Share This Page

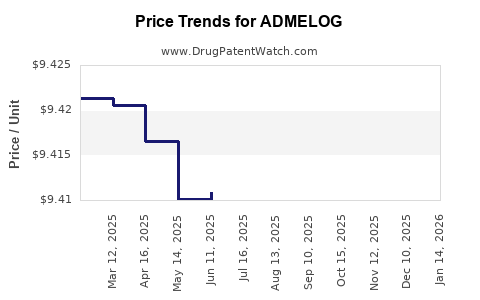

Drug Price Trends for ADMELOG

✉ Email this page to a colleague

Average Pharmacy Cost for ADMELOG

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ADMELOG 100 UNIT/ML VIAL | 00024-5924-10 | 9.39581 | ML | 2025-12-17 |

| ADMELOG 100 UNIT/ML VIAL | 00024-5926-05 | 12.60417 | ML | 2025-12-17 |

| ADMELOG SOLOSTAR 100 UNIT/ML | 00024-5925-05 | 12.11775 | ML | 2025-12-17 |

| ADMELOG 100 UNIT/ML VIAL | 00024-5924-10 | 9.39918 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ADMELOG

Introduction

ADMELOG (insulin lispro-aabc) is a rapid-acting insulin analog developed by Eli Lilly and Company for the management of diabetes mellitus. Approved by the U.S. Food and Drug Administration (FDA) in 2017, ADMELOG is used to control blood sugar levels in adults and children with diabetes. Given the expanding diabetes market, understanding its current positioning, competition, and future pricing trends is vital for stakeholders ranging from pharmaceutical companies to investors and healthcare providers.

Market Overview

Diabetes Market Dynamics

Diabetes mellitus affects approximately 537 million adults globally, with projections reaching 700 million by 2045 [1]. The rising prevalence fuels demand for insulin therapies, including rapid-acting insulins like ADMELOG. The shift towards personalized and fast-acting insulin regimens, patient convenience, and improved glycemic control are driving growth.

ADMELOG’s Market Positioning

ADMELOG competes primarily with other rapid-acting insulins, such as Novo Nordisk’s NovoLog (insulin aspart), Eli Lilly’s own Humalog (insulin lispro), and biosimilar equivalents. Its advantages include similar pharmacokinetics to Humalog but positioned as a more affordable or formulation-based alternative, depending on market strategies. Its availability in multiple delivery systems, including prefilled pens, broadens its accessibility.

Market Penetration and Adoption

Despite being relatively new, ADMELOG has seen steady adoption in the United States, driven by Lilly's marketing efforts, patient demand for rapid-acting options, and clinician familiarity with insulin analogs. However, market share remains competitive, with Novo Nordisk and Sanofi retaining dominant positions owing to strong brand loyalty and extensive distribution networks.

Regulatory and Reimbursement Landscape

FDA Approval and Indications

ADMELOG received approval for mealtime insulin in adults and children with diabetes, aligning with existing rapid-acting analogs. Its approval process followed standard regulatory pathways with demonstrated biosimilarity or clinical equivalence to reference products.

Reimbursement Strategies

Insurance coverage and formulary placements heavily influence sales and pricing. Currently, ADMELOG’s reimbursement landscape varies by region; in the U.S., it benefits from inclusion in many commercial and Medicare plans. However, pricing and prior authorization hurdles can limit access, impacting sales volume and revenue potential.

Pricing Strategy and Trends

Historical Pricing Data

Initially, ADMELOG entered the market at a price comparable to established rapid-acting insulins, around $300–$350 per 10 mL vial prior to rebates and discounts [2]. Pen pack pricing typically ranges from $250–$400, reflecting the standard rates for rapid-acting insulins.

Competitive Pricing Landscape

Pricing among rapid-acting insulins remains relatively stable, supported by high brand loyalty and the necessity for insulin therapy. Biosimilars and generic equivalents in development could exert downward pressure, but currently, branded insulins command premium prices.

Factors Influencing Future Price Movements

- Market Competition: Increased biosimilar entries and biosimilar insulin analogs may lead to price erosion.

