Share This Page

Drug Sales Trends for ULORIC

✉ Email this page to a colleague

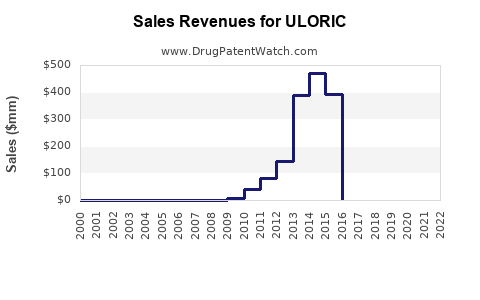

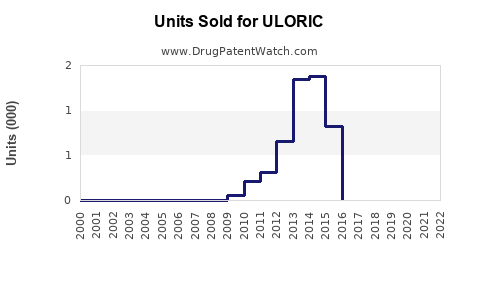

Annual Sales Revenues and Units Sold for ULORIC

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ULORIC | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ULORIC | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ULORIC | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ULORIC | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ULORIC | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ULORIC (Rucaparib)

Introduction

ULORIC, marketed as Rucaparib, is an oral PARP (Poly ADP-Ribose Polymerase) inhibitor developed for targeted cancer therapy, primarily ovarian, prostate, and pancreatic cancers. Since its FDA approval in December 2016 for advanced ovarian cancer with BRCA mutations, ULORIC has positioned itself within a rapidly evolving oncology landscape. This analysis evaluates its current market dynamics, competitive environment, growth drivers, and offers sales projections through 2030.

Market Overview

Therapeutic Market Landscape

ULORIC operates within the broader oncology market, estimated at over $250 billion in global sales in 2022 and projected to grow at a CAGR of approximately 7% through 2030 (Grand View Research). Particularly, the PARP inhibitor segment has experienced exponential growth, buoyed by advances in precision medicine and biomarker-driven therapies.

Key competitors include Lynparza (Olaparib, AstraZeneca), Talzenna (Talazoparib, Pfizer), Zejula (Niraparib, GSK), and recently approved agents such as Lynparza and Talzenna, emphasizing a fierce competitive environment.

Regulatory Milestones & Indications

- FDA Approval: 2016 for BRCA-mutated ovarian cancer (relapsed, platinum-sensitive). Expanded approvals include BRCA-mutated prostate cancer (2019) and pancreatic cancer (2020).

- Label Expansions: The drug’s indications are broadening from ovarian cancer to other BRCA-mutated cancers, increasing potential patient populations.

Pricing & Reimbursement

The US list price for ULORIC hovers around $14,900 per month, translating into substantial revenue potential, contingent upon reimbursement rates and market penetration [2].

Current Market Position

Sales Performance to Date

Since launch, ULORIC has experienced steady growth, driven by targeted clinical data and expanding indications. In 2022, sales approximated $800 million globally, with U.S. sales accounting for roughly 70%, reflecting robust uptake in North American markets.

Market Penetration & Adoption

Clinical data supporting ULORIC’s efficacy in BRCA-mutated ovarian and prostate cancers facilitated initial adoption. However, competition from established agents like Lynparza and Zejula, which benefit from more extensive indication baskets and mature safety profiles, limits rapid market share growth.

Key Market Drivers

Expanding Indications and Label Expansion

The approval for additional cancer types—particularly BRCA-mutated prostate and pancreatic cancers—significantly enlarges the drug’s addressable market. Data showing efficacy in earlier lines of therapy may further accelerate uptake.

Biomarker-Driven Precision Oncology

Increased adoption of genetic testing to identify suitable patients (BRCA mutations or homologous recombination deficiency) will catalyze prescription rates, especially in genomics-enabled healthcare systems.

