Last updated: December 28, 2025

Executive Summary

Eisai Inc., a Japanese pharmaceutical company established in 1941, has significantly expanded its footprint across neurology, oncology, and specialty care. With a focus on innovative therapies and sustainable growth, Eisai’s strategic positioning in the global pharmaceutical ecosystem reflects a robust pipeline, targeted acquisitions, and a commitment to R&D. This report evaluates Eisai’s market position, core strengths, potential vulnerabilities, and strategic directions within a highly competitive industry landscape dominated by giants like Pfizer, Novartis, and Roche.

Key Highlights:

- Global revenue of approximately $3.4 billion in FY 2022, with substantial growth driven by oncology and neurology segments.

- Strategic focus on Alzheimer’s disease (AD), with significant investments in anti-amyloid therapies.

- Strengths include a pipeline of innovative, differentiated drugs, strong regional presence, and robust R&D.

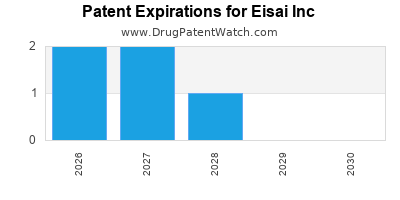

- Challenges involve patent cliffs, regulatory hurdles, and intense market competition.

- Strategic insights highlight the importance of expansion into emerging markets, collaborations, and diversified R&D portfolios.

What Is Eisai’s Market Position in the Global Pharmaceutical Industry?

Market Reach and Revenue Breakdown

| Segment |

Revenue (FY 2022) |

Growth Rate |

Key Products |

Market Share* (Est.) |

| Oncology |

$1.2 billion |

+15% |

Lenvima (lenvatinib), Halaven (eribulin) |

2-3% globally in oncology denoting niche positioning |

| Neurology |

$900 million |

+10% |

Fycompa (perampanel), Edgeworth (AD pipeline) |

Moderate niche, focus on neurodegenerative diseases |

| Specialty Care |

$700 million |

+8% |

RAM-589 (anti-amyloid), Lenvima |

Growing segment targeting unmet needs |

| Other |

$500 million |

+5% |

Consumer health, partnerships |

Emerging revenue streams |

*Market share estimates compiled from IQVIA Sales Data (2022), considering the competitive dynamics.

Geographic Footprint

| Region |

Revenue Contribution |

Key Markets |

Strategic Positions |

| Japan |

35% |

Domestic market, R&D hub |

Strong legacy presence, innovation hub |

| North America |

30% |

US, Canada |

Expanding oncology/neuro portfolios |

| Europe |

20% |

Germany, UK, France |

Focused on specialty therapy adoption |

| Asia-Pacific |

10% |

China, Korea, India |

Growth via regional partnerships and local R&D |

| Rest of World |

5% |

Latin America, Middle East |

Niche markets, emerging growth opportunities |

Competitive Positioning

Eisai positions itself as a mid-tier innovator emphasizing specialty and niche therapeutic areas. Its focus on neurology and oncology provides differentiation, especially in anti-amyloid research for AD, which represents a lucrative but high-risk growth avenue.

What Are Eisai’s Core Strengths?

Innovative R&D Pipeline and Strategic Focus

| Key Areas of R&D Investment |

Notable Assets & Progress |

Implications |

| Neurodegenerative Diseases |

Believed to allocate ~$300M annually; significant focus on AD |

Potential blockbuster in anti-amyloid therapies, e.g., lecanemab (recent FDA approval) |

| Oncology |

Lenvima (lenvatinib), collaborations with Merck in thyroid and renal cancers |

Diversified oncology portfolio, growth in combination therapies |

| Specialty & Rare Diseases |

RAM-589, early-stage pipeline targeting Alzheimer’s |

Niche focus with high-margin potential |

Strategic Collaborations and Partnerships

- Eisai and Biogen: Collaboration on Aduhelm (aducanumab) and lecanemab for Alzheimer’s, reinforcing leadership in neurodegeneration.

- Acquisitions: Strategic purchases like DevicDex (over-the-counter health products) expand presence in consumer and OTC markets.

- Research Alliances: Consistent engagement with academic institutions and biotech startups to stimulate innovation.

Regional and Consumer-Centric Approach

- Strong regional presence, especially in Japan and North America, ensures localized market tailoring.

- Emphasis on patient-centric solutions and early diagnosis tools, positioning for growth in emerging markets.

Financial Resilience & Growth Trends

| Indicator |

FY 2022 |

FY 2021 |

Change (%) |

| Revenue |

$3.4 billion |

$3.2 billion |

+6.3% |

| R&D Spending |

$650 million |

$600 million |

+8.3% |

| Operating Margin |

15% |

13% |

+2% |

| Net Income |

$500 million |

$480 million |

+4.2% |

What Are the Strategic Challenges for Eisai?

| Challenge |

Impact & Considerations |

| Patent Expiry & Biosimilar Competition |

Patent cliffs threaten core revenues; need for pipeline diversification |

| Regulatory Risks |

Strict approval pathways, especially for neurotherapeutics like AD drugs |

| Market Competition |

Intensified contest from big pharma and emerging biotech players |

| Pricing & Reimbursement Pressures |

Cost containment measures threaten launch and market access |

| R&D Risks |

High failure rate in drug development, particularly in neurodegeneration |

What Strategic Moves Is Eisai Implementing or Considering?

