Share This Page

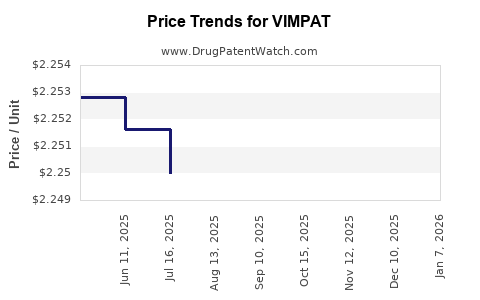

Drug Price Trends for VIMPAT

✉ Email this page to a colleague

Average Pharmacy Cost for VIMPAT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VIMPAT 150 MG TABLET | 00131-2479-35 | 19.14045 | EACH | 2025-12-17 |

| VIMPAT 100 MG TABLET | 00131-2478-60 | 18.04407 | EACH | 2025-12-17 |

| VIMPAT 50 MG TABLET | 00131-2477-60 | 11.55418 | EACH | 2025-12-17 |

| VIMPAT 10 MG/ML SOLUTION | 00131-5410-72 | 2.24138 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VIMPAT (Lacosamide)

Introduction

VIMPAT (Lacosamide) is a prescription medication primarily indicated for adjunctive therapy in partial-onset seizures in adults with epilepsy. Since its FDA approval in 2008, VIMPAT has established itself as a pivotal drug within the antiepileptic market owing to its novel mechanism of action and favorable tolerability profile. As the landscape of epilepsy treatment evolves, understanding VIMPAT’s market trajectory and pricing strategies becomes crucial for stakeholders, including pharmaceutical companies, healthcare payers, and investors.

Market Overview

Global Epilepsy Treatment Market Context

The global epilepsy market is projected to reach approximately USD 4.5 billion by 2028, growing at a compound annual growth rate (CAGR) of around 5.2% (Market Research Future, 2022). The rising prevalence of epilepsy—estimated at 50 million people worldwide—along with increasing awareness and diagnosis, propels demand for effective anticonvulsants.

VIMPAT’s Position in the Market

Lacosamide’s differentiators include once or twice-daily dosing, minimal drug-drug interactions, and a favorable side effect profile. These qualities have facilitated its adoption, especially among adult patients with refractory partial-onset seizures. It competes within a crowded class comprising drugs like levetiracetam, lamotrigine, and carbamazepine. Its share of the antiepileptic drug (AED) market is estimated at approximately 7-10%, with sales totaling around USD 900 million in 2022 (IQVIA, 2023).

Market Penetration and Adoption Factors

- Efficacy and Safety Profile: VIMPAT’s non-sedating profile improves patient compliance.

- Prescriber Preference: Neurologists favor VIMPAT for patients with comorbidities where drug-drug interactions are critical.

- Cost and Insurance Coverage: High cost and insurance formulary positioning influence market penetration.

- Patient Population: Increasing prevalence of drug-resistant epilepsy drives continued demand.

Financial Performance and Revenue Trends

VIMPAT’s revenue trajectory has exhibited steady growth since launch, with annual sales climbing from USD 400 million in 2018 to USD 900 million in 2022. Such growth reflects increased adoption, expanded labeling (e.g., pediatric use in some regions), and ongoing geographic expansion, including Japan and European markets.

Key revenue drivers include:

- Market Expansion: Entry into new geographic territories.

- Formulation Innovations: Introduction of intravenous options facilitates hospital-based use.

- Brand Loyalty: Strong prescriber confidence sustains repeat prescriptions.

Pricing Landscape and Trends

Current Price Points

VIMPAT’s wholesale acquisition cost (WAC) varies globally, with approximate retail prices in the U.S. ranging from USD 600 to USD 800 per month for typical dosing (GoodRx, 2023). The average wholesale price (AWP) is approximately USD 670 for a 30-day supply.

Pricing Strategies

- Premium Pricing: Reflecting its novel mechanism and safety profile, VIMPAT maintains a premium price position within the AED class.

- Price Stability: Despite generic availability in some markets, VIMPAT’s IP protection and formulation patents sustain its pricing power.

