Last updated: October 15, 2025

Introduction

Genentech Inc., a pioneering biotechnology company under the Roche Group, stands as a significant player within the global pharmaceutical industry. Since its founding in 1976, Genentech has been at the forefront of innovative biologics, predominantly in oncology, immunology, and neuroscience. This detailed analysis examines Genentech’s current market positioning, core strengths, competitive advantages, and strategic outlook to inform business decisions and investment considerations.

Market Position Overview

Leadership in Oncology and Immunology

Genentech is renowned for its leadership in oncology, notably through blockbuster therapies such as trastuzumab (Herceptin), rituximab (Rituxan), and atezolizumab (Tecentriq). Its pioneering biologics have reshaped cancer treatment paradigms, solidifying a dominant position in this high-growth sector. The company’s revenue streams heavily depend on these flagship products, which continue to generate substantial sales due to ongoing indications and expanded approvals.

In immunology, Genentech’s portfolio includes ocrelizumab (Ocrevus), used in multiple sclerosis, extending its reach beyond oncology. Advancing novel molecules and creating combination therapies further bolster its competitive position.

Market Share and Revenue Dynamics

According to recent financial disclosures, Genentech consistently ranks among the top biopharmaceutical companies in revenue, with sales figures surpassing $20 billion annually. Its strategic focus on oncology accounts for a significant portion of revenue, with continued growth driven by new indications, biosimilars, and pipeline expansion. The company's robust revenue underscores its entrenched market penetration and sustained innovation.

Global Reach and Market Penetration

Despite being a U.S.-based unit, Genentech benefits from Roche’s global distribution network, enabling a strong presence across developed markets, particularly North America and Europe. In emerging markets, Genentech’s focus on affordability, local partnerships, and regulatory engagement aims to bolster its footprint, although market access remains complex due to pricing pressures and regulatory barriers.

Strengths and Competitive Advantages

1. Robust R&D Pipeline and Innovation Capabilities

Genentech's foundation in innovative biologics is supported by its significant R&D expenditure, which accounts for approximately 20-30% of annual revenues — a testament to its commitment to pioneering therapies. Its pipeline encompasses over 100 investigational compounds, focusing on oncology (e.g., antibody-drug conjugates, immune checkpoint inhibitors), neuroscience, and rare diseases.

The company's early adoption of immuno-oncology and strategic partnerships have facilitated the development of first-in-class therapies, maintaining its competitive edge.

2. Market-Defining Biologics

Genentech's portfolio includes several first-in-class and best-in-class biologic agents that enjoy market exclusivity, such as trastuzumab and bevacizumab. These biologics benefit from substantial patent protections and long-term reimbursement contracts, enabling sustained revenue streams.

3. Strategic Alliances and Intellectual Property

As part of Roche, Genentech has access to pooled resources, joint research initiatives, and a robust IP portfolio. Its patents and proprietary technological platforms such as antibody engineering and biosimulation confer a competitive moat, protecting against generic and biosimilar entrants.

4. Focused Therapeutic Specialization

Genentech’s concentrated expertise in oncology and immunology enables it to develop tailored, highly effective treatments. Its focus on rare and underserved diseases grants it the potential for premium pricing and market exclusivity.

5. Strong Regulatory Track Record

Notable success in obtaining regulatory approvals and navigating complex pathways in multiple jurisdictions translates into faster time-to-market and sustained product lifecycle management.

Competitive Landscape Analysis

Major Competitors

Genentech faces competition from several key players in biologics and targeted therapies:

- Amgen: Known for similar oncology and biosimilar portfolios.

- Novartis and Pfizer: Competing in immunology and oncology segments.

- Bristol-Myers Squibb and Merck: Aggressive in immuno-oncology.

- Regeneron, AbbVie: Expanding product lines in specialty medicines.

- Emerging Biotechs: Innovative startups leveraging novel platforms like CAR-T therapies and gene editing.

