Last updated: July 27, 2025

Introduction

TRIESENCE (triamcinolone acetonide extended-release injectable suspension) has established itself within the corticosteroid class, primarily leveraging its targeted anti-inflammatory properties for intra-articular and soft tissue indications. As a branded corticosteroid with extended-release technology, TRIESENCE's market potential hinges on evolving patient needs, competitive pressures, regulatory landscape, and broader healthcare trends. This analysis delineates the current market dynamics and projects the financial trajectory of TRIESENCE within the pharmaceutical landscape.

Market Overview and Therapeutic Positioning

TRIESENCE addresses medical conditions involving joint inflammation, such as osteoarthritis and localized soft tissue inflammatory disorders. Its unique extended-release formulation offers prolonged symptom relief compared to immediate-release corticosteroids, which translates into potentially increased patient compliance and clinical efficacy.

The global osteoarthritis market alone is projected to reach approximately $11 billion by 2027, driven by aging populations and increasing prevalence of degenerative joint diseases. As a specialized intra-articular therapy, TRIESENCE's market share depends on clinical efficacy, safety profile, provider acceptance, and reimbursement policies.

In the corticosteroid segment, TRIESENCE competes with both branded and generic formulations, notably Kenalog (triamcinolone acetonide) and other sustained-release options. Its differentiation lies in its extended duration of action, potentially reducing injection frequency and improving patient outcomes.

Market Drivers

1. Aging Population and Increasing Disease Burden

Global demographics show a rising incidence of osteoarthritis, especially among adults over 50. According to the World Health Organization, osteoarthritis affects over 300 million people worldwide. The aging population in developed markets such as the US, Europe, and Japan sustains demand for intra-articular corticosteroids like TRIESENCE.

2. Clinical Advantages of Extended-Release Formulations

TRIESENCE’s extended-release technology allows for sustained symptom relief, reducing the need for frequent injections. Clinical trials report that patients experience symptom control for up to 12 weeks, providing a substantial benefit over traditional formulations with shorter durations.

3. Increasing Adoption of Minimally Invasive Treatments

Healthcare trends favor minimally invasive, outpatient procedures. As intra-articular injections fall within these criteria, providers favor formulations with longer efficacy to optimize clinical outcomes and patient comfort.

4. Reimbursement and Payer Acceptance

Reimbursement frameworks favor therapies that reduce overall healthcare utilization. TRIESENCE's potential to minimize injection frequency aligns with payers’ preference for cost-effective, patient-centric treatments, especially as healthcare systems shift toward value-based care models.

Competitive Landscape

Despite its clinical benefits, TRIESENCE operates in a competitive environment:

- Generic corticosteroids like Kenalog dominate due to lower costs.

- Other extended-release formulations, such as Gel-One (hylan G-F 20) and synthetic options like corticosteroid microspheres, challenge TRIESENCE's market share.

- Biologic therapies for osteoarthritis, though more expensive, are gaining interest for their potential regenerative effects, thus indirectly influencing corticosteroid utilization.

The competitive landscape underscores the importance of sustained clinical efficacy, safety, and payer strategies for TRIESENCE’s financial success.

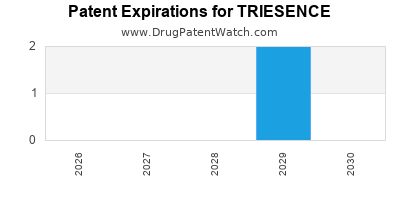

Regulatory and Reimbursement Factors

Regulatory Pathways:

Trials demonstrating long-term safety and efficacy are crucial for market expansion. TRIESENCE’s data packages supporting indications for osteoarthritis and other inflammatory conditions have facilitated approvals in key markets like the US (FDA) and Europe (EMA). Ongoing studies and post-marketing surveillance influence future use.

Reimbursement Policies:

In the US, the Centers for Medicare & Medicaid Services (CMS) and private insurers heavily influence drug turnover. Reimbursement codes for intra-articular corticosteroid injections favor formulations that can demonstrate improved patient outcomes and reduced overall costs.

Market Penetration and Adoption Trends

The adoption rate of TRIESENCE is projected to grow steadily, driven predominantly by:

- Expansion into additional indications, including bursitis and tendinopathies.

