kalydeco Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Kalydeco, and when can generic versions of Kalydeco launch?

Kalydeco is a drug marketed by Vertex Pharms Inc and Vertex Pharms and is included in two NDAs. There are fourteen patents protecting this drug and two Paragraph IV challenges.

This drug has two hundred and fifty-seven patent family members in thirty-six countries.

The generic ingredient in KALYDECO is ivacaftor. There are three drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the ivacaftor profile page.

DrugPatentWatch® Generic Entry Outlook for Kalydeco

Kalydeco was eligible for patent challenges on January 31, 2016.

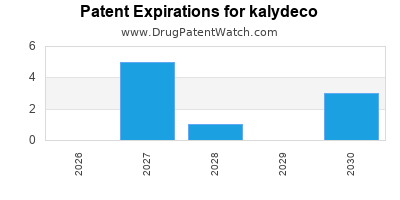

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be February 13, 2030. This may change due to patent challenges or generic licensing.

There have been five patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There are two tentative approvals for the generic drug (ivacaftor), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for kalydeco?

- What are the global sales for kalydeco?

- What is Average Wholesale Price for kalydeco?

Summary for kalydeco

| International Patents: | 257 |

| US Patents: | 14 |

| Applicants: | 2 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 94 |

| Clinical Trials: | 26 |

| Patent Applications: | 1,513 |

| Drug Prices: | Drug price information for kalydeco |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for kalydeco |

| What excipients (inactive ingredients) are in kalydeco? | kalydeco excipients list |

| DailyMed Link: | kalydeco at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for kalydeco

Generic Entry Dates for kalydeco*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

GRANULE;ORAL |

Generic Entry Dates for kalydeco*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for kalydeco

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) | Phase 2 |

| University of Miami | Early Phase 1 |

| University of Kansas Medical Center | Early Phase 1 |

Pharmacology for kalydeco

US Patents and Regulatory Information for kalydeco

kalydeco is protected by seventeen US patents and eleven FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of kalydeco is ⤷ Get Started Free.

This potential generic entry date is based on patent 10,646,481.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Vertex Pharms Inc | KALYDECO | ivacaftor | GRANULE;ORAL | 207925-001 | Mar 17, 2015 | RX | Yes | No | 10,272,046*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Vertex Pharms Inc | KALYDECO | ivacaftor | GRANULE;ORAL | 207925-002 | Mar 17, 2015 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Vertex Pharms Inc | KALYDECO | ivacaftor | GRANULE;ORAL | 207925-003 | Apr 29, 2019 | RX | Yes | No | 8,629,162 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Vertex Pharms Inc | KALYDECO | ivacaftor | GRANULE;ORAL | 207925-005 | May 3, 2023 | RX | Yes | No | 8,354,427*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Vertex Pharms | KALYDECO | ivacaftor | TABLET;ORAL | 203188-001 | Jan 31, 2012 | RX | Yes | Yes | 10,646,481*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for kalydeco

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Vertex Pharms Inc | KALYDECO | ivacaftor | GRANULE;ORAL | 207925-004 | May 3, 2023 | 8,629,162 | ⤷ Get Started Free |

| Vertex Pharms Inc | KALYDECO | ivacaftor | GRANULE;ORAL | 207925-001 | Mar 17, 2015 | 8,629,162 | ⤷ Get Started Free |

| Vertex Pharms Inc | KALYDECO | ivacaftor | GRANULE;ORAL | 207925-003 | Apr 29, 2019 | 8,629,162 | ⤷ Get Started Free |

| Vertex Pharms Inc | KALYDECO | ivacaftor | GRANULE;ORAL | 207925-005 | May 3, 2023 | 8,629,162 | ⤷ Get Started Free |

| Vertex Pharms Inc | KALYDECO | ivacaftor | GRANULE;ORAL | 207925-002 | Mar 17, 2015 | 8,629,162 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for kalydeco