- Insurance Reimbursements: Payers often negotiate discounts, influencing net prices.

Impact of Patent Expiry and Generics

VIMPAT's patent expiration in 2028 in major markets may introduce generic competitors, likely exerting downward pressure on prices. Historically, patent cliffs for AEDs result initially in a price drop of 20-40%, depending on market dynamics.

Market Dynamics and Future Price Projections

Influences on Future Pricing

- Patent Expiry and Generics: Anticipated in 2028; potential 30-50% reduction in price post-generic entry.

- Market Competition: Entry of new AEDs, including newer mechanisms like selective sodium channel blockers, may pressure VIMPAT's premium position.

- Regulatory and Reimbursement Policies: Stricter formulary controls and value-based pricing models could impact profitability.

- Geographic Expansion: Entry into emerging markets presents opportunities but often at lower price points due to differing healthcare economics.

Projected Price Trends (2023-2030)

| Year | Price Range (USD/month) | Influencing Factors | Outlook |

|---|---|---|---|

| 2023 | 600-800 | Stable patent protection, market positioning | Stable high prices |

| 2024-2027 | 580-750 (gradual decline) | Negotiated discounts, market saturation | Slight decline, maintained premium status |

| 2028 (patent expiry) | 350-450 (post-generic) | Increased competition, generic penetration | Significant price drop post-generic entry |

| 2029-2030 | 350-500 | Market stabilization, new formulation or indications | Stabilized at lower but competitive levels |

These projections assume typical patent-related price erosion and competition-induced discounts, aligned with historical patterns observed for similar AEDs.

Implications for Stakeholders

- Pharmaceutical Companies: Investment in patent protection, formulation innovation, and geographic expansion remain critical. Vigilance around patent cliffs is essential for strategic planning.

- Healthcare Payers: Anticipate increased pressure to negotiate discounts post-patent expiry; consider value-based reimbursement models.

- Investors: Sales growth is projected to plateau approaching patent expiry but may benefit from emerging indications or formulations delaying generic competition.

Key Takeaways

- VIMPAT remains a significant player in the epilepsy treatment market, driven by its efficacy, safety, and prescriber confidence.

- Market growth is expected to continue regionally, though pricing power sustains primarily under patent protection.

- The upcoming patent expiry in 2028 will likely lead to substantial price erosion, emphasizing the importance of timely lifecycle management strategies.

- Market dynamics, including competition, regulatory environment, and geographic expansion, heavily influence future price projections.

- Stakeholders should monitor patent statuses, competitive entry, and reimbursement policies closely for strategic decision-making.

Frequently Asked Questions (FAQs)

-

When is VIMPAT’s patent set to expire, and what does this mean for its pricing?

VIMPAT’s key patents are expected to expire by 2028 in major markets. Post-expiry, generic versions are likely to enter the market, causing significant price reductions and affecting revenue streams. -

How does VIMPAT compare to other AEDs concerning pricing and market share?

VIMPAT commands a premium price compared to older AEDs but maintains a modest market share. Its positioning is strengthened by its favorable safety profile and once-daily dosing, though generic competition threatens its price advantage after patent expiry. -

What are the main factors driving VIMPAT’s sales growth?

Factors include increased adoption in multiple regions, expanding indications, formulation versatility (including IV administration), and continued prescriber preference due to its safety profile. -

What impact will upcoming regulatory changes have on VIMPAT’s market?

Stricter reimbursement policies and adoption of value-based pricing may pressure margins. Conversely, expanding indications and formulations can mitigate some erosion. -

How can stakeholders prepare for the post-patent landscape?

Stakeholders should focus on lifecycle management through new indications, combination therapies, formulation innovations, and geographic expansion to sustain revenue beyond patent expiration.

References

[1] Market Research Future. (2022). Epilepsy Treatment Market Report.

[2] IQVIA. (2023). Pharmaceutical Market Analytics Report.

[3] GoodRx. (2023). VIMPAT (Lacosamide) Price Comparison.

More… ↓