- Patent Expirations: Patent cliffs could enable generic or biosimilar versions, intensifying price competition.

- Cost of Manufacturing: Advances in biosimilar manufacturing reduce production costs, potentially leading to lower retail prices.

- Reimbursement Policies: Healthcare reforms focusing on cost containment may incentivize formulary negotiations, discounts, or price caps.

- Patient and Provider Preferences: Evolving preferences for insulin delivery systems and affordability can influence pricing strategies.

Forecasting Price Trends

Short-Term (1–3 Years)

Given the current regulatory and market environment, ADMELOG’s price is expected to remain relatively stable in the short term, with potential discounts driven by insurance negotiations and promotional efforts. No significant price reductions are anticipated unless biosimilar competition accelerates.

Medium to Long-Term (3–10 Years)

As biosimilar insulins gain traction, prices for the class—including ADMELOG—may decline by 15–30% over the next five years. Market consolidation, increased generic options, and healthcare cost pressures are key factors influencing downward trends.

Influence of Biosimilar Market Entry

Biosimilar insulins, once approved, typically trigger price reductions due to increased competition. For instance, the approval of biosimilar insulins in Europe and the U.S. has already led to notable reductions in insulin prices across markets [3].

Implications for Stakeholders

- Pharmaceutical Companies: Must balance innovation investments with strategic pricing to maintain competitiveness amidst biosimilar proliferation.

- Healthcare Providers: Should evaluate cost-effective insulin options, considering both efficacy and affordability.

- Patients: Will ultimately benefit from potential price decreases, improving insulin access and adherence.

- Insurers and Payers: Will continue to negotiate rebates and formulary placements to optimize costs while ensuring therapeutic access.

Key Market Drivers and Challenges

| Drivers | Challenges |

|---|---|

| Increasing diabetes prevalence | Patent expirations and biosimilar competition |

| Rising demand for rapid-acting insulin | High therapeutic interchangeability among insulins |

| Healthcare reforms promoting affordability | Variability in reimbursement policies |

| Patient preference for convenience | Price sensitivity and cost barriers |

Conclusion

ADMELOG’s market prospects hinge on broad adoption amidst a competitive landscape increasingly shaped by biosimilar entrants. While current pricing remains stable, medium-term forecasts indicate potential price declines aligned with biosimilar market growth. Stakeholders must monitor patent statuses, regulatory developments, and healthcare policy shifts to adapt strategies accordingly.

Key Takeaways

- ADMELOG is positioned within a rapidly expanding global diabetes market, competing primarily with other rapid-acting insulins.

- Current pricing remains stable but is subject to downward pressure from biosimilar competition and healthcare reforms.

- Market share growth depends on formulary acceptance, reimbursement negotiations, and patient/provider preferences.

- Patent expirations and biosimilar approvals over the next 3–5 years are likely to catalyze price decreases of 15–30%.

- Effective stakeholder strategies should focus on cost management, access facilitation, and innovation to sustain competitiveness.

FAQs

1. How does ADMELOG differ from other rapid-acting insulins?

ADMELOG is a formulation of insulin lispro designed for similar pharmacokinetics as Humalog but may be positioned as a more affordable alternative, depending on regional pricing and reimbursement strategies.

2. What factors influence the future price of ADMELOG?

Market competition, biosimilar developments, patent expiration, healthcare policy changes, manufacturing costs, and formulary negotiations are primary determinants.

3. Are biosimilars likely to reduce ADMELOG’s price significantly?

Yes. The entrance of biosimilar insulin analogs generally leads to substantial price reductions due to increased market competition.

4. How does reimbursement impact ADMELOG’s market pricing?

Reimbursement policies dictate patient access and influence pharmacy and provider pricing strategies through negotiations and formulary placements.

5. What is the projected impact of biosimilar insulin approvals on the global insulin market?

Biosimilar approvals are expected to decrease prices across insulin classes, improve accessibility, and pressure branded insulin manufacturers to innovate or alter pricing models.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 2022.

[2] GoodRx. Insulin Prices & Cost Comparison, 2022.

[3] IMS Health Reports. Biosimilar Market Trends, 2021.

More… ↓