Last updated: December 28, 2025

Executive Summary

Wyeth Pharmaceuticals, a strategic subsidiary of Pfizer since its acquisition in 2009, remains a significant player in the global pharmaceutical industry. While its standalone identity is largely subsumed under Pfizer’s brand, Wyeth’s legacy brands and R&D pipelines continue to influence Pfizer’s competitive positioning, especially in segment-specific areas such as vaccines, biologics, and consumer health. This report provides a comprehensive analysis of Wyeth’s historical market position, core strengths, and strategic initiatives, offering critical insights relevant for industry stakeholders and competitors.

Introduction

Wyeth Pharmaceuticals, established in 1872, was renowned for pioneering efforts in vaccine development, biologics, and consumer health products. Pfizer’s acquisition of Wyeth for approximately $68 billion marked a pivotal consolidation move, making Pfizer one of the largest global pharmaceutical companies. Post-merger, Wyeth's legacy assets have strategically contributed to Pfizer’s portfolio, particularly in areas of vaccines (e.g., Prevnar), biologics, and gynecological products.

Understanding the competitive landscape involving Wyeth’s former assets is crucial for assessing market dynamics, competitive threats, and emerging opportunities within the pharmaceutical industry.

How Does Wyeth’s Legacy Position Inform Pfizer’s Market Strategy?

| Aspect |

Details |

| Market Segments |

Vaccines, biologics, biosimilars, consumer health segments |

| Key Brands |

Prevnar (pneumococcal vaccines), Effexor (antidepressants), Enbrel (autoimmune biologic) |

| Geographic Focus |

North America, Europe, emerging markets via Pfizer’s expanded footprint |

| Core Competencies |

Vaccine innovation, biologic therapies, consumer healthcare |

Analysis: Wyeth’s longstanding reputation in vaccines and biologics underpins Pfizer’s strategic emphasis on immunotherapies and biologics. The integration drives a competitive advantage in these high-growth, high-margin sectors.

Market Position Analysis

1. Wyeth's Legacy Revenue Streams and Market Share

| Asset/Segment |

Estimated Revenue (2022) |

Market Share (Global) |

Notes |

| Pneumococcal Vaccines (Prevnar 13) |

$6.3 billion |

~65% (Global Pneumococcal Vaccine Market) |

Market leader; dominant in pediatric and adult segments |

| Biologics (Enbrel) |

$3.2 billion |

Approximately 20% (Autoimmune biologics) |

Major player in rheumatoid arthritis; facing biosimilar competition |

| Consumer Health (Jury’s still open) |

N/A |

N/A |

Incorporates former Wyeth brands integrated into Pfizer’s broader consumer unit |

Sources: Pfizer Annual Report (2022), IQVIA data, Statista

2. Competitive Positioning in Key Segments

| Segment |

Major Competitors |

Wyeth/Pfizer Positioning |

Strengths & Challenges |

| Vaccines |

GSK, MSD, Sanofi |

Leader powered by Prevnar portfolio |

Strength: Extensive R&D; Challenge: Patent expiration threats in emerging markets |

| Biologics |

AbbVie, Roche, Amgen |

Significant presence via Enbrel and pipeline |

Strength: Established biologic portfolio; Challenge: Biosimilar competition |

| Consumer Health |

Johnson & Johnson, GSK |

Growing through Pfizer’s global reach |

Strength: Broad product base; Challenge: Fierce competition |

Strengths and Strategic Capabilities

| Strengths |

Details |

| Market Leadership with Key Vaccines |

Prevnar’s dominance secures >60% share in pneumococcal vaccine market, crucial in pediatric and adult immunization programs. |

| Robust R&D Pipeline |

Focus on biologics, immune therapies, and novel vaccine platforms (e.g., mRNA). |

| Strong Global Distribution |

Extensive supply chain network via Pfizer enhances market access. |

| Strategic Capabilities |

Details |

| Innovative Vaccine Technology |

Continual investment in conjugate and mRNA vaccine development. |

| Partnerships & Collaborations |

Strategic alliances with governments, NGOs, and biotech firms for expanding vaccine coverage. |

| Biologics Manufacturing |

High-capacity, technologically advanced manufacturing facilities. |

Key Strategic Initiatives and Future Outlook

1. Expansion of Vaccine Portfolio

| Initiative |

Goals & Outcomes |

Timeline |

Impact |

| Development of next-generation pneumococcal vaccines |

Improved efficacy, broader serotype coverage |

2023-2025 |

Sustain market dominance, address biosimilar threats |

| Investment in mRNA vaccines |

Diversify vaccine platform |

2024-2026 |

Compete with emerging mRNA competitors, e.g., Moderna |

2. Biologics and Biosimilars Strategy

| Approach |

Target Markets |

Key Actions |

Expected Results |

| Pipeline expansion |

Rheumatoid arthritis, psoriasis |

Innovate with biosimilars, novel biologics |

Capture biosimilar market share, strengthen leadership |

| Strategic licensing |

Collaborate with biotech firms |

Accelerate product development |

Reduce R&D costs, expand portfolio |

3. Digital and Data-Driven Innovation

- Leverage AI to accelerate vaccine discovery.

