Last updated: July 28, 2025

Introduction

AMRIX, the brand designation for indomethacin, is a non-steroidal anti-inflammatory drug (NSAID) primarily used to treat acute and chronic pain conditions, including arthritis, gout, and bursitis. Its market landscape is shaped by evolving healthcare demands, patent statuses, regulatory frameworks, and competitive forces within the NSAID sector. This analysis explores the underlying factors influencing AMRIX’s market dynamics and forecasts its financial trajectory amid contemporary therapeutic trends.

Market Overview and Therapeutic Positioning

Indomethacin’s long-standing presence in medical practice underscores its role as a potent NSAID, recognized for effective anti-inflammatory and analgesic properties. Despite the advent of newer drugs, amply available formulations, and established safety profiles contribute to steady demand. However, concerns regarding adverse cardiovascular and gastrointestinal effects have prompted shifts toward alternative agents, influencing AMRIX’s market share.

The global NSAID market, valued at approximately USD 25 billion in 2022, projects a compound annual growth rate (CAGR) of about 4.0% through 2030. This expansion reflects increased prevalence of chronic inflammatory diseases, especially among aging populations, and heightened awareness of pain management strategies. Within this landscape, indomethacin maintains relevance for specific indications, such as patent ductus arteriosus closure in neonatology, but faces competition from selective COX-2 inhibitors and novel pain management modalities.

Market Drivers

Rising Prevalence of Chronic Pain and Inflammatory Conditions

An aging demographic and lifestyle-related risk factors have escalated incidences of rheumatoid arthritis, osteoarthritis, and gout. According to the World Health Organization (WHO), musculoskeletal conditions account for a significant portion of global disability, constituting a persistent driver for NSAID demand, including indomethacin formulations.

Established Therapeutic Efficacy and Cost-Effectiveness

Generic availability, affordability, and familiarity bolster indomethacin’s utilization, especially in developing markets. Healthcare providers often prefer well-documented efficacy profiles, influencing prescription patterns.

Regulatory Approvals for Specialized Indications

Indomethacin’s approved indication for closing patent ductus arteriosus (PDA) in preterm infants sustains niche market segments, particularly in neonatal intensive care, which is less vulnerable to generic competition.

Increased Focus on Pain Management

The global opioid crisis has prompted healthcare systems to emphasize NSAIDs as safer alternatives for pain relief, fostering sustained demand for drugs like AMRIX where appropriate.

Market Challenges and Constraints

Safety and Tolerability Concerns

Gastrointestinal ulcers, bleeding risks, and cardiovascular events associated with indomethacin constrain its broader application. Regulatory agencies have issued warnings, encouraging cautious prescribing, especially in vulnerable populations.

Competitive Pressure from Selective COX-2 Inhibitors

Celecoxib and etoricoxib, offering improved gastrointestinal safety, have eroded indomethacin’s market share. The shift towards these agents especially influences chronic therapy prescriptions.

Generic Market Penetration and Pricing Pressures

Post-patent expiration, generic indomethacin products dominate, exerting downward price pressure. Pharmaceutical companies face commoditization, diminishing profit margins.

Emergence of Alternative Pain Modalities

Advances in biologic therapies, corticosteroids, and non-pharmacologic interventions contribute to a diversifying pain management landscape, impacting NSAID utilization patterns.

Regulatory and Reimbursement Landscape

Regulatory agencies such as the FDA and EMA regulate AMRIX’s labeling and safety communications. Countries with robust healthcare reimbursement systems favor newer agents, while cost-sensitive regions maintain reliance on older generics.

In certain markets, reimbursement policies incentivize prescribing less expensive NSAIDs, further challenging AMRIX’s market share. Additionally, regulatory restrictions related to safety concerns have led to prescribing restrictions in some jurisdictions.

Financial Trajectory and Forecasting

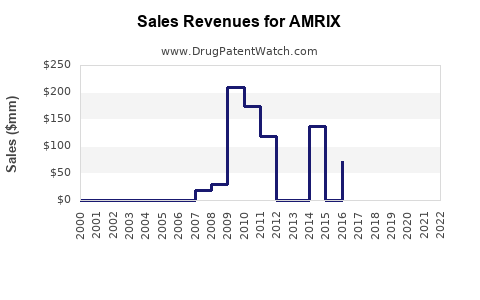

Historical Revenue Trends

Although specific AMRIX sales data are proprietary, the overall NSAID segment’s growth indicates stable demand. Generic sales dominate, with revenue stability bolstered by continuous prescriptions for acute pain and off-label uses, such as PDA closure.

