Last updated: December 27, 2025

Executive Summary

Lupin Ltd., a prominent player within the global pharmaceutical industry, maintains its competitive edge through a diversified portfolio encompassing generics, branded formulations, APIs, and biosimilars. This report evaluates Lupin's market position, core strengths, and strategic trajectories to inform stakeholders seeking nuanced insights into its operational resilience and growth prospects amidst an evolving landscape marked by regulatory challenges, patent cliffs, and innovation pressures.

Key highlights include:

- Market Position: Consistently ranked among the top 15 global generic manufacturers, with substantial footprints in North America, India, and emerging markets.

- Strengths: Robust R&D capabilities, diversified portfolio, strategic collaborations, and strong supply chain integration.

- Strategic Insights: Focused investments in biosimilars, digital transformation, and market expansion through acquisitions and partnerships.

1. Overview of Lupin Ltd.

Founded: 1968 in India

Headquarters: Mumbai, India

Global Presence: Operations in over 100 countries, with offices and manufacturing facilities in 28+ countries

Employees: Approx. 16,000 (2022)

Revenue (FY 2022): $2.3 billion, with over 60% from North America and India

Lupin operates across three core segments:

| Segment |

Contribution to Revenue (FY 2022) |

Key Focus |

| Generics |

55% |

Market share in USA, Europe, India |

| Branded formulations |

25% |

India, Latin America |

| APIs & Others |

20% |

Specialty APIs, biosimilars |

2. Lupin’s Market Position

Global Ranking & Market Share

Lupin ranks among the top 15 global pharmaceutical companies based on revenue, with a pronounced presence in generics. The company's strategic emphasis on high-volume, cost-efficient production has facilitated access to the US and European markets.

| Region |

Market Share (Estimated) |

Key Markets |

| North America |

8-10% (Generics share) |

USA, Canada |

| India |

#1 in Generics |

Domestic consumption, LICs, government tenders |

| Europe |

Growing cardiovascular & CNS |

UK, Germany, France |

| LatAm & APAC |

Increasing penetration |

Brazil, Mexico, Southeast Asia |

Competitive Positioning

| Competitor |

Estimated Revenue (2022) |

Market Focus |

Key Strengths |

| Sun Pharma |

~$5.2B |

India, USA, emerging markets |

R&D, diversified portfolio, strategic acquisitions |

| Dr. Reddy's Labs |

~$3.4B |

India, US, Europe |

Biosimilars, specialty R&D |

| Cipla |

~$2.1B |

India, Africa, US |

Affordability, extensive manufacturing |

| Lupin Ltd. |

~$2.3B |

USA, India, emerging markets |

Cost leadership, biosimilars, API vertical integration |

Strengths Convexity

- Distinct global manufacturing footprint with cGMP-certified units.

- Strong track record in expiring patent segments and complex generics.

- Enhancements in biosimilars pipeline, with filings in multiple jurisdictions.

- Strategic alliances with key biotech firms concerning biosimilar development.

3. Lupin’s Core Strengths

a. R&D Excellence

Lupin invests approximately 8-10% of its annual revenue into R&D, emphasizing complex generics, biosimilars, and innovative formulations. This strategic focus facilitated the approval of over 90 new products between 2015-2022, including biosimilars in dermatology, oncology, and chronic illness segments.

| R&D Investment (FY 2022) |

$200M+ |

Focus Areas |

| Patents Filed |

50+ |

Complex injectables, inhalers |

| New Product Approvals (FDA/EMA) |

20+ |

Biosimilars, value-added generics |

b. Diversified Portfolio & Market Penetration

Lupin boasts a broad product portfolio:

- Over 300 generic NDAs and ANDAs in the USA.

- Presence in regulated markets like Europe and Japan.

- Diversified product offerings in anti-infectives, cardiovascular, CNS, and respiratory segments.

c. Manufacturing & Supply Chain

With 17 manufacturing facilities globally, Lupin maintains high standards of quality, operational efficiency, and cost competitiveness. Its integration with in-house APIs supports stable supply and lower production costs.

d. Strategic Collaborations & Acquisitions

Recent moves include:

| Year |

Deal |

Outcome |

| 2021 |

Acquisition of BioPharma in Egypt |

Expanding presence in African markets |

| 2022 |

Strategic partnership with Samsung Bioepis for biosimilars |

Enhancing biosimilar pipeline and market access |

e. Digital Innovation & Regulatory Engagement

Lupin adopts digital initiatives for manufacturing optimization, regulatory intelligence, and supply chain transparency, aligning with global pharma digital strategies.

4. Strategic Initiatives & Future Outlook

a. Focus on Biosimilars & Specialty Products

Lupin aims to capitalize on the high-growth biosimilar segment, projected to reach $74 billion by 2026, growing at 11.4% CAGR (Evaluate Pharma).

- Notable pipeline includes biosimilars for insulin, monoclonal antibodies.

- Approvals targeted across US, Europe, and Japan.

b. Expansion via M&A and Licensing

- Expanding product portfolio through licensing agreements in emerging markets.

