Last updated: July 29, 2025

Introduction

Wyeth Pharmaceuticals, a once-prominent player in the global pharmaceutical industry, has experienced significant shifts through acquisitions and strategic realignments. Historically known for its robust portfolio in vaccines, biologics, and consumer health, Wyeth's position in the current competitive landscape furnishes insights into its strengths, challenges, and strategic pathways amid evolving market dynamics. This analysis provides a detailed dissection of Wyeth's market positioning, competitive advantages, vulnerabilities, and strategic outlook, offering valuable intelligence for industry stakeholders and investors.

Historical Context and Evolution

Founded in 1860, Wyeth evolved as a diversified healthcare powerhouse, particularly excelling in vaccines, biopharmaceuticals, and consumer health. Its notable innovations include the development of Prevnar (pneumococcal conjugate vaccine) and intricate biologic therapies. In 2009, Pfizer acquired Wyeth for approximately $68 billion, integrating its strengths into Pfizer’s expansive portfolio. This acquisition positioned Pfizer as a dominant giant, but the Wyeth legacy persists through retained brand identities and legacy products.

Post-acquisition, Wyeth continued operating within Pfizer's broader corporate framework, with several branded drugs and vaccine portfolios continuing under the Pfizer umbrella. Despite its integration, Wyeth's historical identity as an innovator and trusted brand has persisted, especially in vaccines and biologics.

Market Position and Business Focus

1. Core Therapeutic Areas

Wyeth’s legacy encompasses several core therapeutic areas:

-

Vaccines: Leading in pediatric and adult vaccines, particularly with products like Prevnar (pneumococcal vaccine) and FluMist (intranasal influenza vaccine).

-

Biologics: Focused on monoclonal antibodies and complex biologic therapies, especially in oncology and immunology.

-

Consumer Healthcare: A legacy segment comprising nutrition, topical products, and over-the-counter drugs.

Despite integration into Pfizer, these segments continue to maintain distinct brand identities and operational centers, especially in vaccine production and biologics R&D.

2. Market Share and Competitive Positioning

Wyeth’s vaccine portfolio remains a stronghold, with Prevnar commanding substantial market share globally. As of 2021, Prevnar was one of the top-selling vaccines worldwide, with annual revenues exceeding $5 billion[1].

In biologics, Wyeth historically pioneered innovations such as Rituxan (rituximab) in lymphoma and rheumatoid arthritis, which continue to be flagship drugs in Pfizer’s portfolio. Its biologic expertise bolsters Pfizer’s leading position in immunology and oncology.

However, Wyeth’s standalone market influence has diminished compared to the pre-acquisition era, primarily absorbed within Pfizer’s overarching global strategy. The vaccine segment, in particular, sustains Wyeth’s legacy market dominance.

Strengths

1. Robust Vaccine Portfolio and Global Reach

Wyeth’s pioneering work in vaccines, especially Prevnar, conferred a significant competitive advantage. Its extensive manufacturing capabilities, regulatory experience, and established distribution channels sustain its dominance in pediatric and adult immunizations across developed and emerging markets.

2. Pioneering Biologic Expertise

Wyeth's history of biologic innovation, including monoclonal antibodies like Rituxan, provides Pfizer with a competitive edge in immunology and oncology segments. This biologic expertise promotes R&D in newer biologics and biosimilars.

3. Strong R&D Legacy and Product Pipeline

Although now part of Pfizer, Wyeth’s established R&D infrastructure and early therapeutic discoveries serve as a springboard for ongoing innovation in targeted therapies, vaccines, and biologics.

4. Global Brand Recognition and Trust

Legacy brand recognition remains high, especially among healthcare providers and immunization programs. This trust translates into favorable market reception and higher acceptance rates.

5. Strategic Collaborations and Licensing Agreements

Wyeth’s history of collaborations with industry leaders, academic institutions, and government health agencies enhances its market access and innovative capacities.

Challenges and Vulnerabilities

1. Limited standalone operational presence

Post-acquisition, Wyeth’s operational independence has decreased, reducing agility in responding to market shifts. Its vaccine and biologic assets are managed under Pfizer’s broader corporate strategies.

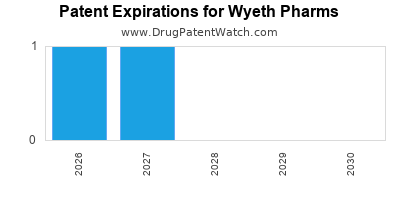

2. Patent Expiries and Generic Competition

Key products like Prevnar face eventual patent cliffs, risking significant revenue erosions unless new formulations or successors are introduced.

