Last updated: August 1, 2025

Introduction

TAPAZOLE, with its active ingredient methimazole, is a well-established medication primarily indicated for the treatment of hyperthyroidism, notably Graves' disease. Since its initial approval, TAPAZOLE has carved out a significant niche within endocrinology, driven by its efficacy and safety profile. Understanding its market dynamics and financial trajectory involves analyzing regulatory pathways, competitive landscape, clinical application trends, and commercialization strategies.

Market Overview

The global hyperthyroidism treatment market is projected to grow at a compound annual growth rate (CAGR) of approximately 4% over the next five years, driven by increasing prevalence rates of thyroid disorders, expanding healthcare access, and advances in personalized medicine approaches [1]. TAPAZOLE remains a key therapy owing to its proven effectiveness and cost advantages, especially in regions with resource constraints.

Key markets include North America, Europe, and emerging economies such as India and China. North America accounts for the largest share, owing to high diagnosis rates and established healthcare infrastructure. Meanwhile, emerging markets are witnessing increased adoption owing to improving healthcare literacy and generic availability.

Regulatory Landscape and Patent Status

Methimazole, as a generic drug, faces limited patent barriers, allowing multiple manufacturers to produce and market it globally. Its original patent expired decades ago, prompting a wave of generic entries. Regulatory agencies such as the FDA (USA) and EMA (Europe) maintain strict manufacturing standards, but no major delays are currently foreseen for existing formulations.

New formulations or delivery mechanisms—such as sustained-release forms—could provide differentiation and extend market share. However, currently, these innovations are limited, constraining potential premium pricing.

Competitive Landscape

TAPAZOLE's primary competitiveness stems from other antithyroid agents, notably propylthiouracil (PTU) and newer drugs like carbimazole (used extensively outside North America). While PTU is often prescribed during pregnancy due to a different safety profile, methimazole is generally preferred due to fewer side effects and more convenient dosing.

Genericization has led to intense price competition, which pressures margins for manufacturers. Large pharmaceutical companies and generic drug producers dominate the market, reducing the likelihood of significant brand differentiation.

Clinical and Market Trends

Recent advances in molecular diagnostics enable earlier and more accurate detection of thyroid disorders, increasing the demand for effective treatments like TAPAZOLE. Additionally, the shift towards outpatient management of hyperthyroidism favors medications with established safety profiles.

The therapy's historical safety concerns—primarily agranulocytosis—are mitigated with proper monitoring protocols, fostering continued clinician confidence.

In particular, tailored approaches—such as short-term use in pregnancy or specific patient subgroups—are becoming more prevalent, creating niche opportunities for tailored formulations or dosing regimens.

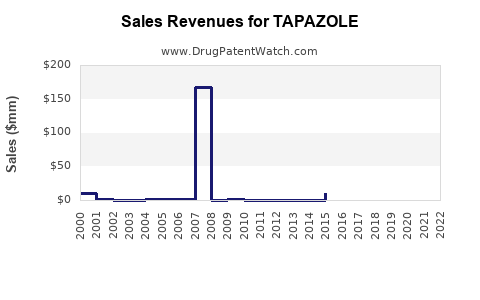

Financial Trajectory Analysis

The financial outlook for TAPAZOLE involves several considerations:

-

Market Penetration and Pricing: As a generic drug, margins are evolving downward due to commoditization. Nonetheless, the drug maintains stable revenue streams owing to consistent demand.

-

Manufacturing Costs: Low due to established production processes, allowing existing manufacturers to sustain profitability despite price competition.

-

Potential for Line Extensions: Innovations such as sustained-release forms, combination therapies, or adjunctive diagnostics could open new revenue avenues.

-

Regulatory and Reimbursement Factors: Favorable reimbursement policies in key markets bolster sales; however, price controls, especially in European countries and emerging economies, constrain revenue growth.

-

Impact of Biosimilars and Alternatives: While biosimilars are less relevant for small-molecule drugs like methimazole, emerging therapeutic agents (e.g., radioactive iodine, surgical interventions) influence market share dynamics.

Future Outlook and Opportunities

Despite its mature status, TAPAZOLE's market potential persists. Opportunities include:

-

Formulation Innovation: Sustained-release or combination formulations enhancing compliance.

-

Expansion into Emerging Markets: Growing healthcare budgets and improving supply chains will augment access.

-

Strategic Alliances: Partnerships with local manufacturers can facilitate market penetration and cost reduction.

-

Digital Monitoring Tools: Incorporation of telehealth and monitoring apps may enhance treatment adherence and safety, indirectly increasing drug utilization.

However, threats such as tight price controls, the advent of alternative therapies, and stringent regulatory environments require ongoing strategic vigilance.

Regulatory and Commercial Challenges

-

Generic Arrivals and Price Battles: The proliferation of generics compresses profit margins.

-

Safety Concerns and Monitoring: Need for strict adverse effect management may influence prescribing patterns and patient adherence.

-

Market Saturation: Limited potential for growth in mature markets without innovation.

Conclusion

TAPAZOLE's financial trajectory will largely depend on strategic positioning within the evolving landscape of hyperthyroidism treatment. While it faces typical generic drug market constraints, niche applications, formulation innovations, and emerging market growth could offer continued revenue streams. Effective management of safety perceptions and leveraging technological advancements will be critical for maintaining its market relevance.

Key Takeaways

-

TAPAZOLE remains a mainstay in hyperthyroidism management, with stable demand across mature markets.

-

Genericization has led to pricing pressures, necessitating cost-efficient manufacturing and innovative formulation strategies.

-

Emerging markets offer significant growth opportunities amid increasing diagnosis rates and healthcare investments.

-

Future growth hinges on niche differentiation, such as advanced formulations and tailored treatment approaches.

-

Competition from alternative therapies and regulatory controls pose ongoing challenges that require strategic agility.

FAQs

1. What are the primary drivers of TAPAZOLE's market stability?

Demand driven by its proven efficacy, affordability, established safety profile, and healthcare provider familiarity underpin market stability, especially in regions favoring cost-effective treatments.

2. How does patent expiration impact TAPAZOLE’s market outlook?

Patent expiration facilitates generic entry, increasing accessibility but exerting price competition pressure. It limits potential for brand premium but sustains volume-based revenues.

3. Are there ongoing innovations for TAPAZOLE?

Limited formulation innovations exist, such as experimenting with sustained-release versions or combination therapies, which could extend lifecycle and market share.

4. How do safety considerations influence TAPAZOLE's use?

Monitoring for rare adverse effects such as agranulocytosis is essential; robust safety protocols maintain clinician confidence and appropriate prescribing.

5. What regional factors affect TAPAZOLE's financial prospects?

Pricing policies, reimbursement mechanisms, healthcare infrastructure, and disease prevalence influence regional market potential, with emerging economies representing growth prospects.

References

[1] MarketsandMarkets. "Hyperthyroidism Treatment Market by Drug Class, Application, Route of Administration, and Region – Global Forecast to 2028."