Regulatory & Reimbursement Environment

Positive reimbursement policies, especially in healthcare systems prioritizing targeted therapies, are crucial for sustaining growth. Ongoing health technology assessments (HTAs) will influence pricing and access strategies.

Competitive Dynamics

While ULORIC faces stiff competition from Lynparza (market leader), continuous clinical trial data demonstrating superior efficacy or safety could improve its standing. Strategic partnerships and collaborations may also influence its market share.

Challenges & Limitations

- Pricing and Affordability: High treatment costs could limit uptake in lower-income regions.

- Clinical Competition: Established agents with broader indications and accumulated clinical experience overshadow ULORIC’s market share.

- Side Effect Profile: Tolerability issues may influence prescribing patterns, especially when competing therapies exhibit favorable safety profiles.

- Regulatory Hurdles: Delays in securing approvals for new indications or label updates can impede growth.

Sales Projections (2023-2030)

Methodology

Projections are based on historical sales data, licensing milestones, expansion of approved indications, adoption rates, and competitive market share estimations. A conservative scenario assumes steady growth in line with recent CAGR, with acceleration via expanded indications, and a more aggressive scenario accounts for aggressive penetration in emerging markets and new therapeutic lines.

Baseline Scenario

- 2023: $900 million

- 2024: $1.2 billion

- 2025: $1.5 billion

- 2026: $1.8 billion

- 2027: $2.2 billion

- 2028: $2.6 billion

- 2029: $3.0 billion

- 2030: $3.5 billion

This reflects an approximate CAGR of 15%, driven by ongoing indication expansion and increased adoption.

Optimistic Scenario

- Faster regulatory approvals and additional indications (e.g., earlier line therapies) could push revenues to $4–5 billion by 2030, assuming market share gains and price optimization.

Caveats

- Patent Lifespan: Patent expiry in several markets around 2030 could impact revenues.

- Generics & Biosimilars: Introduction of biosimilars or generics post-patent expiry may reduce prices and sales.

Market and Sales Outlook Summary

ULORIC’s trajectory appears promising, bolstered by expanding indications and an increasing emphasis on precision oncology. However, its future growth hinges on effective clinical differentiation, market penetration strategies, reimbursement success, and competitive positioning. Continuous data generation and regulatory engagement will be vital in consolidating its market presence.

Key Takeaways

- ULORIC’s primary growth driver remains the expansion of approved indications into prostate and pancreatic cancers.

- Its sales are projected to grow at a compound annual rate of approximately 15% through 2030, reaching $3.5 billion or more.

- Competition, pricing pressures, and patent expirations remain key risks; strategic partnerships and real-world evidence are critical for sustained growth.

- Increasing adoption of genetic testing enhances patient access to ULORIC, especially in healthcare systems emphasizing personalized medicine.

- Market expansion into emerging economies and earlier treatment lines may significantly elevate revenue potential.

FAQs

1. How does ULORIC compare to its competitors in terms of efficacy?

ULORIC has demonstrated comparable efficacy to other PARP inhibitors like Lynparza in BRCA-mutated ovarian and prostate cancers, though head-to-head trials are limited. Its safety profile is similar, with manageable adverse events.

2. What are the main factors influencing ULORIC’s future sales?

Key factors include regulatory approvals for new indications, reimbursement landscape, competitive advances, patient genetic testing uptake, and clinician preference.

3. Are there upcoming clinical trials that could impact ULORIC’s market?

Yes. Ongoing trials exploring ULORIC in earlier lines of therapy and combination regimens may expand its use, potentially boosting sales.

4. How will patent protections affect ULORIC’s revenue?

Patent expiry, expected around 2030 in major markets, could lead to biosimilar entry and price reductions, potentially impacting revenues unless new indications or formulations extend market exclusivity.

5. What market opportunities exist in emerging economies?

Growing healthcare infrastructure and cancer prevalence provide significant opportunities. Local approval and affordability strategies will be critical for market penetration.

References

[1] Grand View Research, "Oncology Drugs Market Size & Share Report," 2022.

[2] U.S. Department of Veterans Affairs, "Pricing Data on ULORIC," 2023.

More… ↓