3. Market Dynamics and Pricing Pressure

Vaccine and biologic markets face mounting pricing pressures, especially from governments and payers seeking cost containment. Additionally, emerging markets expose Wyeth/Pfizer to pricing and access challenges.

4. Regulatory and Political Challenges

Vaccine approval processes and immunization policies vary globally, with policymakers advocating for affordability and safety, potentially impacting product demand.

5. Competition in Biologics and Vaccines

Competitors like GlaxoSmithKline, Sanofi, and emerging biotech firms invest heavily in vaccines and biologics, threatening Wyeth’s market share.

Strategic Insights and Future Outlook

1. Innovation and R&D Investment

Continued investment in next-generation vaccines—such as universal flu vaccines or pneumococcal conjugates—for emerging pathogens can maintainWyeth/Pfizer’s leadership position. Advances in mRNA technology could revolutionize vaccine development, and Wyeth's legacy research infrastructure positions it to capitalize.

2. Expanding Global Access and Market Penetration

Strategic focus on expanding vaccine access in emerging markets, through partnerships with local governments and NGOs, offers growth opportunities, especially amid global health initiatives targeting infectious diseases.

3. Biosimilars and Biologic Portfolio Optimization

Leveraging biologic expertise to develop biosimilars can secure revenue streams as patent protections lapse on flagship biologics. Strategic licensing and partnerships may accelerate development and market entry.

4. Diversification and Lifecycle Management

Introducing new formulations, combination vaccines, and immunization schedules can prolong product lifecycle. Investing in digital health tools and real-world evidence collection boosts product and brand value.

5. Navigating Regulatory Ecosystems

Active engagement with regulatory agencies to streamline approval processes for vaccines and biologics remains vital. Proactive clinical development aligned with evolving safety standards can sustain market access.

6. Impact of COVID-19 and Pandemic Preparedness

The global emphasis on vaccine development and distribution during the COVID-19 pandemic underscores the importance of flexible manufacturing capabilities and rapid R&D. Wyeth/Pfizer’s investments in mRNA and other innovative platforms position it well for future pandemic responses.

Conclusion

Wyeth Pharmaceuticals maintains a historically strong market position in vaccines, biologics, and immunology, primarily as a legacy brand within Pfizer’s corporate structure. Its extensive product portfolio, global manufacturing capabilities, and pioneering research establish a formidable competitive advantage. However, facing patent expiries, rising competition, and evolving regulatory landscapes necessitate strategic adaptation. Focused innovation, market expansion, and biopharmaceutical pipeline development will be pivotal in sustaining Wyeth’s legacy and harnessing growth opportunities.

Key Takeaways

-

Wyeth’s leading vaccine portfolio, particularly Prevnar, sustains significant revenue and global influence, reinforcing its market position.

-

Biologic expertise, especially in oncology and immunology, remains a core strength, facilitating growth through pipeline expansion and biosimilar development.

-

Integration with Pfizer offers broad resources but poses challenges to operational agility; strategic autonomy remains essential for targeted growth.

-

Addressing patent expiries proactively through innovation, lifecycle management, and biosimilar strategies will mitigate revenue erosion.

-

Expanding access in emerging markets and aligning with global health initiatives can unlock substantial growth opportunities.

FAQs

1. How does Wyeth’s vaccine portfolio compare to competitors?

Wyeth’s Prevnar remains a market leader globally, with competitive advantages over rivals like Sanofi and GlaxoSmithKline due to its early development, regulatory approvals, and established distribution channels. However, increasingly stiff competition and patent expiries necessitate continuous innovation.

2. What strategic moves can Wyeth/Pfizer pursue to sustain its biologics dominance?

Focusing on pipeline diversification, biosimilar development, strategic licensing, and new biosynthetic platforms will be critical. Additionally, expanding manufacturing capacities and engaging in innovative R&D collaborations can reinforce its leadership.

3. How has the COVID-19 pandemic affected Wyeth’s operations?

The pandemic underscored Wyeth/Pfizer’s strengths in vaccine R&D and manufacturing agility. Pfizer’s success with the BNT162b2 mRNA COVID-19 vaccine highlighted its capacity for rapid development and scaled production, reinforcing its strategic focus on innovative vaccine platforms.

4. What are the main threats to Wyeth’s market share?

Patent cliffs, aggressive competition, global pricing pressures, and emerging biotech entrants threaten its market share, especially in vaccines and biologics.

5. What are the key opportunities for Wyeth to grow post-Pfizer acquisition?

Expanding vaccine indications, developing next-generation vaccines, entering emerging markets, and leveraging biosimilar pipelines represent significant growth avenues.

Sources

[1] Global Vaccines Market Report, 2021.

[2] Pfizer Annual Report 2022.

[3] Industry Analysis: Vaccine and Biologic Markets, 2022.