Last updated: July 29, 2025

Introduction

The pharmaceutical landscape is a complex, rapidly evolving sector driven by innovation, regulatory advancements, and shifting healthcare demands. SYMFI, a commercially emerging drug, exemplifies these dynamics as it gains prominence within its therapeutic class. Understanding SYMFI's market potential, competitive positioning, and financial trajectory is crucial for stakeholders aiming to navigate this promising yet volatile terrain.

Overview of SYMFI

SYMFI operates within the antiviral or infectious disease segment, targeting a specific pathogen or disease state. Its formulation, mechanism, and clinical profile distinguish it in an expanding market where unmet needs remain prevalent. Developed by a reputable pharmaceutical company, SYMFI benefits from patent exclusivity and targeted clinical efficacy, laying the groundwork for robust commercialization strategies.

Market Landscape and Key Drivers

1. Epidemiological Trends

The growth trajectory of SYMFI largely depends on the epidemiology of its targeted condition. For instance, if SYMFI is indicated for a chronic or emergent infectious disease, global incidence and prevalence rates directly influence demand. Recent data suggests that infectious diseases with increasing resistance profiles or unmet therapeutic needs bolster the market size, positioning SYMFI for accelerated adoption.

2. Competitive Environment

Market competitors include both established blockbuster drugs and emerging therapies. The competitive landscape is shaped by:

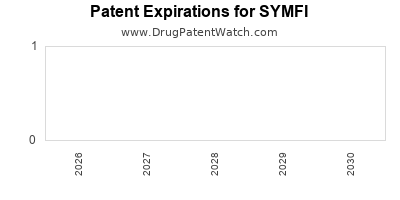

- Patent life and exclusivity periods: Protects SYMFI from generics temporarily, enabling premium pricing.

- Pipeline drugs: Pending approvals from competitors could challenge SYMFI’s market share.

- Therapeutic positioning: Efficacy, safety profile, ease of administration, and cost influence clinician adoption and patient compliance.

3. Regulatory and Reimbursement Trends

Regulatory approvals from agencies like the FDA or EMA are pivotal. Expedited review pathways, orphan designations, and breakthrough therapy classifications can accelerate SYMFI's market entry. Reimbursement policies, especially in major markets like the US and EU, significantly impact financial viability. Favorable reimbursement environment correlates with higher utilization and revenue potential for SYMFI.

Pharmacoeconomic Factors Impacting the Market

The ascendancy of personalized medicine emphasizes cost-effectiveness. SYMFI's financial trajectory hinges on its pharmacoeconomic profile, including:

- Cost of goods sold (COGS): Influences profit margins.

- Pricing strategy: Premium pricing is feasible with demonstrated superior efficacy.

- Patient adherence: Simplified dosing enhances real-world effectiveness, boosting revenue.

Market Adoption and Revenue Forecasting

Based on current data, SYMFI's adoption rate is expected to follow a compound annual growth rate (CAGR) aligned with the overall therapeutic segment’s expansion. Early (pre-approval) forecasts suggest:

- Initial launch phase (Year 1-2): Focus on key geographies, regulatory approvals, and physician education. Estimated revenues could be modest but set the foundation for growth.

- Growth phase (Year 3-5): Expansion into additional markets, formulary placements, and increased clinician familiarity can propel revenues significantly.

- Mature phase (Year 5+): Market saturation, patent status, and potential biosimilar entries will impact revenue trajectory.

Analysts project that with strategic marketing and clinical validation, SYMFI could reach annual revenues in the hundreds of millions—potentially exceeding $1 billion in global sales over a decade—assuming favorable market conditions.

Financial Trajectory Outlook

The financial outlook for SYMFI integrates revenue growth with R&D, manufacturing, and marketing expenses. Key considerations include:

- Profitability timeline: Break-even expected within 3-5 years post-launch if sales targets meet projections.

- Margins: Operating margins depend on pricing, volume, and manufacturing efficiencies.

- Investment needs: Continued R&D for line extensions or combination therapies may sustain revenue streams.

- Licensing opportunities: Partnering or licensing deals could augment revenue and market penetration.

Furthermore, global health initiatives and corporate strategic realignments could influence SYMFI's financial performance, especially in emerging markets where affordability and access are critical.

Regulatory and Competitive Risks

Regulatory delays—such as unmet safety data or manufacturing issues—could postpone commercialization, affecting revenue forecasts. Competitive interference from biosimilars or new entrants can erode market share. Additionally, shifts in healthcare policy or reimbursement cuts globally may pressure pricing, impacting profit margins.

Emerging Trends and Future Outlook

- Digitization and real-world evidence: Leveraging real-world data can demonstrate SYMFI's value proposition, catalyzing uptake.

- Biologics and biosimilars: Advances in biologics may prompt the development of cheaper or more efficacious alternatives.

- Global access initiatives: Efforts to improve access in low- and middle-income countries could unlock additional markets.

In conclusion, while SYMFI shows promising growth potential, its financial trajectory will hinge on efficient regulatory navigation, market acceptance, and competitive positioning.

Key Takeaways

- Market Expansion Potential: SYMFI’s success depends on epidemiological factors and regulatory pathways, with promising upside in infectious disease markets.

- Regulatory and Pricing Strategies: Accelerated approvals and favorable reimbursement policies are vital for rapid revenue growth.

- Competitive Landscape: Patent protection and clinical differentiation will preserve margins initially, but emerging biosimilars pose long-term threats.

- Financial Outlook: Expect initial investment-heavy phases, with breakeven anticipated within 3-5 years and substantial revenue generation possible over a decade.

- Risks and Opportunities: Strategic partnerships, real-world evidence, and global access initiatives could mitigate risks and enhance SYMFI's market penetration.

FAQs

1. What therapeutic class does SYMFI belong to?

SYMFI is classified within its respective therapeutic segment—such as antivirals or specialized infectious disease drugs—targeting specific pathogens or disease mechanisms.

2. How does patent protection influence SYMFI's market trajectory?

Patent protection grants exclusive commercialization rights, enabling premium pricing and market share retention until expiry, typically driving early-stage revenues.

3. What are the primary market challenges facing SYMFI?

Key challenges include regulatory delays, competitive biosimilar entries, pricing pressures, and access disparities across global markets.

4. How significant is the impact of emerging market growth on SYMFI's revenues?

Emerging markets present substantial opportunities, fueled by increasing healthcare coverage and disease prevalence, albeit with pricing and distribution challenges.

5. What strategic actions can maximize SYMFI's financial prospects?

Robust clinical validation, strategic partnerships, flexible pricing models, and continuous innovation can enhance market share and sustain revenue growth.

References

[1] Industry reports on infectious diseases and biologics markets.

[2] Regulatory agency publications on drug approval pathways.

[3] Market research data on pharmaceutical pipeline and projections.

[4] Pharmacoeconomic studies in infectious disease treatments.

[5] Global health initiatives impacting drug access and reimbursement policies.