Last updated: July 30, 2025

Introduction

Hoffmann-La Roche, commonly known as Roche, stands as one of the world’s leading pharmaceutical companies, with a robust presence spanning innovative healthcare solutions, diagnostics, and bioinformatics. With over a century of operational history, Roche’s strategic positioning emphasizes personalized medicine, cutting-edge oncology treatments, and diagnostic technologies. This analysis delves into Roche’s market standing, core strengths, competitive differentiators, and strategic outlook, offering insights crucial for stakeholders navigating the complex pharmaceutical landscape.

Market Position and Global Footprint

Roche has cemented itself as a dominant player within the global pharmaceutical and diagnostics sectors. According to recent industry reports, Roche consistently ranks in the top tier by R&D expenditure, revenue, and pipeline strength. As of 2022, Roche was the world’s largest biotech company by market capitalization, surpassing competitors like Pfizer and Johnson & Johnson in several key areas (Statista, 2022).

The company’s extensive geographic footprint spans over 100 countries, with its core markets situated in North America, Europe, and Asia. The United States remains its largest single market, driven by increasing adoption of innovative oncology therapies and diagnostics. Roche’s strategic emphasis on personalized healthcare models aligns with global shifts toward precision medicine, positioning it favorably amidst evolving healthcare policies.

Core Strengths

Innovative R&D Portfolio

Roche invests heavily in research and development, channeling approximately 13% of its revenue into R&D efforts annually (Roche Annual Report 2022). This focus underpins its competitive pipeline, featuring notable advancements in oncology, immunology, ophthalmology, and infectious diseases. The company’s emphasis on biologics and targeted therapies has allowed it to maintain leadership in treatment segments such as cancer and autoimmune conditions.

Leadership in Oncology and Diagnostics

Roche’s strategic emphasis on oncology positions it as a market leader. Key blockbuster products like Herceptin, Avastin, and Perjeta exemplify its dominance in breast and colorectal cancers. Furthermore, Roche’s diagnostics segment, including offerings like cobas systems and COVID-19 testing solutions, accounts for nearly half of its revenue, underscoring its diversification strength (Roche Quarterly Earnings, 2023).

Robust Intellectual Property Portfolio

With thousands of patents secured globally, Roche’s intellectual property safeguards its innovations and provides significant leverage against generic competition, especially in biologics. Its patent estate also enables licensing and collaborations, bolstering revenue streams.

Strategic Collaborations and Acquisitions

Roche sustains a dynamic partnership portfolio with biotech firms, academic institutions, and healthcare providers. Its acquisition of established biotech firms like Spark Therapeutics enhances its gene therapy pipeline, illustrating its commitment to cutting-edge modalities.

Digital Transformation and Diagnostics Leadership

Investments in digital health initiatives, artificial intelligence, and companion diagnostics augment Roche’s clinical value proposition. Its diagnostic tools enable more precise patient stratification, thereby enhancing therapeutic efficacy and reducing adverse events.

Competitive Advantages and Differentiators

Personalized Medicine Leadership

Roche’s focus on genomics-driven therapies and companion diagnostics enables highly targeted treatments, aligning with shifts toward personalized healthcare. Its innovative approach differentiates it from traditional pharmaceutical firms reliant on blockbusters.

Strong Regulatory and Market Access Strategies

Roche’s early engagement with regulators worldwide facilitates smoother approval processes. Its proactive market access strategies ensure reimbursement and adoption, especially in complex markets like the U.S. and Europe.

Early-Mover Advantage in Cell & Gene Therapy

The company’s investments in gene therapy—such as Luxturna and Zolgensma—position it ahead of competitors in this rapidly emerging field. Its integrated approach combining therapeutics and diagnostics enhances its value chain.

Strategic Challenges and Risks

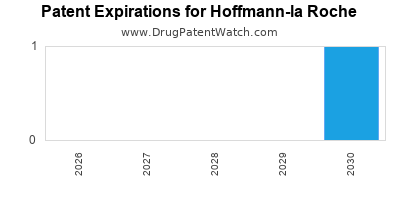

Patent Expirations and Generic Competition

The impending expiration of patent exclusivities on several blockbuster drugs poses significant revenue risks. Patent cliffs threaten to erode Roche’s market share unless mitigated by pipeline success and biosimilar strategies.

