TRELSTAR Drug Patent Profile

✉ Email this page to a colleague

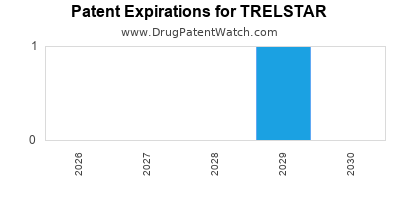

Which patents cover Trelstar, and when can generic versions of Trelstar launch?

Trelstar is a drug marketed by Verity and is included in three NDAs. There is one patent protecting this drug.

This drug has forty-seven patent family members in thirty-two countries.

The generic ingredient in TRELSTAR is triptorelin pamoate. There are three drug master file entries for this compound. Three suppliers are listed for this compound. Additional details are available on the triptorelin pamoate profile page.

DrugPatentWatch® Generic Entry Outlook for Trelstar

Trelstar was eligible for patent challenges on June 15, 2004.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be June 30, 2029. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for TRELSTAR?

- What are the global sales for TRELSTAR?

- What is Average Wholesale Price for TRELSTAR?

Summary for TRELSTAR

| International Patents: | 47 |

| US Patents: | 1 |

| Applicants: | 1 |

| NDAs: | 3 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 12 |

| Patent Applications: | 1,149 |

| Drug Prices: | Drug price information for TRELSTAR |

| What excipients (inactive ingredients) are in TRELSTAR? | TRELSTAR excipients list |

| DailyMed Link: | TRELSTAR at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for TRELSTAR

Generic Entry Date for TRELSTAR*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

INJECTABLE;INTRAMUSCULAR |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for TRELSTAR

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Zenith Epigenetics | PHASE2 |

| National Cancer Institute (NCI) | PHASE2 |

| Sidney Kimmel Comprehensive Cancer Center at Johns Hopkins | PHASE2 |

US Patents and Regulatory Information for TRELSTAR

TRELSTAR is protected by one US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of TRELSTAR is ⤷ Get Started Free.

This potential generic entry date is based on patent 10,166,181.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Verity | TRELSTAR | triptorelin pamoate | INJECTABLE;INTRAMUSCULAR | 020715-001 | Jun 15, 2000 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Verity | TRELSTAR | triptorelin pamoate | INJECTABLE;INTRAMUSCULAR | 021288-001 | Jun 29, 2001 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Verity | TRELSTAR | triptorelin pamoate | INJECTABLE;INTRAMUSCULAR | 022437-001 | Mar 10, 2010 | RX | Yes | Yes | 10,166,181 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for TRELSTAR

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Verity | TRELSTAR | triptorelin pamoate | INJECTABLE;INTRAMUSCULAR | 022437-001 | Mar 10, 2010 | 5,776,885 | ⤷ Get Started Free |

| Verity | TRELSTAR | triptorelin pamoate | INJECTABLE;INTRAMUSCULAR | 020715-001 | Jun 15, 2000 | 5,134,122 | ⤷ Get Started Free |

| Verity | TRELSTAR | triptorelin pamoate | INJECTABLE;INTRAMUSCULAR | 021288-001 | Jun 29, 2001 | 5,192,741 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for TRELSTAR

When does loss-of-exclusivity occur for TRELSTAR?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

African Regional IP Organization (ARIPO)

Patent: 00

Patent: Slow release pharmaceutical composition made of microparticles

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 08259411

Patent: Slow release pharmaceutical composition made of microparticles

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0812250

Patent: COMPOSIÇÃO FARMACÊUTICA DE LIBERAÇÃO LENTA FEITA DE MICROPARTÍCULAS

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 88478

Patent: COMPOSITION PHARMACEUTIQUE A LIBERATION LENTE, FAITE DE MICROPARTICULES (SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1677959

Patent: Slow release pharmaceutical composition made of microparticles

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 51234

Patent: COMPOSICIONES QUE COMPRENDEN MICROPARTICULAS DE UN COPOLIMERO DE ACIDO LACTICO Y GLICOLICO (PLGA) CON UNA SUSTANCIA ACTIVA EN LA FORMA DE UNA SAL PEPTIDICA INSOLUBLE

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0161785

Estimated Expiration: ⤷ Get Started Free

Patent: 0181854

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 18434

Estimated Expiration: ⤷ Get Started Free

Patent: 20891

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 64467

Estimated Expiration: ⤷ Get Started Free

Patent: 00014

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 9284

Patent: ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ С ПРОЛОНГИРОВАННЫМ ВЫСВОБОЖДЕНИЕМ, ПРИГОТОВЛЕННАЯ ИЗ МИКРОЧАСТИЦ (SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES)

