Last updated: October 5, 2025

Introduction

Lab Salvat, a prominent player within the pharmaceutical sector, has established a notable presence through its commitment to innovation, quality, and strategic expansion. As the industry becomes increasingly competitive, understanding Lab Salvat’s market position, core strengths, and growth strategies is vital for stakeholders, competitors, and investors aiming to navigate the evolving landscape effectively. This analysis delves into Lab Salvat’s market dynamics, highlighting its strengths, competitive advantages, and future strategic pathways.

Market Position and Industry Context

Lab Salvat operates in the highly regulated and competitive pharmaceutical industry, primarily focusing on developing, manufacturing, and distributing prescription medications, generics, and specialty drugs. The company’s footprint spans multiple regions, with a significant presence in Europe and Latin America, regions characterized by robust healthcare markets and growing demand for affordable medicines.

The pharmaceutical landscape is shaped by factors such as accelerating innovation, regulatory complexity, patent expiration of blockbuster drugs, and increasing pressure to reduce healthcare costs. In this environment, Lab Salvat positions itself as a mid-tier pharmaceutical firm embodying agility and cost-effectiveness, enabling swift adaptation to market shifts and regulatory changes.

According to industry reports, the global pharmaceutical market is projected to reach over $1.5 trillion by 2024, with generics and biosimilars marked for accelerated growth. Lab Salvat strategically leverages this trend through its portfolio diversification and geographic diversification, securing its place in the competitive hierarchy.

Core Strengths of Lab Salvat

1. Focused Portfolio and Diversification

Lab Salvat maintains a diversified portfolio comprising generic medicines, biosimilars, and specialty therapies. This diversity mitigates reliance on a limited product set, allowing the company to capitalize on various market segments. Its focus on cost-effective manufacturing and R&D investment in biosimilars positions it favorably in the biosimilar wave expected to reshape the pharmaceutical industry over the next decade.

2. Strategic Geographic Presence

With a strong foothold in Latin America and Europe, Lab Salvat benefits from high-growth healthcare markets. Its regional expertise provides resilience against global economic fluctuations and allows tailored strategies aligning with local regulatory environments. The Latin American market, characterized by expanding healthcare coverage and increasing prevalence of chronic diseases, presents significant growth opportunities.

3. Robust R&D Capabilities

The company invests appreciably in R&D, specifically in biosimilars and niche therapies. This investment fosters innovation and allows rapid development of cost-effective alternatives to branded biologics, aligning with the market's demand for patient-accessible medicines. Such capabilities enable timely regulatory approvals and quicker market entry.

4. Cost Leadership and Manufacturing Efficiency

Lab Salvat’s emphasis on efficient manufacturing processes grants it a competitive edge in cost containment. Its integrated supply chain and investment in advanced manufacturing technologies ensure consistent quality and scalability—key factors in bidding for tenders and penetrating price-sensitive markets.

5. Strategic Collaborations and Licensing Agreements

Through partnerships with international biotech firms and licensing deals, Lab Salvat expands its R&D pipeline and product portfolio more rapidly. These collaborations enhance access to innovative compounds and facilitate market entry.

Strategic Insights and Opportunities

1. Expansion into Biosimilars and Specialty Therapies

Given the exponential growth anticipated in biosimilars, Lab Salvat’s ongoing R&D-focused initiatives present substantial upside. Developing biosimilars for highly profitable biologics can boost revenue streams, particularly in European markets where biosimilar adoption accelerates due to cost-saving imperatives.

2. Geographic Diversification into Emerging Markets

Further expansion into Asia and Africa can diversify revenue streams and tap into burgeoning demand for affordable medicines. Tailoring products to meet local regulatory standards and partnering with regional distributors will be pivotal.

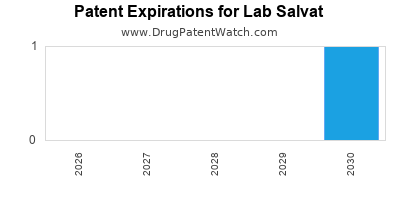

3. Regulatory Navigation and Intellectual Property Strategies

Securing regulatory approvals efficiently and managing intellectual property rights effectively will sustain competitive advantages, especially given the increasing patent expirations on blockbuster drugs.