Pricing Pressures and Regulatory Scrutiny

Global healthcare systems increasingly scrutinize drug pricing, especially in the U.S. and Europe. Roche faces pressure to justify high-cost therapies, impacting profitability and market access.

Intense Competition

Competitors like Pfizer, Novartis, and GSK intensify R&D investments, launching similar or improved therapies. The rapid evolution of biosimilars presents an ongoing threat to Roche’s biologics portfolio.

Pipeline Uncertainty

Despite a strong R&D pipeline, clinical trial failures or regulatory setbacks could hinder growth prospects. Maintaining a balanced pipeline across therapeutic areas remains critical.

Strategic Outlook and Future Initiatives

Focus on Personalized, Immuno-Oncology Therapies

Roche’s ongoing investments aim to strengthen its leadership in immuno-oncology, especially CAR-T, bispecific antibodies, and personalized vaccine platforms. Its collaborations with tech firms explore artificial intelligence for biomarker discovery.

Enhancement of Digital Diagnostics and Data Analytics

Roche plans to expand its diagnostics portfolio by integrating AI and big data analytics, improving diagnostic accuracy, and enabling early disease detection.

Expansion into Emerging Markets

Targeted expansion into Asia, Africa, and Latin America aims to diversify revenue sources, leveraging local partnerships and tailored market entry strategies.

Pipeline Diversification and Gene Therapies

Strategic acquisitions and internal R&D efforts focus on expanding into gene editing, cell therapies, and rare disease treatments, reducing reliance on traditional blockbuster drugs.

Sustainability and Access Initiatives

Roche emphasizes sustainability and affordable access, aligning with global priorities. It commits to reducing environmental impact and enhancing healthcare equity through innovative pricing and partnership models.

Conclusion

Hoffmann-La Roche exemplifies a resilient, innovation-driven enterprise with formidable strengths spanning R&D excellence, diagnostic leadership, and personalized therapeutics. While challenges remain—particularly patent expirations, pricing pressures, and competitive dynamics—its strategic focus on precision medicine, digital transformation, and emerging modalities position it for sustained growth. Stakeholders must monitor Roche’s pipeline efficacy, digital initiatives, and global market strategies to gauge future trajectory.

Key Takeaways

-

Roche’s dominance in oncology and diagnostics positions it as a key innovator in personalized medicine.

-

High R&D investment fuels a robust pipeline, though pipeline risks require vigilant management.

-

Diversification into gene and cell therapies offers growth avenues and mitigates patent expiry impacts.

-

Competition, pricing pressures, and regulatory hurdles remain strategic challenges.

-

Ongoing digital health investments and emerging market expansion are critical for future competitiveness.

FAQs

-

How does Roche differentiate itself in the biotech and pharmaceutical sectors?

Roche’s emphasis on personalized medicine, integrating diagnostics with therapeutics, and leadership in biologics distinguish its offerings in highly targeted, high-value treatments.

-

What are the primary growth drivers for Roche in the coming years?

Key drivers include expansion in immuno-oncology, gene and cell therapies, digital diagnostics, and growth markets in Asia and emerging economies.

-

How vulnerable is Roche to patent expirations?

Patent expirations pose significant risks; however, Roche mitigates these through pipeline diversification, biosimilar strategies, and expanding into innovative modalities like gene therapy.

-

What strategic collaborations does Roche pursue to enhance its pipeline?

Roche partners with biotech firms, academic institutions, and digital health companies to accelerate innovation—examples include acquisition of Spark Therapeutics and collaborations exploring AI-enabled biomarker discovery.

-

What are Roche’s sustainability and access commitments?

The company emphasizes reducing environmental footprint, enhancing healthcare access via innovative pricing models, and supporting global health initiatives aligned with SDGs.

Sources:

- Roche Annual Report 2022

- Statista, "Leading Biotech Companies by Market Cap," 2022

- Roche Quarterly Earnings, 2023