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Vertex Pharmaceuticals (Ireland) Limited | Kalydeco | ivacaftor | EMEA/H/C/002494Kalydeco tablets are indicated:As monotherapy for the treatment of adults, adolescents, and children aged 6 years and older and weighing 25 kg or more with cystic fibrosis (CF) who have an R117H CFTR mutation or one of the following gating (class III) mutations in the cystic fibrosis transmembrane conductance regulator (CFTR) gene: G551D, G1244E, G1349D, G178R, G551S, S1251N, S1255P, S549N or S549R (see sections 4.4 and 5.1).In a combination regimen with tezacaftor/ivacaftor tablets for the treatment of adults, adolescents, and children aged 6 years and older with cystic fibrosis (CF) who are homozygous for the F508del mutation or who are heterozygous for the F508del mutation and have one of the following mutations in the CFTR gene: P67L, R117C, L206W, R352Q, A455E, D579G, 711+3A→G, S945L, S977F, R1070W, D1152H, 2789+5G→A, 3272 26A→G, and 3849+10kbC→T.In a combination regimen with ivacaftor/tezacaftor/elexacaftor tablets for the treatment of adults, adolescents, and children aged 6 years and older with cystic fibrosis (CF) who have at least one F508del mutation in the CFTR gene (see section 5.1).Kalydeco granules are indicated for the treatment of infants aged at least 4 months, toddlers and children weighing 5 kg to less than 25 kg with cystic fibrosis (CF) who have an R117H CFTR mutation or one of the following gating (class III) mutations in the CFTR gene: G551D, G1244E, G1349D, G178R, G551S, S1251N, S1255P, S549N or S549R (see sections 4.4 and 5.1). | Authorised | no | no | no | 2012-07-23 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for kalydeco

When does loss-of-exclusivity occur for kalydeco?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 09282419