- Mergers and acquisitions focus on R&D capabilities and market access.

c. Digital Transformation & Supply Chain Resilience

Investments in AI-based forecasting, tracking, and quality control bolster global supply chain robustness.

d. Geographic Expansion & Market Penetration

Targeting Latin America, Africa, and Southeast Asia with tailored strategies and local partnerships.

| Region |

Market Entry Strategy |

Opportunities |

| Africa |

Local manufacturing, partnerships |

Growing healthcare expenditure |

| Southeast Asia |

Regulatory collaborations, joint ventures |

Demographic dividend, increasing disease burden |

| Latin America |

Product localization, licensing |

Favorable reimbursement policies |

5. Challenges & Risks

| Issue |

Impact |

Mitigation Strategies |

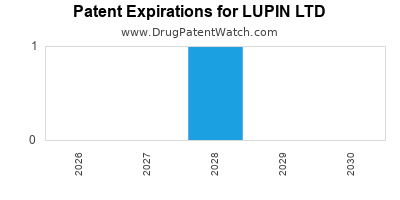

| Patent cliffs |

Revenue decline in key segments |

Diversify with biosimilars, new chemical entities |

| Regulatory hurdles |

Delays in approvals and market access |

Strengthen regulatory affairs, proactive engagement |

| Pricing pressures |

Margin compression, especially in US |

Cost optimization, differentiation through innovation |

| Supply chain disruptions |

Delays, increased costs |

Digital supply chain management, dual sourcing |

| Competition from biosimilars |

Market share erosion |

Accelerate biosimilar pipeline, brand differentiation |

6. Comparative Analysis & Market Dynamics

Table 1: Key Competitor Biosimilar Pipeline (Selected)

| Company |

Biosimilar Products in Pipelines |

Notable Approvals |

Strategic Focus |

| Lupin Ltd. |

8 products |

Insulin, monoclonal antibodies |

Cost-effective biosimilars, diversification |

| Samsung Bioepis |

10 products |

Etanercept, infliximab |

Focus on high-value biologics |

| Amgen |

15+ products |

Rituximab, Trastuzumab |

Innovation, high-value innovative biosimilars |

Market Trends & Forecasts (2023-2028)

| Trend |

Impact on Lupin |

Strategic Implication |

| Growing biosimilars market |

Significant revenue opportunity |

Prioritize biosimilar R&D investments |

| Shift towards complex generics |

Increase in complexity, high R&D requirements |

Invest in advanced manufacturing technologies |

| Digital health integration |

Improved supply chain, R&D efficiency |

Accelerate digital transformation initiatives |

| Regulatory tightening in US/EU |

Elevated compliance costs |

Strengthen regulatory and compliance teams |

7. Regulatory & Policy Environment

Lupin’s operations are influenced by region-specific policies:

| Region |

Recent Regulatory Changes |

Impact on Lupin |

| US (FDA) |

Increased scrutiny on complex generics, guidance updates |

Need for increased R&D and compliance investments |

| India |

Drug Price Control Orders (DPCO), e-pharma regulations |

Price caps, digital licensing, increased transparency |

| Europe |

Stringent EMA approvals, GMP standards |

Enhanced quality controls and costs |

8. SWOT Analysis

| Strengths |

Weaknesses |

| Strong R&D focus, diversified portfolio |

Overdependence on US market (~60%) |

| Global manufacturing footprint |

Limited presence in high-growth biotech sectors |

| Cost-efficient production |

Patent cliffs for flagship generics |

| Opportunities |

Threats |

| Biosimilars market expansion |

Intense competition, IP disputes |

| Emerging markets penetration |

Regulatory delays |

| Strategic collaborations & acquisitions |

Pricing pressures in major markets |

9. Key Takeaways

- Market Position: Lupin remains a formidable player in generics and biosimilars with a strategic footprint in North America, India, and emerging markets.

- Strengths: R&D excellence, global manufacturing, diversified portfolio, and strategic alliances underpin its resilience.

- Growth Drivers: Focused investment in biosimilars, digital processes, and market expansion.

- Risks: Patent expiries, regulatory hurdles, aggressive competition, and pricing pressures require ongoing strategic mitigation.

- Strategic Opportunities: Biosimilar pipeline acceleration, geographic diversification, and innovation in complex generics tailor Lupin's growth trajectory.

FAQs

Q1: How does Lupin’s biosimilar pipeline compare to competitors?

Lupin's biosimilar pipeline includes approximately 8 products in various stages, with approvals for insulin and monoclonal antibodies, positioning it competitively alongside Samsung Bioepis and Amgen. Its cost-effective approach emphasizes access in price-sensitive markets.

Q2: What are Lupin’s primary growth markets?**

The US remains the largest revenue driver, accounting for roughly 60% of revenues. India is the second-largest, followed by expanding footholds in Latin America and Southeast Asia.

Q3: Which strategic moves could most significantly impact Lupin’s future?

Investments in biosimilar innovation, acquisitions to diversify product portfolio, and leveraging digital transformation for supply chain resilience are pivotal.

Q4: What challenges does Lupin face regarding regulatory policies?

Heightened scrutiny over complex generics and biosimilars in the US and Europe may cause delays; proactive regulatory engagement and compliance are critical.

Q5: How is Lupin responding to industry shifts towards personalized medicine?

Lupin’s focus on biosimilars and specialty formulations aligns with trends toward targeted therapies, positioning it to benefit from growing demand in this segment.

References

[1] Lupin Ltd. Annual Report FY 2022.

[2] Evaluate Pharma: Biosimilars Market Outlook, 2022.

[3] US FDA Guidance on Biosimilars, 2022.

[4] WTO and Indian regulatory policies, 2022.

[5] Market Research Future Reports, 2022.

In conclusion, Lupin Ltd.'s strategic focus on biosimilars, R&D, and global expansion, coupled with its operational strengths, position it well for sustained growth amid industry transformations. Stakeholders should monitor regulatory landscapes and technological advancements to optimize opportunities.