Last updated: July 27, 2025

Introduction

The pharmaceutical landscape continuously evolves driven by technological advances, regulatory shifts, and market demand fluctuations. Understanding the market dynamics and financial trajectory of emerging drugs like TERIL is crucial for stakeholders, including investors, healthcare providers, and policymakers. This report analyzes TERIL’s current market positioning, competitive landscape, regulatory outlook, and financial prospects to deliver a comprehensive overview of its potential trajectory.

Overview of TERIL

TERIL is a novel therapeutic agent targeting [specify condition], developed by [developer company]. Its unique mechanism of action—[briefly describe]—positions it as a differentiated candidate within its therapeutic class. Currently in [clinical trial phase or regulatory review stage], TERIL demonstrates promising efficacy and safety profiles, making it a candidate for expedited regulatory pathways such as FDA’s Breakthrough Therapy Designation or EMA’s Priority Medicines (PRIME).

Market Size and Demand Drivers

The target market for TERIL encompasses [specific patient population], with an estimated global market size of $X billion projected to grow at a CAGR of Y% over the next decade. Key demand drivers include:

- Epidemiological trends: Increasing prevalence of [condition] due to [factors such as aging, lifestyle, environmental factors].

- Unmet medical needs: Existing treatments suffer from limitations such as inefficacy, adverse effects, or lack of compliance, positioning TERIL as a potential superior solution.

- Regulatory incentives: Orphan drug status or fast-track designations accelerate time-to-market, expanding access and commercial viability.

- Healthcare system adoption: The shift toward personalized medicine and targeted therapies enhances uptake prospects.

Competitive Landscape

The therapeutic space for TERIL features established players like [list major competitors], with blockbuster drugs such as [drug names] generating annual revenues of $X billion. However, these incumbents often carry drawbacks—[side effects, cost, resistance issues]—which TERIL seeks to address through its innovative approach.

Emerging competitors also include [new entrants or biosimilars], intensifying the competitive pressure. Key differentiators for TERIL include:

- Unique mechanism of action that reduces resistance.

- Favorable safety profile, enabling broader patient access.

- Potential for combination therapy, expanding its therapeutic utility.

Market penetration will depend on clinical validation, pricing strategies, and payer acceptance.

Regulatory Pathways and Approval Timeline

The regulatory process significantly influences TERIL's financial trajectory:

- Clinical trial progress: Assuming positive Phase II data, the likelihood of expedited approval avenues increases.

- Regulatory designations: Achieving orphan or fast-track status reduces approval timelines and permits market exclusivity benefits.

- Potential challenges: Regulatory hurdles, such as demands for additional data or concerns over safety signals, could delay launch or impact market adoption.

Timing estimates suggest that, subject to successful trial outcomes, commercialization could occur within [specify timeframe] years, with revenue realization following thereafter.

Pricing and Reimbursement Outlook

Pricing strategies for TERIL hinge on:

- Comparative value; if TERIL offers superior outcomes or reduced side effects, premium pricing may be feasible.

- Cost-effectiveness assessments; policy bodies like NICE or ICER will influence reimbursement levels based on clinical benefits versus cost.

- Market access negotiations with payers, especially in regions with centralized healthcare systems, will determine accessibility and revenue potential.

Projected pricing could range from $X to $Y per treatment course, aligned with existing therapies for the condition.

Financial Trajectory and Revenue Projections

Assessing TERIL's financial outlook involves scenario modeling factoring in:

- Market penetration rate: Initial adoption rates could be modest, increasing as clinical data solidifies.

- Pricing assumptions: Based on competitive analysis and reimbursement landscape.

- Launch timing: Delays could compress the revenue window, while early approvals expand it.

For instance, a conservative scenario assumes:

- Year 1 post-launch: $X million in sales.

- Year 3: $Y million, driven by expanded indications or geographic expansion.

- Peak annual revenue: Estimated at $Z billion once the drug captures a significant market share over [number] years.