Estimated Expiration: ⤷ Get Started Free

Patent: 10282986

Estimated Expiration: ⤷ Get Started Free

Patent: 13226076

Estimated Expiration: ⤷ Get Started Free

Patent: 16216569

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0916877

Estimated Expiration: ⤷ Get Started Free

Patent: 2012008082

Estimated Expiration: ⤷ Get Started Free

Patent: 2014021090

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 33908

Estimated Expiration: ⤷ Get Started Free

Patent: 69695

Estimated Expiration: ⤷ Get Started Free

Patent: 65519

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 12000348

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2231990

Estimated Expiration: ⤷ Get Started Free

Patent: 2497859

Estimated Expiration: ⤷ Get Started Free

Patent: 4470518

Estimated Expiration: ⤷ Get Started Free

Patent: 9966264

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0180328

Estimated Expiration: ⤷ Get Started Free

Patent: 0190660

Estimated Expiration: ⤷ Get Started Free

Patent: 0210208

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 19945

Estimated Expiration: ⤷ Get Started Free

Patent: 21572

Estimated Expiration: ⤷ Get Started Free

Patent: 23901

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 28618

Estimated Expiration: ⤷ Get Started Free

Patent: 64337

Estimated Expiration: ⤷ Get Started Free

Patent: 45625

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 1706

Estimated Expiration: ⤷ Get Started Free

Patent: 1170330

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 28618

Estimated Expiration: ⤷ Get Started Free

Patent: 64337

Estimated Expiration: ⤷ Get Started Free

Patent: 19670

Estimated Expiration: ⤷ Get Started Free

Patent: 45625

Estimated Expiration: ⤷ Get Started Free

Patent: 42037

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 64337

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 61140

Estimated Expiration: ⤷ Get Started Free

Patent: 03840

Estimated Expiration: ⤷ Get Started Free

Patent: 05690

Estimated Expiration: ⤷ Get Started Free

Patent: 56805

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 35931

Estimated Expiration: ⤷ Get Started Free

Patent: 42437

Estimated Expiration: ⤷ Get Started Free

Patent: 53357

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 1203

Estimated Expiration: ⤷ Get Started Free

Patent: 4307

Estimated Expiration: ⤷ Get Started Free

Patent: 2421

Estimated Expiration: ⤷ Get Started Free

Patent: 5430

Estimated Expiration: ⤷ Get Started Free

Patent: 5854

Estimated Expiration: ⤷ Get Started Free

Patent: 1180

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 75768

Estimated Expiration: ⤷ Get Started Free

Patent: 34041

Estimated Expiration: ⤷ Get Started Free

Patent: 11530598

Estimated Expiration: ⤷ Get Started Free

Patent: 13501787

Estimated Expiration: ⤷ Get Started Free

Patent: 14111656

Estimated Expiration: ⤷ Get Started Free

Patent: 15511583

Estimated Expiration: ⤷ Get Started Free

Patent: 17190356

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 28618

Estimated Expiration: ⤷ Get Started Free

Patent: 64337

Estimated Expiration: ⤷ Get Started Free

Patent: 45625

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 6161

Estimated Expiration: ⤷ Get Started Free

Patent: 3230

Estimated Expiration: ⤷ Get Started Free

Patent: 9751

Estimated Expiration: ⤷ Get Started Free

Patent: 11001782

Estimated Expiration: ⤷ Get Started Free

Patent: 12001939

Estimated Expiration: ⤷ Get Started Free

Patent: 14010253

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 019

Estimated Expiration: ⤷ Get Started Free

Patent: 356

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 1535

Estimated Expiration: ⤷ Get Started Free

Patent: 7823

Estimated Expiration: ⤷ Get Started Free

Patent: 9199

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 28618

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 28618

Estimated Expiration: ⤷ Get Started Free

Patent: 64337

Estimated Expiration: ⤷ Get Started Free

Patent: 45625

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 28618

Estimated Expiration: ⤷ Get Started Free

Patent: 64337

Estimated Expiration: ⤷ Get Started Free

Patent: 45625

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 92779

Estimated Expiration: ⤷ Get Started Free

Patent: 12109390

Estimated Expiration: ⤷ Get Started Free

Patent: 14139006

Estimated Expiration: ⤷ Get Started Free

Patent: 19116577

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 01800074

Estimated Expiration: ⤷ Get Started Free

Patent: 01900210

Estimated Expiration: ⤷ Get Started Free

Patent: 02100077

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 894

Estimated Expiration: ⤷ Get Started Free

Patent: 604

Estimated Expiration: ⤷ Get Started Free

Patent: 408

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 8337

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 28618

Estimated Expiration: ⤷ Get Started Free

Patent: 64337

Estimated Expiration: ⤷ Get Started Free

Patent: 45625

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1101097

Estimated Expiration: ⤷ Get Started Free

Patent: 1200722

Estimated Expiration: ⤷ Get Started Free

Patent: 1406233

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 110042356

Estimated Expiration: ⤷ Get Started Free

Patent: 120061875

Estimated Expiration: ⤷ Get Started Free

Patent: 170072950

Estimated Expiration: ⤷ Get Started Free

Patent: 190143497

Estimated Expiration: ⤷ Get Started Free

Patent: 220057663

Estimated Expiration: ⤷ Get Started Free

Patent: 240066199

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 60143

Estimated Expiration: ⤷ Get Started Free

Patent: 18273

Estimated Expiration: ⤷ Get Started Free

Patent: 57152

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 2261

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering kalydeco around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Japan | 5409010 | ⤷ Get Started Free | |

| European Patent Office | 2502902 | Modulateurs de transporteurs de cassette de liaison a l ́ATP (Modulators of ATP-binding cassette transporters) | ⤷ Get Started Free |

| European Patent Office | 2502912 | Modulateurs de transporteurs de cassette de liaison à l ́ATP (Modulators of ATP-binding cassette transporters) | ⤷ Get Started Free |

| Mexico | 2014010253 | COMPOSICION FARMACEUTICA Y ADMINISTRACIONES DE LA MISMA. (PHARMACEUTICAL COMPOSITION AND ADMINISTRATION THEREOF.) | ⤷ Get Started Free |

| Japan | 2009522278 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for kalydeco

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2826776 | 2021C/517 | Belgium | ⤷ Get Started Free | PRODUCT NAME: SYMKEVI - TEZACAFTOR/IVACAFTOR; EEN COMBINATIE VAN (A) (R)-1-(2,2-DIFLUOROBENZO(D)(1,3)DIOXOL-5-YL)-N-(1-(2,3-DIHYDROXYPROPYL)-6-FLUORO-2-(1-HYDROXY-2-METHYLPROPAN-2-YL)-1H-INDOL-5-YL)CYCLOPROPANECARBOXAMIDE OF EEN VANUIT FARMACEUTISCH OOGPUNT GESCHIKT ZOUT DAARVAN EN (B) N-(5-HYDROXY-2,4-DITERT-BUTYL-PHENYL)-4-OXO-1H-QUINOLINE-3-CARBOXAMIDE OF EEN VANUIT FARMACEUTISCH OOGPUNT GESCHIKT ZOUT DAARVAN; AUTHORISATION NUMBER AND DATE: EU/1/18/1306 20181106 |

| 1773816 | 617 | Finland | ⤷ Get Started Free | |

| 3170818 | 132020000000103 | Italy | ⤷ Get Started Free | PRODUCT NAME: UNA COMBINAZIONE DI (A) LUMACAFTOR E (B) IVACAFTOR O UN SUO SALE FARMACEUTICAMENTE ACCETTABILE(ORKAMBI); AUTHORISATION NUMBER(S) AND DATE(S): EU/1/15/1059, 20151124 |

| 3170818 | 2020C/005 | Belgium | ⤷ Get Started Free | PRODUCT NAME: ORKAMBI (LUMACAFTOR + IVACAFTOR); AUTHORISATION NUMBER AND DATE: EU/1/15/1059 20151124 |

| 2826776 | SPC/GB21/025 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: A COMBINATION OF (A) TEZACAFTOR AND (B) IVACAFTOR; REGISTERED: UK EU/1/18/1306 (NI) 20181106; UK FURTHER MAS ON IPSUM 20181106 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory of Kalydeco (Ivacaftor)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.