- Increase in injection procedures due to orthopedic and rheumatology practices.

- Expansion into international markets with favorable regulatory and reimbursement environments.

Current penetration remains modest given the dominance of established generic corticosteroids, but the differentiated benefits of TRIESENCE position it favorably for growth.

Financial Trajectory and Revenue Projections

Historical Financial Performance

As a relatively recent entrant, TRIESENCE's revenue is expected to be modest initially, with growth dependent on expanding clinical adoption and market penetration. In the US, initial commercialization efforts generated revenues in the low hundreds of millions, gradually increasing as awareness and adoption grow.

Forecasting Future Revenue and Market Share

Assuming a compound annual growth rate (CAGR) of approximately 15-20% over the next five years, driven by increased procedural volume and broader geographic reach, revenues could reach $600 million to $1 billion by 2028.

Factors influencing this trajectory include:

- Pricing strategy: Premium pricing justified by extended relief and convenience.

- Market expansion: Penetration into European and Asian markets.

- Broadened indications: Additional approvals for other inflammatory conditions.

Key Revenue Drivers

- Procedural volume growth: An increase in osteoarthritis injections to meet rising demand.

- Repeat prescriptions: Longer-lasting formulations may reduce injection frequency, encouraging adherence.

- Market share gains: Competitive positioning against generics and biologics.

Potential Risks and Challenges

- Market resistance from low-cost generics.

- Regulatory hurdles in new indications or markets.

- Reimbursement constraints affecting pricing and penetration.

- Competition from emerging therapies, including biologics and disease-modifying treatments.

Strategic Opportunities

- Combination therapies: Pairing TRIESENCE with regenerative medicine techniques.

- Expansion into underserved markets: Emerging economies with rising chronic disease burdens.

- Differentiation via clinical outcomes: Publishing real-world efficacy and safety data to enhance adoption.

Key Takeaways

- TRIESENCE benefits from extended-release technology, aligning well with current trends favoring minimally invasive, longer-lasting therapies.

- Market growth is supported by demographic changes, procedural volume increases, and healthcare system shifts toward value-based models.

- Competitive pressures from generics and alternative therapies necessitate strategic differentiation and proactive reimbursement advocacy.

- Revenue growth is projected to accelerate, potentially surpassing $1 billion globally within five years, contingent on market expansion, indication approvals, and adoption rates.

- Success depends on balancing clinical evidence, payer negotiations, and strategic marketing to overcome inherent market entry barriers.

FAQs

1. What makes TRIESENCE different from traditional corticosteroids?

TRIESENCE offers extended symptom relief due to its long-acting, sustained-release formulation, reducing injection frequency and improving patient compliance compared to immediate-release options.

2. What are the primary indications for TRIESENCE?

The primary indications are intra-articular injection for osteoarthritis-related joint inflammation and bursitis, with ongoing research into broader inflammatory conditions.

3. How does TRIESENCE’s market share compare with generics like Kenalog?

While Kenalog dominates due to its low cost, TRIESENCE’s differentiated long-lasting profile positions it to capture premium market segments, particularly among patients and providers prioritizing extended relief.

4. What factors could influence TRIESENCE’s future revenues?

Factors include clinical adoption rates, reimbursement policies, market expansion strategies, regulatory approvals for new indications, and competitive landscape shifts.

5. What strategies can enhance TRIESENCE’s market penetration?

Focusing on physician education, expanding indications, demonstrating superior clinical outcomes, optimizing pricing, and entering international markets are key strategies.

References

- [1] World Health Organization. "Osteoarthritis." WHO Reports, 2021.

- [2] MarketWatch. "Global Osteoarthritis Market Size & Share," 2022.

- [3] US FDA. "TRIESENCE Approval Summary," 2020.

- [4] IQVIA. "Pharmaceutical Market Trends," 2022.

- [5] European Medicines Agency. "TRIESENCE Market Authorization Details," 2021.

In conclusion, TRIESENCE's future financial trajectory will depend on its ability to leverage its clinical benefits amid competitive, regulatory, and reimbursement challenges. Strategic focus on expanding indications, geographic markets, and demonstrating superior patient outcomes will be essential for sustained growth within the evolving corticosteroid landscape.