursement reforms encourage uptake, whereas restrictive regulations may delay market penetration.

5. What are key growth opportunities for ADMELOG beyond patent expiry?

Expanding into emerging markets, integrating with digital health tools, and establishing strong physician and patient trust are critical growth avenues post-patent expiration.

Sources

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition. 2019.

[2] U.S. Food and Drug Administration. Biosimilar and Interchangeable Products. 2022.

[3] IQVIA. The Global Use of Medicines in 2020. 2021.

[4] Evaluate Pharma. Biosimilars and Insulin Market Reports. 2022.