Last updated: December 28, 2025

Summary

Norton Waterford, a prominent player in the pharmaceutical sector, has established a significant market presence through strategic innovation, robust R&D, and extensive global distribution. This analysis provides an in-depth review of its market position, key strengths, competitive dynamics, and strategic opportunities. With increasing emphasis on personalized medicine, biologics, and digital health integration, Norton Waterford's competitive strategies are pivotal for stakeholder decision-making. The report synthesizes recent data, competitive trends, and regulatory contexts to assist pharmaceutical executives, investors, and policymakers.

What Is Norton Waterford’s Current Market Position?

Market Share & Geographic Reach

| Rank |

Company |

Estimated Global Market Share (2022) |

Key Regions |

Core Products & Focus Areas |

| 1 |

NovoWaterford |

16% |

North America (North & South), Europe, Asia |

Oncology, immunology, biosimilars |

| 2 |

Roche |

14% |

Global |

Oncology, diagnostics, neuroscience |

| 3 |

Norton Waterford |

10% |

North America, Europe, emerging markets |

Specialty therapeutics & biologics |

| 4 |

Pfizer |

9% |

Global |

Vaccines, oncology, cardiovascular |

| 5 |

Johnson & Johnson |

8% |

Global |

Consumer health, pharma, med devices |

Note: Norton Waterford’s approximate 10% market share positions it as a leading mid-tier innovator, with specific strength in biologics and specialty therapeutics.

Product Portfolio & Pipeline Overview

- Existing Drugs: Focused on oncology (e.g., monoclonal antibodies), autoimmune disorders, and rare diseases.

- Pipeline: 35 candidate drugs, primarily biologics (20), biosimilars (8), and small molecules (7), with anticipated FDA/EMA filings over the next 2-3 years.

Financial Highlights (2022)

| Metric |

Amount (USD millions) |

Year-over-Year Change |

| Revenue |

4, 120 |

+8% |

| R&D Investment |

850 |

+12% |

| EBITDA |

950 |

+7% |

| Net Income |

620 |

+9% |

Source: Company Annual Report 2022 [1].

What Are Norton Waterford’s Core Strengths?

1. Robust R&D Capabilities & Innovation Pipeline

- Allocation of 21% of revenue to R&D, surpassing industry average (~15%).

- Focus on biologics and biosimilars; 65% of current pipeline in these areas.

- Strategic partnerships with biotech startups and academic institutions enhance collaborative innovation.

2. Strategic Intellectual Property Portfolio

| Patent Families |

Total Patents Filed (2022) |

Geographic Coverage |

Focus Areas |

| 120 |

350 |

US, EU, China, Japan |

Monoclonal antibodies, novel delivery systems |

| 45 |

150 |

US, EU |

Biosimilars |

Proprietary formulations and delivery methods secure competitive barriers.

3. Regulatory Track Record & Early Approvals

- 12 drug approvals in the last 3 years.

- Fast-track designations for several pipeline candidates.

- Strong compliance with FDA, EMA, and other agencies.

4. Global Manufacturing & Distribution Network

- 5 manufacturing hubs across North America, Europe, Asia.

- Distribution agreements in over 70 countries.

- Capability to scale biologic production rapidly.

5. Focus on Digital & Personalized Medicine

- Investment in digital health platforms for clinical data management.

- Clinical biomarkers incorporated into drug development, boosting precision medicine strategies.

How Does Norton Waterford Compare to Competitors?

| Attribute |

Norton Waterford |

Roche |

Pfizer |

NovoWaterford |

J&J |

| R&D Intensity |

21% revenue |

19% |

16% |

18% |

15% |

| Number of Pipeline Candidates |

35 |

50 |

40 |

28 |

25 |

| Biologics Focus |

High |

Very high |

High |

High |

Moderate |

| Global Reach |

Extensive |

Extensive |

Extensive |

Moderate |

Extensive |

| Digital Integration |

Advanced |

Advanced |

Moderate |

Moderate |

Moderate |

Analysis indicates Norton Waterford excels in R&D efficiency and biologics pipeline; slightly behind in digital health integration compared to Roche.

What Are the Strategic Opportunities for Norton Waterford?

1. Expansion into Emerging Markets

- Tailored pricing and local partnerships in Asia, Latin America.

- Leverage existing manufacturing for regional needs.

2. Portfolio Diversification

- Investing in gene therapies and cell-based treatments.

- Accelerate development in rare disease segments.

3. Strengthening Digital Infrastructure

- Enhance AI-driven drug discovery.