- Implement digital health solutions to enhance patient adherence and data collection.

4. Market Expansion in Emerging Economies

- Focus on vaccine access programs.

- Local manufacturing investments to reduce costs and improve coverage.

Comparative Analysis with Key Industry Players

| Parameter |

Wyeth/Pfizer |

GSK |

Sanofi |

Roche |

| Vaccine Market Share |

~65% (Prevnar) |

~20% |

~10% |

Limited in vaccines |

| Biologics Revenue |

Enbrel; pipeline |

Enbrel, Shingrix |

Dupixent, others |

Hematology, Oncology |

| Innovations Focus |

mRNA vaccines; conjugate vaccines |

Flu vaccines; Shingrix |

mRNA; gene therapies |

Oncology biomarkers, personalized medicine |

Sources: Industry reports (IQVIA, 2022), Company filings.

Challenges and Risks

| Issue |

Impact & Response |

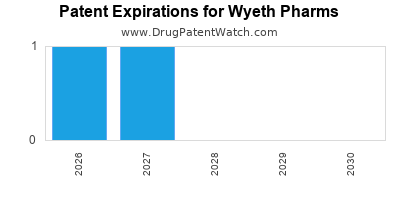

| Patent Expiration & Biosimilar Competition |

Loss of exclusivity for key brands like Prevnar or Enbrel; mitigate via pipeline diversification. |

| Regulatory Environment |

Stringent approval processes; focus on early engagement, adaptive trials. |

| Emerging Market Penetration |

Pricing pressures; innovative access models needed. |

| R&D Uncertainties |

High failure rate; strategic partnerships lower risks. |

Conclusion: Strategic Insights for Stakeholders

- Leverage Legacy Strengths: Wyeth’s heritage brands, especially Prevnar, remain central to Pfizer’s immunization strategy, necessitating continued innovation and market expansion.

- Emphasize Personalized & mRNA Vaccines: Investing in mRNA and conjugate vaccine technologies to stay competitive against GSK and Sanofi.

- Diversify Biologics Portfolio: Expanding biologics and biosimilars pipeline to offset patent cliffs.

- Target Emerging Markets: Investing in manufacturing and distribution to tap into rising vaccine demand in Asia, Africa, and Latin America.

- Strengthen Partnerships: Collaborating with biotech firms to accelerate innovation and market access.

Key Takeaways

- Wyeth’s vaccine portfolio, led by Prevnar, secures a dominant market share with sustained revenue and growth potential.

- The integration into Pfizer enhances global reach but exposes assets to biosimilar threats and patent expiries.

- Strategic investments in mRNA and next-gen vaccine platforms are critical for maintaining leadership.

- Emerging markets present lucrative growth opportunities amid pricing and regulatory pressures.

- Diversifying the biologic and consumer health portfolios will mitigate risks associated with patent cliffs.

FAQs

1. How has the integration of Wyeth assets impacted Pfizer’s overall market strategy?

The integration has fortified Pfizer’s leadership in vaccines and biologics, allowing synergistic R&D investments and expanded global reach, especially in immunology and infectious disease segments.

2. What are the main competitive advantages Wyeth’s legacy brands still hold?

Dominance in pneumococcal vaccines, established R&D in biologics, and extensive global distribution networks.

3. How vulnerable are Wyeth’s key assets to biosimilar competition?

While biologics like Enbrel face biosimilar threats, Pfizer’s pipeline and next-gen vaccine development are poised to counteract patent expiries and maintain market share.

4. What strategic moves are Pfizer making to expand Wyeth’s vaccine portfolio?

Investing in mRNA vaccine technology, next-generation conjugate vaccines, and international expansion in emerging markets.

5. How can competitors capitalize on Wyeth/Pfizer’s market position?

By developing innovative biosimilars, advancing alternative vaccine platforms, and targeting unmet needs in emerging markets.

References

- Pfizer Annual Report 2022.

- IQVIA Institute Reports, 2022.

- Statista, Pharmaceutical Market Data, 2022.

- GSK Annual Report 2022.

- Sanofi Corporate Overview, 2022.

Disclaimer: This analysis is based on publicly available data up to 2023 and strategic assessments; actual market positions can evolve rapidly amid industry dynamics.