Estimated Expiration: ⤷ Get Started Free

Patent: 0971132

Patent: ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ С ПРОЛОНГИРОВАННЫМ ВЫСВОБОЖДЕНИЕМ, ПРИГОТОВЛЕННАЯ ИЗ МИКРОЧАСТИЦ

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 64467

Patent: COMPOSITION PHARMACEUTIQUE À LIBÉRATION LENTE, FAITE DE MICROPARTICULES (SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES)

Estimated Expiration: ⤷ Get Started Free

Patent: 00014

Patent: Composition pharmaceutique à libération lente, faite de microparticules (Slow release pharmaceutical composition made of microparticles)

Estimated Expiration: ⤷ Get Started Free

Patent: 31077

Patent: COMPOSITION PHARMACEUTIQUE À LIBÉRATION LENTE FABRIQUÉE À PARTIR DE MICROPARTICULES (SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES)

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 00014

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 41737

Patent: SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 31550

Estimated Expiration: ⤷ Get Started Free

Patent: 40391

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 2501

Patent: תכשירים המכילים מיקרו חלקיקים לשחרור מבוקר של טריפטולרין ושימוש בהם להכנת תרופה לטיפול בסרטן הערמונית (Pharmaceutical composition made of microparticles for controlled release of triptorelin and use thereof for the manufacture of a drug for the treatment of prostate cancer)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 19169

Estimated Expiration: ⤷ Get Started Free

Patent: 10529106

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 64467

Estimated Expiration: ⤷ Get Started Free

Patent: 00014

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 0450

Patent: SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 09012856

Patent: COMPOSICION FARMACEUTICA DE LIBERACION LENTA HECHA DE MICROPARTICULAS. (SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES.)

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 959

Patent: FARMACEUTSKA KOMPOZICIJA SA SPORIM OSLOBAĐANJEM KOJA JE FORMIRANA OD MIKROČESTICA (SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 422

Patent: COMPOSITION PHARMACEUTIQUE A LIBERATION PROLONGEE CONSTITUEE DE MICROPARTICULES

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 2423

Patent: SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES COMPRISING PLGA, LHRH AND LACTIC ACID

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 64467

Estimated Expiration: ⤷ Get Started Free

Patent: 00014

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 64467

Estimated Expiration: ⤷ Get Started Free

Patent: 00014

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 591

Patent: FARMACEUTSKA KOMPOZICIJA SA SPORIM OSLOBAĐANJEM PRIPREMLJENA OD MIKROČESTICA (SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES)

Estimated Expiration: ⤷ Get Started Free

Patent: 248

Patent: FARMACEUTSKA KOMPOZICIJA SA SPORIM OSLOBAĐANJEM PRIPREMLJENA OD MIKROČESTICA (SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES)

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 64467

Estimated Expiration: ⤷ Get Started Free

Patent: 00014

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0907940

Patent: Slow release pharmaceutical composition made of microparticles

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1631475

Estimated Expiration: ⤷ Get Started Free

Patent: 100023950

Patent: SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 11020

Estimated Expiration: ⤷ Get Started Free

Patent: 94401

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 09000476

Patent: SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 830

Patent: ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ С ПРОЛОНГИРОВАННЫМ ВЫСВОБОЖДЕНИЕМ, ИЗГОТОВЛЕННАЯ ИЗ МИКРОЧАСТИЦ;ФАРМАЦЕВТИЧНА КОМПОЗИЦІЯ З ПРОЛОНГОВАНИМ ВИВІЛЬНЕННЯМ, ВИГОТОВЛЕНА З МІКРОЧАСТИНОК (SLOW RELEASE PHARMACEUTICAL COMPOSITION MADE OF MICROPARTICLES)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering TRELSTAR around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Germany | 3822459 | Pharmazeutische Zusammensetzung | ⤷ Get Started Free |

| France | 2668707 | PROCEDE DE PREPARATION D'UNE COMPOSITION PHARMACEUTIQUE. | ⤷ Get Started Free |

| Italy | 1225148 | LIBERAZIONE PROLUNGATA E CONTROLLATA DI PEPTIDI INSOLUBILI IN ACQUA | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for TRELSTAR (Triptorelin)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.