4. Digital Transformation and Manufacturing Innovation

Adopting Industry 4.0 principles, including automation and digitized supply chains, can enhance productivity and compliance. Digital tools can streamline R&D, production, and distribution processes, reducing time-to-market.

5. Mergers and Acquisitions (M&A)

Strategic acquisitions of smaller biotech firms or specialty pharmaceutical companies could accelerate pipeline expansion and enhance technological capabilities. M&A activity will be crucial in consolidating market position and gaining access to novel therapies.

Competitive Advantages Over Peers

Compared to peers such as Teva Pharmaceutical or Sandoz, Lab Salvat's agility, regional knowledge, and targeted innovation in biosimilars position it favorably. While larger multinationals benefit from expansive resources, Salvat’s lean operational structure allows rapid decision-making and niche market penetration. Its emphasis on biosimilar development fills a critical pipeline gap observed in larger firms, offering better positioning in the biologics market segment.

Challenges and Risks

Despite its strengths, Lab Salvat faces several challenges:

-

Regulatory Risks: Navigating evolving approval standards across regions may delay product launches.

-

Pricing Pressures: Governments and payers worldwide demand cost reductions, pressuring margins.

-

Intellectual Property Litigation: Biosimilar development is often mired in patent disputes.

-

Market Competition: Larger players and new entrants intensify price and innovation pressures.

-

Supply Chain Disruptions: Global geopolitical tensions and logistics issues can impact manufacturing and distribution.

Conclusion

Lab Salvat's strategic focus on biosimilars, regional diversification, and operational efficiency positions it as a resilient and innovative player within the competitive pharmaceutical landscape. Its targeted investments and partnerships offer growth avenues in emerging and mature markets. However, to sustain and enhance its market position, ongoing attention to regulatory developments, technological advancements, and competitive dynamics is essential.

Key Takeaways:

- Diversified Portfolio & Geographic Focus: Lab Salvat's balanced portfolio and regional presence reduce risks and enable targeted growth.

- Innovation in Biosimilars: Focused R&D in biosimilars aligns with industry trends and offers high-margin opportunities.

- Operational Efficiency: Cost leadership affords competitive bidding and market penetration, especially in price-sensitive regions.

- Strategic Expansion: Geographic expansion into emerging markets and strategic M&A activities are crucial for future growth.

- Risk Management: Vigilant regulation tracking and intellectual property strategies are essential to mitigate potential legal and market risks.

FAQs

1. What differentiates Lab Salvat from larger pharmaceutical multinationals?

Lab Salvat’s agility, regional expertise, and focus on biosimilars differentiate it. Its lean structure allows faster innovation cycles and tailored market strategies, contrasting with larger firms' broader but less nimble operations.

2. How significant is Lab Salvat’s role in biosimilars development?

The company’s increased R&D investment positions it as a notable biosimilar developer, especially in Europe and Latin America, where demand for biologic equivalents continues to grow.

3. What regions offer the most growth opportunities for Lab Salvat?

Emerging markets in Asia and Africa, along with expanding healthcare coverage in Latin America and regulatory streamlining in Europe, present promising growth prospects.

4. How does Lab Salvat mitigate patent expiration risks?

By focusing on biosimilars and niche therapies, alongside acquiring or developing new molecular entities, the company reduces dependence on blockbuster drugs nearing patent expiry.

5. What strategic moves should Lab Salvat prioritize for sustained growth?

Prioritizing geographic expansion, advancing biosimilar pipelines, adopting digital manufacturing, and pursuing targeted M&A will be critical for maintaining competitive advantage.

Sources:

[1] Industry Reports on Pharmaceutical Market Projections, 2022.

[2] Company Filings and Press Releases, 2022-2023.

[3] Market Analysis on Biosimilars Growth, 2022.