Projected Market Share Evolution

Analyst projections suggest that indomethacin’s market share will decline gradually over the next five years due to increasing competition from safer, targeted NSAIDs. Nonetheless, its niche applications, particularly in neonatal care and short-term pain relief, will sustain modest revenue streams.

Revenue Forecasts

-

Short Term (1-3 years): Marginal decline in revenues driven by generic market saturation and safety concerns. Expected revenues hovered around USD 200-250 million globally, consistent with generic NSAID market averages.

-

Medium to Long Term (4-10 years): A further decrease of 10-25%, as newer therapies gain prominence, but steady demand persists in niche segments and emerging markets.

Investment and R&D Outlook

Limited R&D investment for indomethacin derivatives or new formulations suggests a focus on generic maintenance rather than innovation-driven growth. Companies may pursue reformulations to reduce gastrointestinal toxicity or targeted delivery systems, potentially reviving its utility.

Strategic Implications for Stakeholders

Pharmaceutical firms should evaluate competitive positioning, considering niche indications and geographic markets where AMRIX retains advantages. Patients’ evolving safety expectations necessitate innovation, and strategic partnerships may be essential to sustain profitability.

Manufacturers focusing on cost leadership can leverage manufacturing efficiencies, while investing selectively in reformulation IP to extend product lifecycle. Market diversification into pediatric and neonatal indications can also enhance revenue stability.

Conclusion

AMRIX's future hinges on balancing its established efficacy against safety limitations and entry barriers from newer agents. While current revenues are stable, long-term prospects depend on innovation, regulatory navigation, and strategic market positioning. Stakeholders should anticipate gradual declines in traditional markets but remain alert to niche opportunities and emerging demand for safe, cost-effective pain management alternatives.

Key Takeaways

-

Market stability amid decline: AMRIX will experience gradual revenue erosion due to competition from safer NSAID alternatives and generic price pressures.

-

Niche markets sustain relevance: Pediatric and neonatal indications provide ongoing revenue streams; innovations in formulation may open new opportunities.

-

Safety concerns are pivotal: Cardiovascular and gastrointestinal safety profiles heavily influence prescribing patterns, impacting AMRIX's market penetration.

-

Geographic disparities: Emerging markets may offer growth potential owing to lower drug costs and higher prevalence of unmet needs.

-

Strategic focus for firms: Invest in formulations with improved safety profiles and explore niche indications to mitigate revenue losses.

FAQs

1. What are the primary therapeutic indications for AMRIX?

AMRIX (indomethacin) is mainly prescribed for acute pain, arthritis, gout, bursitis, and in specific neonatal indications such as patent ductus arteriosus closure.

2. How does safety affect AMRIX’s market outlook?

Safety concerns—particularly gastrointestinal and cardiovascular risks—limit its use, prompting clinicians to prefer newer NSAIDs with improved safety profiles, impacting its long-term market share.

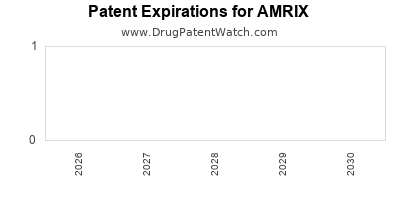

3. What is the impact of patent expiration on AMRIX’s revenue?

Patent expiry generally leads to generic competition, significantly reducing revenues due to price competition and lower profit margins.

4. Are there ongoing innovations in indomethacin formulations?

Research focuses on reformulations to reduce toxicity, such as sustained-release or targeted delivery systems, potentially extending its lifecycle.

5. Which markets represent growth opportunities for AMRIX?

Emerging markets offer growth prospects driven by lower drug costs and high prevalence of pain-related conditions, although market penetration remains challenged by safety concerns.

Sources:

[1] Global NSAID Market Report, 2022

[2] WHO Global Burden of Disease Study, 2021

[3] FDA and EMA safety communications, 2020-2022