Last updated: August 3, 2025

Introduction

ARIXTRA (fondaparinux sodium) stands as a pivotal anticoagulant prescribed primarily for thrombosis prevention and treatment. Since its approval, ARIXTRA has carved a distinct niche within the anticoagulant segment, driven by its unique mechanism of action and expanding clinical indications. The drug’s market dynamics are shaped by factors such as evolving reimbursement policies, competitive landscape shifts, and advancing therapeutic guidelines. This article provides a comprehensive analysis of ARIXTRA's current market environment, future growth prospects, and financial trajectory.

Overview of ARIXTRA and Its Therapeutic Position

ARIXTRA, developed by GlaxoSmithKline (GSK) and marketed globally, is a synthetic pentasaccharide that exerts its anticoagulant effect by selectively inhibiting activated Factor Xa. Its high specificity offers advantages in safety profiles, including a lower risk of heparin-induced thrombocytopenia. Initially approved in 2002 for deep vein thrombosis (DVT) prophylaxis following hip surgery, ARIXTRA's indications have since expanded to include treatment for acute pulmonary embolism (PE) and prophylaxis of venous thromboembolism (VTE) in various surgical and medical settings.

Market Positioning:

ARIXTRA's key strength lies in its predictable pharmacokinetics, ease of administration via subcutaneous injection, and reduced need for laboratory monitoring. These features position it favorably among newer oral anticoagulants, especially in perioperative and hospital-based settings.

Market Dynamics

1. Competitive Landscape and Market Share

The global anticoagulant market is intensely competitive, featuring direct rivals such as low-molecular-weight heparins (enoxaparin, dalteparin), warfarin, and direct oral anticoagulants (DOACs) like rivaroxaban, apixaban, and dabigatran. Recent years have seen a shift towards oral agents due to convenience, impacting injectable agents like ARIXTRA.

Market Share Trends:

ARIXTRA's market share has experienced compression as DOACs gained momentum, favored for their oral delivery and simplified dosing regimens. Nonetheless, in hospital settings, especially for prophylaxis post-surgery, ARIXTRA maintains a significant role, supported by clinical guidelines emphasizing its efficacy and safety profile.

2. Clinical Guidelines and Regulatory Influence

Guidelines from organizations such as the American College of Chest Physicians (ACCP) continue to recommend fondaparinux for DVT and PE prophylaxis, particularly in orthopedic surgery. These endorsements bolster ARIXTRA’s utilization in specific institutional contexts, but the growing acceptance of NOACs (novel oral anticoagulants) for extended use has slightly tapered its dominance.

3. Reimbursement Policies & Pricing Strategies

Reimbursement landscape significantly influences ARIXTRA’s accessibility. In markets like the U.S. and Europe, favorable reimbursement supports usage, especially for hospitalized patients. Price competition, especially from generic or biosimilar rivals where applicable, pressures margins. GSK’s pricing strategies continue to target hospital formularies and institutional procurement, emphasizing value over volume.

4. Geographical Expansion

Emerging markets represent substantial growth avenues, with increasing surgical volumes and expanding medical infrastructure. Regulatory approvals in countries like China, India, and Brazil have enhanced ARIXTRA's reach. Localized pricing and distribution arrangements are critical to capturing these markets.

5. Innovation and Pipeline Developments

While ARIXTRA’s patent exclusivity has largely expired or is nearing expiration in multiple jurisdictions, GSK’s focus on demonstrating additional therapeutic benefits and positioning within combination therapy regimens remains vital. The lack of recent formulations or delivery innovations has limited new uptake but preserves the drug’s steady clinical role.

Financial Trajectory Analysis

1. Revenue Trends

ARIXTRA's revenues peaked during the early 2010s, bolstered by robust demand for perioperative prophylaxis. Post-2015, revenues experienced stabilization and slight declines attributable to competitive pressures and the rising adoption of oral anticoagulants.

Forecast:

Given the current landscape, ARIXTRA's global revenues are projected to decline modestly over the next five years, barring new indications or formulations, with stabilization primarily in hospital-based indications.

2. Cost Dynamics & Margins

Manufacturing costs for ARIXTRA are relatively stable, benefiting from synthetic production processes. However, marketing and distribution costs fluctuate with regional expansion efforts. As generic competition increases, profit margins are under pressure, necessitating efficiency gains and strategic shifts.

