ROZLYTREK Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Rozlytrek, and what generic alternatives are available?

Rozlytrek is a drug marketed by Genentech Inc and is included in two NDAs. There are fourteen patents protecting this drug.

This drug has one hundred and twenty-nine patent family members in thirty-one countries.

The generic ingredient in ROZLYTREK is entrectinib. One supplier is listed for this compound. Additional details are available on the entrectinib profile page.

DrugPatentWatch® Generic Entry Outlook for Rozlytrek

Rozlytrek was eligible for patent challenges on August 15, 2023.

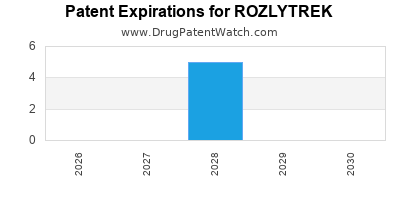

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be October 20, 2030. This may change due to patent challenges or generic licensing.

There have been two patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ROZLYTREK?

- What are the global sales for ROZLYTREK?

- What is Average Wholesale Price for ROZLYTREK?

Summary for ROZLYTREK

| International Patents: | 129 |

| US Patents: | 14 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 59 |

| Clinical Trials: | 9 |

| Patent Applications: | 1,735 |

| Drug Prices: | Drug price information for ROZLYTREK |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for ROZLYTREK |

| What excipients (inactive ingredients) are in ROZLYTREK? | ROZLYTREK excipients list |

| DailyMed Link: | ROZLYTREK at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for ROZLYTREK

Generic Entry Dates for ROZLYTREK*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

Generic Entry Dates for ROZLYTREK*:

Constraining patent/regulatory exclusivity:

TREATMENT OF PEDIATRIC PATIENTS OLDER THAN 1 MONTH UP TO 12 YEARS OF AGE WITH SOLID TUMORS THAT HAVE A NEUROTROPHIC TYROSINE RECEPTOR KINASE (NTRK) GENE FUSION, AS DETECTED BY AN FDA-APPROVED TEST WITHOUT A KNOWN ACQUIRED RESISTANCE MUTATION, ARE METASTATIC OR WHERE SURGICAL RESECTION IS LIKELY TO RESULT IN SEVERE MORBIDITY, AND HAVE PROGRESSED FOLLOWING TREATMENT OR HAVE NO SATISFACTORY ALTERNATIVE THERAPY NDA:

Dosage:

PELLETS;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for ROZLYTREK

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Cancer Research UK | Phase 2/Phase 3 |

| Royal Marsden NHS Foundation Trust | Phase 2/Phase 3 |

| University of Manchester | Phase 2/Phase 3 |

US Patents and Regulatory Information for ROZLYTREK

ROZLYTREK is protected by nineteen US patents and six FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of ROZLYTREK is ⤷ Get Started Free.

This potential generic entry date is based on TREATMENT OF PEDIATRIC PATIENTS OLDER THAN 1 MONTH UP TO 12 YEARS OF AGE WITH SOLID TUMORS THAT HAVE A NEUROTROPHIC TYROSINE RECEPTOR KINASE (NTRK) GENE FUSION, AS DETECTED BY AN FDA-APPROVED TEST WITHOUT A KNOWN ACQUIRED RESISTANCE MUTATION, ARE METASTATIC OR WHERE SURGICAL RESECTION IS LIKELY TO RESULT IN SEVERE MORBIDITY, AND HAVE PROGRESSED FOLLOWING TREATMENT OR HAVE NO SATISFACTORY ALTERNATIVE THERAPY.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

EU/EMA Drug Approvals for ROZLYTREK

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Roche Registration GmbH | Rozlytrek | entrectinib | EMEA/H/C/004936Rozlytrek as monotherapy is indicated for the treatment of adult and paediatric patients 12 years of age and older with solid tumours expressing a neurotrophic tyrosine receptor kinase (NTRK) gene fusion,who have a disease that is locally advanced, metastatic or where surgical resection is likely to result in severe morbidity, andwho have not received a prior NTRK inhibitorwho have no satisfactory treatment options.Rozlytrek as monotherapy is indicated for the treatment of adult patients with ROS1 positive, advanced non small cell lung cancer (NSCLC) not previously treated with ROS1 inhibitors. | Authorised | no | no | no | 2020-07-31 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for ROZLYTREK

When does loss-of-exclusivity occur for ROZLYTREK?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 18302170

