Last updated: July 29, 2025

Introduction

SYMFI LO (sacubitril/valsartan) is a combination drug developed by Novartis, primarily designated for the treatment of heart failure with reduced ejection fraction (HFrEF). As a novel angiotensin receptor-neprilysin inhibitor (ARNI), SYMFI LO has transformed heart failure management since its market approval, influencing both clinical outcomes and industry dynamics. This analysis explores the evolving market landscape, competitive positioning, and projected financial trajectory of SYMFI LO, providing insights for stakeholders aiming to capitalize on its growth potential.

Market Overview

1. Therapeutic Context and Unmet Needs

Heart failure remains a significant global health burden, affecting approximately 64 million people worldwide[1]. Despite advances, many patients remain inadequately managed, with high hospitalization rates and mortality. Traditional therapies—ACE inhibitors, beta-blockers, mineralocorticoid receptor antagonists—address symptoms but often fail to prevent disease progression fully.

SYMFI LO, approved in 2015 by the U.S. FDA and subsequent regulatory agencies worldwide, addresses this gap by reducing morbidity and mortality among HFrEF patients. Its dual mechanism enhances vasodilation, natriuresis, and counteracts maladaptive neurohormonal activation—factors linked to worse outcomes in heart failure.

2. Market Penetration and Adoption Dynamics

Since launch, SYMFI LO's adoption has grown steadily, driven by clinical evidence from landmark trials like PARADIGM-HF, which demonstrated a significant reduction in cardiovascular death and hospitalization[2]. The drug's positioning as a first-line therapy in guideline-recommended steps has accelerated its uptake.

However, prescribing barriers exist, including cost considerations, clinician familiarity, and the transition from established therapies. Patient tolerability and side effect profiles influence patient selection, with hypotension and renal impairment being notable concerns.

Competitive Landscape

1. Key Competitors and Differentiators

The primary competitors include traditional ACE inhibitors (e.g., enalapril), angiotensin receptor blockers (e.g., valsartan), and other novel agents like SGLT2 inhibitors (e.g., dapagliflozin, empagliflozin), which have gained approval for heart failure.

SYMFI LO distinguishes itself with superior efficacy demonstrated in prior trials, leading to its recommendation as the preferred initial therapy in guidelines[3]. Its ability to reduce hospitalization rates and mortality positions it favorably, despite higher price points.

2. Regulatory and Market Access Challenges

Pricing negotiations and healthcare payor interests influence market access. Some payors require prior authorizations, potentially delaying wide adoption. Nonetheless, cost-effectiveness analyses favor SYMFI LO, citing reduced hospitalization costs and improved quality of life.

Financial Trajectory Analysis

1. Revenue Projections

Based on current market penetration, global heart failure prevalence, and guideline-driven prescribing behaviors, SYMFI LO's revenue is projected to grow substantially over the next decade.

Short-term (1-3 years):

- Initial growth phase with expanding adoption in North America and Europe.

- Estimated revenues of $3-$5 billion annually by 2025, assuming continued expanding penetration and reimbursement agreements.

Medium- to Long-term (3-10 years):

- Market saturation in core territories.

- Potential expansion into less-treated populations and indications (e.g., HF with preserved ejection fraction, pending regulatory approvals).

- Revenue growth could plateau or accelerate with new formulations or combination therapies, potentially reaching $8-$12 billion annually by 2030.

2. Key Revenue Drivers

- Clinical guidelines endorsement: Reinforces prescribing patterns.

- Pricing strategies: Premium positioning due to efficacy advantages.

- Market access policies: Reimbursement coverage expanding globally.

- Patient awareness: Increased education leading to higher uptake.

3. Revenue Risks and Challenges

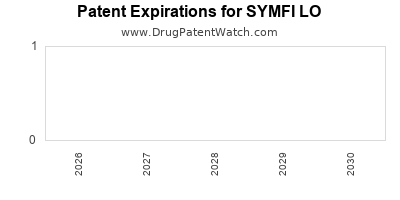

- Generic competition: Pending patents and biosimilar entry could erode pricing and market share.

- Regulatory hurdles: Additional approvals or restrictions could limit growth.

- Clinical trial data: Emerging data might influence competitor dynamics.

- Market saturation: Slower adoption in some regions due to healthcare infrastructure limitations.

Market Expansion Opportunities

1. Geographic Penetration

Emerging markets represent substantial growth opportunities, given rising cardiovascular disease prevalence and expanding healthcare access. Customization of pricing and partnerships with local payors will be critical.

2. Indication Expansion

FDA and EMA evaluations for broader indications (e.g., HFpEF) could unlock new patient populations, fueling additional revenues.

3. Combination Therapies and Line Extensions

Developing fixed-dose combinations with other heart failure agents or novel formulations—such as sustained-release tablets—may improve adherence and expand market share.

Conclusion

SYMFI LO stands at the forefront of heart failure therapeutics, with a trajectory driven by robust clinical efficacy and evolving guideline endorsements. While challenges such as pricing pressures and market penetration hurdles persist, the drug’s innovative mechanism and proven benefits position it for sustained growth. Strategic expansion into emerging markets and indication expansion remain vital for maximizing its financial potential over the coming decade.

Key Takeaways

- Market dominance: SYMFI LO's clinical advantages position it as the preferred therapy for HFrEF, with significant upside in adoption rates.

- Revenue growth foreseen: Estimated to reach up to $12 billion annually by 2030, contingent on market expansion and competitive dynamics.

- Barriers to growth: Patent life, biosimilar entry, and healthcare system challenges could temper revenue acceleration.

- Expansion opportunities: New indications and geographies offer substantial growth avenues.

- Strategic focus: Collaborations for patient access, real-world data generation, and optimizing formulary access are critical for long-term success.

FAQs

1. What has driven the rapid adoption of SYMFI LO globally?

The landmark PARADIGM-HF trial demonstrated significant mortality and hospitalization reductions, leading to guideline endorsements favoring SYMFI LO as first-line therapy, which accelerated its adoption.

2. How does SYMFI LO compare financially to traditional heart failure treatments?

While priced higher than ACE inhibitors or ARBs, its cost-effectiveness is supported by reduced hospitalization and mortality, translating into long-term healthcare savings.

3. What are the main barriers to market expansion for SYMFI LO?

Pricing negotiations, reimbursement hurdles, clinician familiarity, and regulatory delays pose significant barriers, especially in emerging markets.

4. Are there any upcoming regulatory decisions that could impact SYMFI LO's market trajectory?

Potential label expansions to include additional heart failure populations and new indications could further boost revenues, contingent on positive trial outcomes and regulatory approval.

5. How can Novartis sustain SYMFI LO's growth in the face of biosimilar competition?

Innovative formulations, expanding indications, digital health integration, and improving patient adherence strategies will be crucial for maintaining competitive advantage.

Sources

[1] Ponikowski P, et al. ESC Guidelines for the diagnosis and treatment of acute and chronic heart failure. Eur Heart J. 2016.

[2] McMurray JJ, et al. Angiotensin–Neprilysin inhibition versus enalapril in heart failure. N Engl J Med. 2014.

[3] Yancy CW, et al. 2022 AHA/ACC/HFSA guideline for the management of heart failure. J Am Coll Cardiol. 2022.