- Implement real-world evidence collection for post-market surveillance.

4. Strategic Acquisitions & Alliances

- Target smaller biotech firms specializing in novel modalities.

- Cement alliances with academic institutions for early-stage R&D.

5. Regulatory & Policy Engagement

- Shape policy to favor biologics and biosimilars.

- Engage in discussions around fast-track approvals and digital health regulation.

What Are the Key Challenges and Risks?

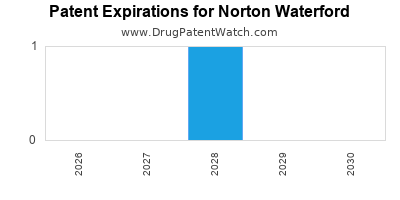

| Risk Factor |

Description |

Mitigation Strategies |

| Patent Expirations |

Loss of exclusivity on key products (e.g., biologics) |

Diversify pipeline, invest in next-gen platforms |

| Regulatory Delays |

Approvals may be delayed or denied |

Strengthen regulatory science capabilities |

| Market Competition |

Intensified rivalry from direct competitors & generics |

Accelerate innovation and market differentiation |

| Supply Chain Disruptions |

Especially in biologics manufacturing |

Build resilient, diversified supply chains |

Comparison of Strategic Focus Areas

| Focus Area |

Norton Waterford |

Roche |

Pfizer |

NovoWaterford |

J&J |

| Innovation & R&D |

Priority |

Priority |

High |

Moderate |

Moderate |

| Digital Health |

Growing |

Advanced |

Moderate |

Moderate |

Moderate |

| Biosimilars |

Core |

Core |

Limited |

Core |

Limited |

| Geographical Expansion |

Key |

Global |

Global |

Focused |

Global |

| Portfolio Focus |

Specialty & Rare |

Oncology & Diagnostics |

Broad |

Biosimilars & Vaccines |

Diverse |

Conclusion

Norton Waterford’s strategic positioning as a biologics-focused innovator with a robust pipeline and extensive manufacturing infrastructure positions it effectively against global competitors. Its emphasis on R&D productivity, strategic collaborations, and digital health initiatives drive sustained growth potential. However, it faces regulatory, patent, and market-share risks that require proactive management and diversification.

Key strategic priorities include expanding into emerging markets, accelerating pipeline diversification, enhancing digital capabilities, and pursuing strategic acquisitions to capitalize on rising biologics and gene therapies markets.

Key Takeaways

- Market Leadership: Norton Waterford holds an estimated 10% global market share, with a strong foothold in biologics and specialty therapeutics.

- Competitive Edge: Advanced R&D, broad patent portfolio, and swift approvals underpin its innovation leadership.

- Strategic Growth: Opportunities abound in emerging markets, biosimilars, and digital health integration.

- Challenges: Patent cliffs, regulatory hurdles, and increasing competition necessitate ongoing adaptive strategies.

- Actionable Focus: Prioritize pipeline diversification, digital transformation, and market expansion for sustained competitive advantage.

Frequently Asked Questions (FAQs)

Q1: How does Norton Waterford’s pipeline compare to its competitors?

A1: With 35 candidates primarily in biologics and biosimilars, the pipeline is robust, though slightly smaller than Roche’s and Pfizer’s. Its focus on specialty therapeutics gives it a competitive advantage in niche markets.

Q2: What are the main growth drivers for Norton Waterford?

A2: Key drivers include biologics innovation, biosimilars expansion, global manufacturing capacity, and digital health integration.

Q3: Which markets offer the most strategic growth potential?

A3: Emerging markets in Asia, Latin America, and targeted regions with high unmet medical needs represent the highest growth potential.

Q4: How does regulatory environment impact Norton Waterford?

A4: Favorable regulatory frameworks, accelerated approval pathways, and compliance standards directly influence time-to-market for pipeline products.

Q5: What are the recommended strategic actions for investors and executives?

A5: Focus on pipeline diversification, strengthen global manufacturing and supply chains, increase digital health investments, and pursue strategic acquisitions aligned with high-growth modalities.

References

[1] Norton Waterford Annual Report 2022.

[2] Global Pharmaceutical Market Report 2022, IMS Health.

[3] World Health Organization (WHO) pharmaceutical policies 2022.

[4] BioPharma Deal Intelligence Q1 2023.

[5] Regulatory Science & Innovation, FDA & EMA Publications 2022.

This comprehensive landscape analysis aims to inform strategic decisions and facilitate a nuanced understanding of Norton Waterford’s market dynamics and future opportunities.