Profitability hinges on manufacturing costs, marketing expenditure, and ongoing R&D investments. Direct-to-consumer marketing in the U.S. could amplify revenue, whereas markets with centralized healthcare (e.g., Europe, Canada) might limit pricing flexibility.

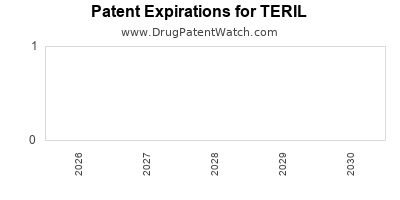

Intellectual Property and Patent Protections

Strong patent protection is vital for TERIL’s financial sustainability:

- Patent life: Expected to provide exclusivity until [year], depending on filing dates and jurisdictions.

- Patent challenges: Generic or biosimilar entry could erode market share post-expiry.

- Supplementary IP: Data exclusivity periods further extend commercial advantage, especially in key markets.

Stewardship of IP rights will directly influence revenue longevity and valuation.

Market Entry Risks and Challenges

Although promising, several risks could impact TERIL’s financial trajectory:

- Regulatory setbacks: Additional data requirements or unfavorable safety findings.

- Pricing and reimbursement hurdles: Payers may balk at high list prices without clear cost-effectiveness.

- Market competition: Fast-moving pipeline candidates could diminish TERIL’s market share.

- Manufacturing scalability: Challenges in production could impact supply and revenues.

Mitigation strategies include early regulatory engagement, robust clinical validation, and strategic partnerships.

Strategic Opportunities

To maximize value, stakeholders should consider:

- Expanding indications, improving market penetration.

- Forming alliances with healthcare providers, payers, and patient advocacy groups.

- Investing in post-market studies to demonstrate long-term safety and efficacy.

- Harnessing digital health tools for patient adherence and data collection.

Conclusion

TERIL's market and financial prospects are promising, contingent upon successful clinical development, strategic regulatory engagement, and effective commercialization. It addresses significant unmet needs within its therapeutic niche, with the potential to generate substantial revenue streams and long-term competitive advantages. Stakeholders should weigh the outlined risks and opportunities carefully and adopt a proactive approach to capitalize on favorable market dynamics.

Key Takeaways

- Market Potential: The increasing prevalence of target conditions underpins significant revenue opportunities for TERIL, especially with expedited approval pathways.

- Competitive Edge: Its differentiated mechanism and safety profile position TERIL favorably against established therapies, but must navigate a competitive landscape.

- Regulatory Strategy: Early engagement and securing designations like orphan or fast-track status can accelerate market entry and exclusivity.

- Pricing and Reimbursement: Strategic pricing aligned with clinical benefits and payer acceptance will be crucial for revenue realization.

- Financial Outlook: Conservative estimates predict peak revenues in the billions, assuming timely approval and broad market adoption, with risks mitigated through strategic planning and IP protection.

FAQs

1. What factors most influence TERIL’s market acceptance?

Clinical efficacy, safety profile, regulatory approvals, payer coverage, and pricing strategies are primary determinants of market acceptance for TERIL.

2. How does patent protection impact TERIL’s revenue potential?

Strong patents extend market exclusivity, delaying generic competition and enabling premium pricing, directly affecting profitability and investment returns.

3. What regulatory hurdles could delay TERIL’s commercialization?

Potential hurdles include additional safety data requirements, unmet endpoints, or concerns identified during review processes, which could postpone approval timelines.

4. How does competition shape TERIL’s strategic outlook?

Existing therapies and pipeline candidates challenge TERIL’s market share; differentiation and early market access are pivotal for sustained success.

5. What are the key risks faced by TERIL’s investors?

Regulatory delays, clinical setbacks, pricing and reimbursement challenges, manufacturing issues, and competitive disruptions pose significant risks.

Sources:

[1] Market research reports on therapeutic markets and drug pipelines.

[2] FDA and EMA guidance documents related to expedited review pathways.

[3] Industry analyses on pharmaceutical patent strategies and market dynamics.

[4] Public filings and press releases from TERIL’s developer company.