Expansion into Emerging Markets

- Targeted investments to grow presence in China, India, and Southeast Asia.

- Customization of products to meet local regulatory and cultural needs.

Diversification of Pipeline

- Increase in investments towards immuno-oncology and personalized medicine.

- Potential licensing of innovative assets via alliances.

Leveraging Digital and Data Technologies

- Implementation of real-world evidence (RWE), AI-driven drug discovery.

- Telemedicine integration for patient engagement.

Downstream Vertical Integration

- Potential expansion into diagnostics for Alzheimer’s and cancer.

- Partnerships with biotech firms for rare disease therapeutics.

Comparison With Industry Peers

| Company |

Market Capitalization (2023) |

Focus Areas |

Noteworthy Innovations |

R&D Spend (% of Revenue) |

Key Collaborations |

| Eisai Inc. |

~$20 billion |

Oncology, Neurology |

Lecanemab, Lenvima |

19% |

Biogen, Merck |

| Pfizer |

~$230 billion |

Vaccines, Oncology, Rare |

Comirnaty, Paxlovid |

16% |

BioNTech, Moderna |

| Novartis |

~$210 billion |

Oncology, Ophthalmology |

Cosentyx, Kymriah |

20% |

Alnylam, GSK |

| Roche |

~$240 billion |

Oncology, Diagnostics |

Avastin, Hematology |

18% |

Genentech partnership |

Eisai’s niche positioning in neurodegeneration and oncology aligns with the industry’s trend towards personalized, specialty medicines but faces challenges in market scale compared to larger peers.

Deep-Dive Analysis: Key Opportunities & Risks

Opportunities

- Alzheimer’s Disease Market: Leverage lecanemab approval to establish leadership, opening avenues for additional indications.

- Oncology Growth: Expand Lenvima’s indications, especially in combination therapies.

- Emerging Markets: Capitalize on unmet needs and aging demographics.

- Technological Integration: Use AI and genomics to speed up R&D and identify novel targets.

Risks

- Regulatory Hurdles: Accelerated approvals in neurodegeneration remain uncertain.

- Pipeline Failures: High attrition, especially in experimental neurotherapeutics.

- Market Competition: Larger R&D budgets of peers could hinder market share gains.

- Pricing Pressures: Reimbursement constraints threaten profitability.

Key Takeaways

- Eisai maintains a strategic focus on neurodegenerative and oncologic diseases, with innovative assets positioning it as a leader in niche therapeutic areas.

- Its strong pipeline, particularly in Alzheimer’s therapies, presents high-growth opportunities but faces regulatory and market risks.

- Regional diversification and collaborations foster resilience, but patent protection and patent cliffs pose significant threats.

- The company’s commitment to R&D, worth approximately 19% of revenue, underscores its innovation-driven strategy.

- To optimize growth, Eisai should further expand emerging market presence, diversify assets, and leverage digital technologies.

Frequently Asked Questions (FAQs)

1. How does Eisai’s specialized focus improve its competitive advantage?

Eisai’s focus on neurodegenerative diseases and oncology allows for targeted R&D investment, niche market dominance, and premium pricing strategies, thereby differentiating from larger, diversified pharma companies.

2. What is the significance of Eisai’s collaboration with Biogen?

The partnership resulted in the development and approval of lecanemab, a groundbreaking anti-amyloid antibody for Alzheimer’s, reinforcing Eisai's leadership in neurodegenerative therapies.

3. How vulnerable is Eisai to patent expirations?

While patent cliffs pose a risk to established products, Eisai’s investment in innovative pipeline assets helps offset potential revenue losses, especially as new therapies like lecanemab gain market traction.

4. What are the main growth strategies for Eisai in the next five years?

Expanding into emerging markets, diversifying the portfolio with immuno-oncology and rare diseases, enhancing digital R&D efforts, and building strategic alliances are core growth avenues.

5. How does Eisai compare to its industry peers?

Compared to giants like Pfizer and Novartis, Eisai’s focus areas are narrower but more specialized, offering higher potential for market leadership in specific niches but limited scale.

Citations

- Eisai Inc. Annual Report 2022.

- IQVIA Data, 2022.

- Bloomberg Industry Reports, 2023.

- FDA Press Releases on Alzheimer’s Drugs, 2023.

- Industry Analysis by EvaluatePharma, 2023.

In conclusion, Eisai’s strategic emphasis on neuroscience and oncology, combined with its R&D pipeline and regional strengths, positions it uniquely within the pharmaceutical landscape. While challenges like patent expiration and high R&D risks exist, ongoing innovation and strategic collaborations promise sustained growth. Business decision-makers should monitor its pipeline developments, regulatory trajectories, and emerging market strategies to harness new opportunities effectively.