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2020000793

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 69339

Estimated Expiration: ⤷ Get Started Free

China

Patent: 0913842

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 54952

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 1759

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 03083

Estimated Expiration: ⤷ Get Started Free

Patent: 20527575

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2718538

Estimated Expiration: ⤷ Get Started Free

Patent: 200031115

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 85074

Estimated Expiration: ⤷ Get Started Free

Patent: 1907924

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ROZLYTREK around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Mexico | 2014013924 | PROCESO PARA LA PREPARACION DE N- [5- (3,5-DIFLUORO-BENCIL) -1H-INDAZOL-3-IL] -4- (4-METIL-PIPERAZIN-1-IL) -2- (TETRAHIDRO-PIRAN-4-ILAMINO) -BENZAMIDA. (PROCESS FOR THE PREPARATION OF N-[5-(3,5-DIFLUORO-BENZYL)-1H-INDA ZOL-3-YL]-4-(4-METHYL-PIPERAZIN-1-YL)-2-(TETRAHYDRO-PYRAN-4-YLAM INO)-BENZAMIDE.) | ⤷ Get Started Free |

| China | 104395308 | Process for the preparation of n-[5-(3,5-difluoro-benzyl)-1h-indazol-3-yl]-4-(4-methyl-piperazin-1-yl)-2-(tetrahydro-pyran-4-ylamino)-benzamide | ⤷ Get Started Free |

| Israel | 235761 | תהליך להכנת n - [5 - (3, 5 - דיפלואורו - בנזיל) -1h - אינדאזול - 3 - איל] - 4 - (4 - מתיל - פיפראזין - 1 - איל) - 2 - (טטראהידרו - פיראן - 4 - אילאמינו) - בנזאמיד (Process for the preparation of n - [5-(3, 5-difluoro-benzyl) -1h-indazol-3-yl]-4-(4-methyl-piperazin-1-yl)-2-(tetrahydro-pyran-4-ylamino)-benzamide) | ⤷ Get Started Free |

| Mexico | 2018014298 | ⤷ Get Started Free | |

| China | 101754956 | Substituted indazole derivatives active as kinase inhibitors | ⤷ Get Started Free |

| World Intellectual Property Organization (WIPO) | 2015124697 | ⤷ Get Started Free | |

| Hong Kong | 1200162 | 作為具有激酶抑制劑活性的取代的吲唑衍生物 (SUBSTITUTED INDAZOLE DERIVATIVES ACTIVE AS KINASE INHIBITORS) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for ROZLYTREK

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 3107541 | 301111 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: ENTRECTINIB OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN; REGISTRATION NO/DATE: EU/1/20/1460 20200803 |

| 2176231 | CR 2020 00058 | Denmark | ⤷ Get Started Free | PRODUCT NAME: ENTRECTINIB ELLER ISOMERER, TAUTOMERER ELLER FARMACEUTISK ACCEPTABLE SALTE DERAF; REG. NO/DATE: EU/1/20/1460 20200803 |

| 3107541 | 2190021-2 | Sweden | ⤷ Get Started Free | PRODUCT NAME: ENTRECTINIB OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF; REG. NO/DATE: EU/1/20/1460 20200803 |

| 2176231 | 46/2020 | Austria | ⤷ Get Started Free | PRODUCT NAME: ENTRECTINIB ODER ISOMERE, TAUTOMERE ODER PHARMAZEUTISCH ANNEHMBARE SALZE DAVON; REGISTRATION NO/DATE: EU/1/20/1460 (MITTEILUNG) 20200803 |

| 2176231 | 122020000081 | Germany | ⤷ Get Started Free | PRODUCT NAME: ENTRECTINIB ODER ISOMERE, TAUTOMERE ODER PHARMAZEUTISCH ANNEHMBARE SALZE DAVON; REGISTRATION NO/DATE: EU/1/20/1460 20200731 |

| 2176231 | C202030070 | Spain | ⤷ Get Started Free | PRODUCT NAME: ENTRECTINIB O SUS ISOMEROS, TAUTOMEROS, O SALES FARMACEUTICAMENTE ACEPTABLES.; NATIONAL AUTHORISATION NUMBER: EU/1/20/1460; DATE OF AUTHORISATION: 20200731; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/20/1460; DATE OF FIRST AUTHORISATION IN EEA: 20200731 |

| 2176231 | 2020/057 | Ireland | ⤷ Get Started Free | PRODUCT NAME: ENTRECTINIB OR ISOMERS, TAUTOMERS, OR PHARMACEUTICALLY ACCEPTABLE SALTS THEREOF; REGISTRATION NO/DATE: EU/1/20/1460 20200803 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Rozlytrek (Entrectinib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.