Last updated: July 29, 2025

Introduction

The biopharmaceutical industry remains a fiercely competitive landscape, characterized by innovation, aggressive mergers, and strategic alliances. This analysis examines the competitive positioning of Onyx Pharmaceuticals, now part of Amgen, against key industry peers. It evaluates their market share, core strengths, and strategic trajectories, providing insights vital for stakeholders to navigate future opportunities and challenges.

Market Position and Industry Context

Following Amgen's acquisition of Onyx Pharmaceuticals in 2014 for approximately $10.4 billion, the combined entity significantly bolstered its oncology pipeline and market share. Onyx's portfolio, primarily led by the blockbuster multiple myeloma drug Kyprolis (carfilzomib), strengthened Amgen’s foothold in hematologic malignancies, competing directly with firms like Johnson & Johnson, Novartis, and Bayer.

Amgen's core strategic positioning centers on biologics and biosimilars, leveraging cutting-edge biotechnology to develop innovative therapies. The integration of Onyx's assets expanded this focus into targeted oncology treatments, aligning with global shift towards personalized medicine.

Market Share and Revenue Dynamics

Amgen Post-Acquisition

Post-acquisition, Amgen's oncology revenues surged, with Kyprolis and newer agents like Blincyto (blinatumomab) contributing substantially. Fiscal year 2022 data indicated oncology accounted for approximately 19% of Amgen's total revenue, reflecting a strategic pivot.

Onyx's Standalone Position

Prior to acquisition, Onyx positioned itself as a niche player with its focus on multiple myeloma and solid tumor treatments. Its flagship, Kyprolis, generated revenue exceeding $700 million annually pre-acquisition, representing a competitive alternative to Novartis’ Pomalyst and Takeda’s Velcade.

Industry Competition

Onyx/Amgen's key competitors include Johnson & Johnson's Janssen (Imbruvica), Novartis (Pomalyst, Kisqali), and Bayer (Xofigo). These firms dominate therapeutic segments through extensive pipelines and established market presence. The competitive landscape continues to evolve with emerging therapies and biosimilar entrants.

Strengths and Strategic Advantages

1. Robust R&D Capital and Innovation

Amgen's substantial R&D investment, approximately $3.4 billion in 2022, underpins its pipeline. The integration with Onyx's assets enhances this portfolio, especially in hematology-oncology. Notably, the focus on novel mechanisms such as proteasome inhibition and immunotherapy positions Amgen ahead in targeted treatments.

2. Diversified Product Portfolio

Beyond oncology, Amgen maintains leadership in nephrology, inflammatory diseases, and cardiovascular indications. This diversification mitigates risks associated with therapy-specific market shifts, buoyed by Onyx's contributions.

3. Global Reach and Manufacturing Capabilities

Amgen's extensive global footprint facilitates market access and scale. The company's advanced manufacturing networks ensure supply stability, critical amid pandemic-induced disruptions.

4. Strategic Alliances and Licensing

Partnerships with major biotech firms (e.g., BeiGene, BeiGene’s tislelizumab) amplify Amgen’s reach into emerging markets and innovative therapies, fostering sustainable growth.

Challenges and Strategic Considerations

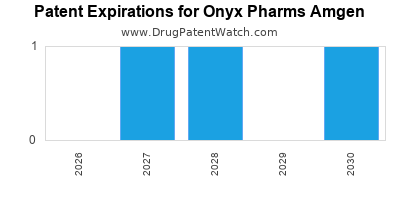

1. Patent Expirations and Biosimilar Competition

The imminent patent cliff for key biologics, including Enbrel and Neulasta, threatens revenue streams. Biosimilar market entry pressure intensifies competition, demanding aggressive R&D and strategic diversification.

2. Pricing Pressures and Regulatory Hurdles

Global healthcare systems impose pricing constraints, especially in Europe and the US. Additionally, regulatory scrutiny over high-cost therapies necessitates transparency and value demonstration.

3. Innovation Pipeline Risks

Despite significant investments, the success rate of clinical trials remains variable. Over-reliance on the oncology segment could expose the company to therapeutic area-specific risks.

Strategic Insights and Future Outlook

Leverage of Targeted Oncology and Cell Therapy:

Amgen's emphasis on CAR-T cell therapies, exemplified by its collaboration with Adaptimmune, positions it within cutting-edge immuno-oncology. Investing in these areas offers high-growth potential amid rising demand for precision medicines.

Pipeline Expansion via Strategic M&As:

Amgen leverages acquisitions to fill pipeline gaps and access novel mechanisms. For instance, potential acquisitions of innovative biotech firms specializing in hematologic or solid tumor therapeutics could sustain growth.

Focus on Biosimilars and Value-Based Pricing:

Scaling biosimilar manufacturing and adopting value-based pricing models will mitigate biosimilar threats and align with payers' cost containment efforts.

Digital Transformation and Patient-Centric Approaches:

Investment in digital tools for clinical trials, remote monitoring, and patient engagement enhances R&D efficiency and market competitiveness.

Conclusion

The integration of Onyx Pharmaceuticals has markedly enhanced Amgen's positioning within the oncology segment, elevating its competitive profile against industry giants. Its strengths in innovation, diversified portfolio, and global manufacturing are strategic assets, but the company must navigate patent expirations, pricing pressures, and pipeline risks. Emphasizing targeted therapies and strategic alliances will be vital for Amgen's sustained growth in the evolving pharmaceutical landscape.

Key Takeaways

- Strategic Acquisitions Drive Growth: The Amgen-Onyx merger exemplifies leveraging acquisitions to strengthen oncology positioning amid fierce industry competition.

- Diversification is Critical: A broad portfolio mitigates risks associated with patent cliffs and therapy-specific market shifts.

- Innovation and R&D Investment Remain Paramount: Sustaining pipeline vitality through continuous innovation ensures long-term competitiveness.

- Biosimilars Present Both Risks and Opportunities: Managing biosimilar challenges while exploring biosimilar development can optimize revenue streams.

- Global and Digital Expansion Will Define Future Success: Expanding into emerging markets and integrating digital health solutions will fortify market access and operational efficiency.

FAQs

1. How has the Amgen-Onyx acquisition impacted Amgen's market share?

The acquisition significantly increased Amgen’s oncology revenue share, particularly through Kyprolis, and strengthened its position in hematologic malignancies.

2. What are the main competitive advantages of Amgen’s oncology portfolio?

Amgen’s strengths include a robust R&D pipeline, innovative targeted therapies, and global manufacturing capability, positioning it favorably against peers.

3. What challenges does Amgen face in maintaining its oncology leadership?

Patent expirations, biosimilar competition, and regulatory pricing pressures threaten revenue streams, requiring strategic agility and pipeline diversification.

4. How is Amgen leveraging digital health and partnerships to sustain growth?

Amgen invests in digital solutions for R&D and patient engagement, and forms alliances with biotech firms to access novel therapies and expand market reach.

5. What strategic moves should Amgen consider for future growth?

Focusing on cell therapy innovations, expanding biosimilar offerings, and pursuing targeted acquisitions in emerging therapeutic areas will sustain competitiveness.

References

[1] Amgen Annual Report 2022, Amgen Inc.

[2] IQVIA MIDAS Data 2022

[3] MarketWatch, "Amgen to acquire Onyx Pharmaceuticals," 2014.

[4] EvaluatePharma, "2022 Oncology Market Outlook," 2022.