Last updated: July 29, 2025

Introduction

Array BioPharma Inc., a renowned biopharmaceutical enterprise focusing on oncology and dermatology therapeutics, exemplifies a strategic player navigating a highly competitive industry. Known for its focused portfolio and innovative drug development, Array’s market position reflects both its strengths and ongoing strategic adaptations within the evolving pharmaceutical landscape. This analysis provides a comprehensive overview of Array BioPharma’s current market stance, key strengths, competitive advantages, and strategic outlook to inform stakeholders and industry professionals.

Company Overview and Market Position

Founded in 1999 and acquired by Pfizer in 2019 for $11.4 billion, Array BioPharma operates primarily within targeted cancer therapies, particularly kinase inhibitors, and dermatological treatments. Its core portfolio comprises late-stage and marketed drugs such as BRAFTIVY (encorafenib), a BRAF inhibitor for melanoma, and MEKTOVI (binimetinib). Its integration into Pfizer’s extensive pipeline and commercial infrastructure amplifies its market reach but also aligns its strategic positioning with Pfizer’s global operations.

Array’s strategic geographic focus centers on North America and Europe, with a growing push into emerging markets, leveraging Pfizer's extensive distribution channels. Its emphasis on niche oncology segments where targeted therapies surpass traditional treatments positions it distinctly against broader-spectrum pharmaceutical manufacturers.

Market Share Overview

While Array's market share is concentrated within specific oncology niches, the company benefits from a stronghold in the BRAF inhibitor segment, capturing a significant portion of the pipeline for melanoma and other BRAF-mutant cancers. As per recent reports, its drugs hold competitive positions against emerging biosimilars and alternative targeted therapies, reaffirming its relevance in precision medicine.

Strengths of Array BioPharma Inc.

Focused Oncology Portfolio and Innovation

Array’s targeted approach in oncology, particularly its focus on kinase inhibitors targeting BRAF and MEK pathways, aligns with modern precision medicine trends. Its drugs, such as encorafenib and binimetinib, exemplify high efficacy and manageable safety profiles in melanoma therapy. The company’s extensive R&D pipeline emphasizes combination therapies, optimizing synergistic effects against resistant cancer types.

Strategic Acquisition and Integration

Pfizer’s acquisition not only provided substantial capital infusion but also integrated Array’s pipeline into a global commercial network. This synergy enhances market penetration, especially in complex oncology markets, and accelerates drug development timelines through Pfizer’s global research resources.

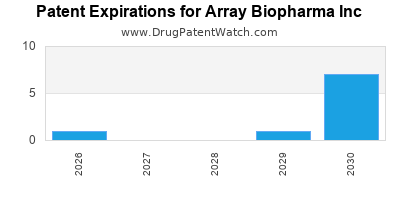

Strong Patent Portfolio and Lifecycle Management

Array maintains a robust patent portfolio around its core assets, safeguarding market exclusivity and enabling strategic licensing and co-marketing arrangements. Its ability to extend drug lifecycle via combination therapies and new indications secures sustained revenue streams.

Regulatory Success and Market Approvals

The company's ability to achieve regulatory approvals in major markets for its flagship drugs underscores its clinical and regulatory expertise. BRAFTIVY, approved for use in multiple geographies, benefits from regulatory predictability, facilitating market stability.

Partnerships and Strategic Collaborations

Beyond Pfizer, Array has established collaborations with academic institutions and biotech firms to expand its pipeline. These partnerships mitigate R&D risks and foster innovation in targeted therapeutics.

Strategic Insights and Competitive Dynamics

Competitive Landscape

Array operates amidst key competitors, including Novartis, Roche, and Bayer, specializing in targeted oncology therapies. The competitive edge hinges on its specialized focus and rapid innovation cycle. Biosimilars and next-generation targeted inhibitors are potential threats, emphasizing the importance of continuous R&D investment.

Market Expansion and Diversification

To maintain its market position, Array should emphasize geographic expansion, particularly into emerging markets with increasing cancer incidence. Diversification into other therapeutic areas, such as immuno-oncology, can capitalize on cross-industry growth trends.

Pipeline Optimization and Next-Generation Therapies

Investing in next-generation kinase inhibitors, overcoming resistance mechanisms, and combining existing drugs with immunotherapies can sustain competitive advantage. Early-stage development of agents targeting other genetic mutations or tumor microenvironment modifications can diversify its portfolio.

Regulatory and Pricing Strategies

Navigating complex pricing regulations globally requires strategic planning—balancing premium pricing for innovative therapies with affordability mandates. Engaging with health authorities early promotes smoother approvals and favorable reimbursement environments.

Digital Transformation and Data-Driven Drug Development

Leveraging big data analytics, AI, and biomarker discovery enhances drug development efficiency. Array’s integration of digital tools can expedite clinical trials and personalize treatment algorithms, aligning with industry evolution towards precision medicine.

Conclusion

Array BioPharma’s strategic focus on precision oncology, combined with its integration into Pfizer’s global platform, positions it favorably within the competitive landscape. Its strengths in targeted therapy innovation, patent protection, and strategic collaborations provide resilience against industry pressures. However, ongoing R&D investment, geographic expansion, and adaptive regulatory navigation remain crucial for sustaining growth. Stakeholders should monitor emerging competitors, biosimilar threats, and technological advancements to reinforce Array’s market leadership.

Key Takeaways

- Array’s niche specialization in kinase inhibitors ensures a competitive edge within targeted oncology markets, especially in melanoma.

- The Pfizer acquisition amplifies Array’s global market access, R&D capabilities, and pipeline development.

- Continuous innovation, particularly in combination therapies and resistance management, is vital for future growth.

- Geographic expansion into emerging markets and diversification into related therapeutic areas can offset competitive and patent expiry risks.

- Embracing digital health tools and biomarker-driven personalized treatments enhances pipeline productivity and market relevance.

FAQs

Q1. How does Array BioPharma differentiate itself from competitors in oncology?

Array’s focus on highly targeted kinase inhibitors, specifically BRAF and MEK inhibitors, combined with a strategy to develop combination therapies, positions it as a leader in precision melanoma treatment, differentiating it from broader-spectrum oncologic drugs.

Q2. What impact did Pfizer’s acquisition have on Array’s market position?

Pfizer’s acquisition provided Array with expanded global commercialization, R&D resources, and increased financial stability, enabling accelerated drug development and wider market penetration for its key therapies.

Q3. What are the main challenges facing Array in maintaining its market share?

Challenges include emerging biosimilars, resistance developments in targeted therapies, patent expirations, and competition from next-generation inhibitors. Staying ahead requires continuous innovation and diversification.

Q4. What strategic areas should Array prioritize for future growth?

Priorities include expanding into immuno-oncology, leveraging digital health for personalized medicine, entering emerging markets, and developing next-generation inhibitors to combat resistance.

Q5. How does Array plan to address regulatory and pricing hurdles globally?

Array should engage proactively with health authorities, demonstrate cost-effectiveness through real-world evidence, and adapt pricing strategies to regional markets to ensure broad access and sustainability.

References

[1] Pfizer Acquisition Announcement. (2019). Pfizer Inc. Press Release.

[2] Array BioPharma Product Portfolio. (2023). Official Website.

[3] Industry Reports on Oncology Therapeutics Market. (2022). MarketResearch.com.

[4] Regulatory Guidance in Oncology Drug Approvals. (2022). FDA and EMA Publications.