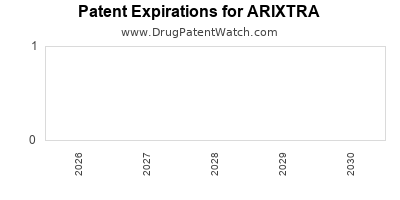

3. Impact of Patent Expiry and Biosimilar Entry

The impending patent expiry in key markets like the EU and U.S. (expected around 2025-2026) opens the door for biosimilar competitors, which could erode market share and compress prices. GSK’s strategic response involves differentiating ARIXTRA through clinical positioning and addressing niche markets resistant to oral alternatives.

4. Investment in Life Cycle Management

GSK has explored branding extensions and combination therapies, although limited success has been reported. Investment in post-market surveillance and new data generation can sustain demand.

5. Long-term Financial Outlook

In a conservative projection, ARIXTRA's global sales are expected to decline at an average compound annual rate (CAGR) of approximately 2-4% over the next five years due to competitive pressures. However, specialized institutional use and strategic market expansion may mitigate declines somewhat, sustaining revenues around USD 500-700 million annually.

Market Opportunities & Challenges

Opportunities:

- Expansion into emerging markets with increasing surgical volumes.

- Potential for label expansion into new indications such as cancer-associated thrombosis, where anticoagulants are increasingly used.

- Combining ARIXTRA with novel agents to target resistant patients.

Challenges:

- Growing dominance of oral anticoagulants in outpatient settings.

- Patent cliffs approaching, risking biosimilar competition that could reduce prices and revenues.

- Clinical preference shifts driven by evolving guidelines favoring longer-acting agents with easy dosing.

Key Factors Influencing Future Financial Trajectory

| Factor |

Impact |

Strategic Consideration |

| Patent expiry |

Revenue decline due to biosimilar entry |

Accelerate pipeline diversification |

| Market penetration in emerging markets |

Potential new revenue streams |

Customize pricing and distribution strategies |

| Adoption of guidelines favoring NOACs |

Market share pressure for injectable agents |

Highlight specific clinical benefits |

| Reimbursement landscape evolution |

Affects access and volume |

Engage with policymakers and payers |

| Technological innovations |

Potential for new formulations or delivery methods |

Invest in R&D for pipeline renewal |

Conclusion

ARIXTRA’s market dynamics reflect a complex interplay of clinical efficacy, competitive innovations, regulatory changes, and shifting treatment paradigms. While facing headwinds from the ascendancy of oral anticoagulants and looming patent expirations, ARIXTRA retains a vital role within specific institutional and European markets, bolstered by regulatory endorsements and favorable reimbursement patterns.

Financially, ARIXTRA’s trajectory indicates a gradual decline in revenues unless offset by strategic initiatives such as geographic expansion, new indications, or formulation innovations. Stakeholders must closely monitor patent landscapes, guideline shifts, and reimbursement policies to optimize portfolio management and investment decisions.

Key Takeaways

- Market Position: ARIXTRA continues to serve niche hospital markets effectively but faces stiff competition from DOACs.

- Revenue Drivers: Institutional use, guideline endorsements, and expansion into emerging markets sustain revenue streams amid competitive pressures.

- Patent and Competition Risks: Patent expiries from 2025 onward threaten revenue, necessitating strategic diversification and pipeline investments.

- Strategic Opportunities: Market expansion in emerging regions and potential label extensions could provide new growth avenues.

- Financial Outlook: Expect a modest annual revenue decline (~2-4%) over the next five years, emphasizing the importance of strategic adaptation.

FAQs

1. Will ARIXTRA's market share increase in the coming years?

Unlikely in most mature markets due to competition from oral anticoagulants but possible in specific hospital settings and emerging markets with expanding surgical volumes.

2. How imminent are patent expiries for ARIXTRA?

Potential patent cliffs are expected around 2025-2026 in major markets, opening significant competition from biosimilars.

3. Are there any promising pipeline developments for ARIXTRA?

Current focus centers on maintaining existing indications; no significant new formulations or indications are announced. Strategic efforts may include investigating additional thrombotic conditions.

4. How does reimbursement affect ARIXTRA's financial performance?

Favorable reimbursement in key markets supports its institutional use, but pricing pressures and policy changes could impact revenues.

5. What strategies should GSK pursue to sustain ARIXTRA’s relevance?

Invest in novel applications, enhance market penetration in emerging economies, and explore combination therapies or formulations to extend product lifecycle.

References

- [1] "Fondaparinux (ARIXTRA)." U.S. Food & Drug Administration.

- [2] "Guidelines for Venous Thromboembolism Prevention." American College of Chest Physicians.

- [3] "Global Anticoagulant Market Report," MarketWatch, 2022.

- [4] "GSK Annual Report 2022." GlaxoSmithKline.

- [5] "Patent Landscape and Biosimilar Entry in Anticoagulants," Intellectual Property Watch, 2023.