SYFOVRE Drug Patent Profile

✉ Email this page to a colleague

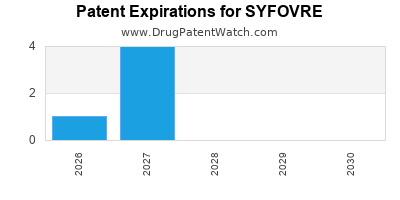

When do Syfovre patents expire, and when can generic versions of Syfovre launch?

Syfovre is a drug marketed by Apellis Pharms and is included in one NDA. There are twelve patents protecting this drug.

This drug has two hundred patent family members in thirty countries.

The generic ingredient in SYFOVRE is pegcetacoplan. One supplier is listed for this compound. Additional details are available on the pegcetacoplan profile page.

DrugPatentWatch® Generic Entry Outlook for Syfovre

Syfovre was eligible for patent challenges on May 14, 2025.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be November 15, 2033. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for SYFOVRE?

- What are the global sales for SYFOVRE?

- What is Average Wholesale Price for SYFOVRE?

Summary for SYFOVRE

| International Patents: | 200 |

| US Patents: | 12 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Clinical Trials: | 4 |

| Drug Prices: | Drug price information for SYFOVRE |

| What excipients (inactive ingredients) are in SYFOVRE? | SYFOVRE excipients list |

| DailyMed Link: | SYFOVRE at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for SYFOVRE

Generic Entry Date for SYFOVRE*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

SOLUTION;INTRAVITREAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for SYFOVRE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Apellis Pharmaceuticals, Inc. | PHASE3 |

| AbbVie | PHASE1 |

| Hoffmann-La Roche | PHASE1 |

Pharmacology for SYFOVRE

| Drug Class | Complement Inhibitor |

| Mechanism of Action | Complement Inhibitors |

US Patents and Regulatory Information for SYFOVRE

SYFOVRE is protected by fifteen US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of SYFOVRE is ⤷ Get Started Free.

This potential generic entry date is based on patent 10,035,822.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Apellis Pharms | SYFOVRE | pegcetacoplan | SOLUTION;INTRAVITREAL | 217171-001 | Feb 17, 2023 | RX | Yes | Yes | 11,292,815 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Apellis Pharms | SYFOVRE | pegcetacoplan | SOLUTION;INTRAVITREAL | 217171-001 | Feb 17, 2023 | RX | Yes | Yes | 11,903,994 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Apellis Pharms | SYFOVRE | pegcetacoplan | SOLUTION;INTRAVITREAL | 217171-001 | Feb 17, 2023 | RX | Yes | Yes | 9,056,076 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Apellis Pharms | SYFOVRE | pegcetacoplan | SOLUTION;INTRAVITREAL | 217171-001 | Feb 17, 2023 | RX | Yes | Yes | 7,989,589 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for SYFOVRE

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Swedish Orphan Biovitrum AB (publ) | Aspaveli | pegcetacoplan | EMEA/H/C/005553Aspaveli is indicated in the treatment of adult patients with paroxysmal nocturnal haemoglobinuria (PNH) who are anaemic after treatment with a C5 inhibitor for at least 3 months. | Authorised | no | no | yes | 2021-12-13 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for SYFOVRE

When does loss-of-exclusivity occur for SYFOVRE?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 13344462

Estimated Expiration: ⤷ Get Started Free

Patent: 18247243

Estimated Expiration: ⤷ Get Started Free

Patent: 20260435

Estimated Expiration: ⤷ Get Started Free

Patent: 23200929

Estimated Expiration: ⤷ Get Started Free

Patent: 25201748

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2015011244

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 91673

Estimated Expiration: ⤷ Get Started Free

China

Patent: 5051057

Estimated Expiration: ⤷ Get Started Free

Patent: 0882376

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0211342

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 24474

Estimated Expiration: ⤷ Get Started Free

Patent: 22015

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 20201

Estimated Expiration: ⤷ Get Started Free

Patent: 60033

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 20201

Estimated Expiration: ⤷ Get Started Free

Patent: 60033

Estimated Expiration: ⤷ Get Started Free

Patent: 29206

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1025

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 15445

Estimated Expiration: ⤷ Get Started Free

Patent: 17336

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 55564

Estimated Expiration: ⤷ Get Started Free

Patent: 200026

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6004

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 73167

Estimated Expiration: ⤷ Get Started Free

Patent: 93871

Estimated Expiration: ⤷ Get Started Free

Patent: 41271

Estimated Expiration: ⤷ Get Started Free

Patent: 16505527

Estimated Expiration: ⤷ Get Started Free

Patent: 19070011

Estimated Expiration: ⤷ Get Started Free

Patent: 21107441

Estimated Expiration: ⤷ Get Started Free

Patent: 22120193

Estimated Expiration: ⤷ Get Started Free

Patent: 24056923

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 660033

Estimated Expiration: ⤷ Get Started Free

Patent: 2022010

Estimated Expiration: ⤷ Get Started Free

Patent: 60033

Estimated Expiration: ⤷ Get Started Free

Luxembourg

Patent: 0265

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 6404

Estimated Expiration: ⤷ Get Started Free

Patent: 3350

Estimated Expiration: ⤷ Get Started Free

Patent: 15006154

Estimated Expiration: ⤷ Get Started Free

Patent: 19007709

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 1178

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 22017

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 20201

Estimated Expiration: ⤷ Get Started Free

Patent: 60033

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 20201

Estimated Expiration: ⤷ Get Started Free

Patent: 60033

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 05215

Estimated Expiration: ⤷ Get Started Free

Patent: 15119165

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 02100514

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 243

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 60033

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 80674

Estimated Expiration: ⤷ Get Started Free

Patent: 79430

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering SYFOVRE around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Cyprus | 1113441 | ⤷ Get Started Free | |

| World Intellectual Property Organization (WIPO) | 2014078734 | ⤷ Get Started Free | |

| China | 103505718 | ⤷ Get Started Free | |

| Israel | 304291 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for SYFOVRE

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 3660033 | 301178 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: PEGCETACOPLAN; REGISTRATION NO/DATE: EU/1/21/1595 20211214 |

| 3660033 | 2290021-1 | Sweden | ⤷ Get Started Free | RAETTAD SKYDDSTID FOER TILLAEGGSSKYDD'; DEN 2025-03-07 MEDDELADE PRV BESLUT OM RAETTAD SKYDDSTID FOER FOELJANDE TILLAEGGSSKYDD. SKYDDSTIDEN FOER SAMTLIGA DESSA TILLAEGGSSKYDD AER FOERLAENGD MED EN DAG, I ENLIGHET MED PATENT- OCH MARKNADSDOMSTOLENS BESLUT I PMAE 7804-24. DEN BESLUTADE SKYDDSTIDEN FRAMGAR AV SVENSK PATENTDATABAS. |

| 3660033 | CA 2022 00023 | Denmark | ⤷ Get Started Free | PRODUCT NAME: PEGCETACOPLAN; REG. NO/DATE: EU/1/21/1595 20211214 |

| 3660033 | CR 2022 00023 | Denmark | ⤷ Get Started Free | PRODUCT NAME: PEGCETACOPLAN; REG. NO/DATE: EU/1/21/1595 20211214 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for SYFOVRE

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.