Competitive Dynamics

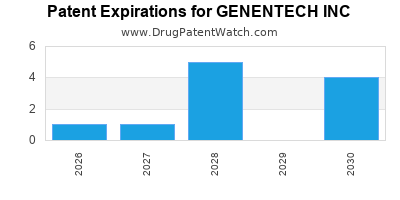

The biotech industry exhibits rapid innovation cycles, high R&D costs, and stringent regulatory environments. Patent expirations threaten revenue stability; for example, trastuzumab’s patent expiry in several jurisdictions prompts increased biosimilar competition. However, Genentech mitigates these risks through:

- Expanding indications and combination regimens

- Developing next-generation biologics

- Investing in personalized medicine approaches

Biosimilars and Market Disruption

Biosimilar competition is intensifying globally, especially in Europe and the U.S. after patent cliffs. While biosimilars threaten generics in biologics, Genentech leverages its first-mover advantage, robust patent portfolio, and brand loyalty to defend market share, exemplified by ongoing patent pipelines and legal defenses.

Strategic Insights

Innovation and Pipeline Prioritization

Investing in next-generation immunotherapies such as CAR-T cells and bispecific antibodies is critical. Genentech’s substantial R&D budget allows early-stage research to capture future market segments.

Diversification Beyond Oncology

Expanding into neurology, rare diseases, and autoimmune disorders offers avenues for growth. Ocrelizumab’s success in multiple sclerosis highlights potential in neurology’s underserved segments.

Digital Transformation and Data Utilization

Incorporating digital health tools, real-world evidence, and AI-driven drug discovery enhances R&D efficiency and accelerates development timelines.

Global Market Expansion

Targeted strategies for emerging markets, including localized partnerships and affordability programs, are vital for sustained growth amid global price pressures.

Intellectual Property and Patent Strategy

Proactive patent filing, strategic litigation, and lifecycle management extend product exclusivity and safeguard revenue streams against biosimilar encroachment.

Key Takeaways

- Market Leadership: Genentech maintains a dominant position in oncology biologics, supported by a strong portfolio of first-in-class therapies.

- Innovation Focus: Persistent investment in R&D fuels pipeline development, ensuring competitiveness amid patent expiries and biosimilar threats.

- Strategic Partnerships: Leveraging Roche’s global infrastructure and collaborations enhances market access and innovation capabilities.

- Pipeline Diversification: Expanding beyond oncology into neurology and rare diseases mitigates sector-specific risks and unlocks new growth avenues.

- Biosimilar Challenges: Active patent strategies and continuous innovation are essential to combat increasing biosimilar competition.

- Future Outlook: Genentech’s strategic emphasis on personalized, targeted therapies, digital integration, and global expansion positions it favorably to sustain leadership.

FAQs

1. How does Genentech stay competitive amid patent expiries of key biologics?

Genentech invests heavily in pipeline innovation, develops next-generation biologics, extends product life cycles through combination therapies, and employs strategic legal protections to defend existing patents and delay biosimilar entry.

2. What are Genentech’s most promising pipeline products?

Notable investigational therapies include CELMoDs (cereblon modulators) for multiple myeloma, novel immune checkpoint inhibitors, and advanced cell therapies like CAR-T products designed to target hematological cancers.

3. How significant is biosimilar competition for Genentech’s portfolio?

Biosimilars present a growing threat, particularly in the U.S. and Europe. While they erode market share for some biologics, Genentech counters through patent litigation, lifecycle management, and by fostering brand loyalty and expanded indications.

4. Which markets offer the most growth potential for Genentech?

Emerging markets, especially China and India, represent substantial growth opportunities through strategic partnerships and affordability initiatives. Additionally, expanding indications in developed markets further sustains revenue streams.

5. What strategic moves should Genentech prioritize for future growth?

Priorities include investing in personalized medicine technologies, expanding into underserved therapeutic areas like neurology, enhancing digital health initiatives, and strengthening global market access strategies.

References

- Roche Annual Report 2022.

- Genentech Pipeline Overview. (2023).

- IQVIA Biotech Industry Data, 2022.

- Fitch Ratings, "Biopharma Industry Outlook," 2023.

- EvaluatePharma, "Top Companies and Revenue," 2022.

This comprehensive analysis provides vital insights into Genentech’s strategic positioning within the competitive pharmaceutical landscape. By leveraging its core strengths and navigating industry hurdles, the company is well-positioned to sustain its leadership and capitalize on future growth opportunities.