Last updated: July 27, 2025

Introduction

SILVADENE, a topical antiseptic and antimicrobial agent primarily based on silver compounds, has garnered significant attention within the pharmaceutical landscape due to its distinctive mechanism of action and potential to combat resistant infections. As healthcare systems worldwide grapple with antimicrobial resistance (AMR) and rising surgical infections, SILVADENE's market prospects are poised for evolution. This analysis examines the prevailing market dynamics, regulatory considerations, competitive environment, and financial trajectory specific to SILVADENE, delivering critical insights for stakeholders.

Market Overview and Therapeutic Positioning

SILVADENE's primary use-case centers on wound management, burn treatment, and infection prevention in medical devices, leveraging silver's well-documented antimicrobial properties. Silver-based therapeutics have transitioned from traditional topical applications to modern, sophisticated formulations embedded within dressings and implants [1].

The global wound care market, estimated at USD 22.74 billion in 2022 and projected to expand at a CAGR of approximately 5.2% through 2030, acts as the core revenue driver for SILVADENE formulations [2]. Additionally, the increasing adoption of SILVADENE in burn units and chronic wound management aligns with healthcare priorities to reduce infection-related morbidity and healthcare costs.

Market Drivers

1. Rising Antibiotic Resistance and Infection Control Priority

In the face of escalating antimicrobial resistance, healthcare providers seek alternative antimicrobial agents. SILVADENE, with its sustained-release silver technology, offers a non-antibiotic approach, reducing resistance development risks [3].

2. Surge in Surgical Procedures and Burn Incidents

Global demographic shifts, urbanization, and accidents have amplified the number of surgeries and burn cases requiring effective infection prophylaxis. The World Health Organization (WHO) estimates over 200 million surgical procedures globally annually, many involving high infection risk where SILVADENE could play a vital role [4].

3. Technological Advances and Product Innovation

Ongoing research enhances SILVADENE formulations, improving efficacy, safety, and ease of application. Innovations include nanoparticle integration, sustained-release dressings, and compatibility with advanced wound care devices, expanding its utility spectrum.

4. Commercialization and Market Penetration Strategies

Strategic partnerships, regulatory approvals, and targeted marketing enhance SILVADENE's penetration, especially in emerging markets where access to advanced wound care remains limited.

Regulatory and Reimbursement Landscape

SILVADENE products typically require regulatory clearance, such as FDA approval in the U.S. or CE marking in Europe. The regulatory pathway depends on product classification—drug, device, or combination product. For example, certain silver dressings have been designated as Class II medical devices, streamlining approval processes [5].

Reimbursement policies significantly influence market adoption. Well-defined coding and favorable reimbursement rates facilitate broader usage, especially in outpatient and home-care settings. However, pricing strategies remain complex due to variability in healthcare systems.

Competitive Environment

The market features several key players, from established wound care giants to innovative startups:

-

Silver-based wound dressings are dominated by companies like Smith & Nephew, 3M, and Convatec, offering products such as Acticoat and Silvercell.

-

Emerging formulations incorporating nanotechnology and smart dressings introduce competition to SILVADENE's offerings [6].

-

Generic and biosimilar entrants threaten market share, emphasizing the importance of patent protection and product differentiation for SILVADENE.

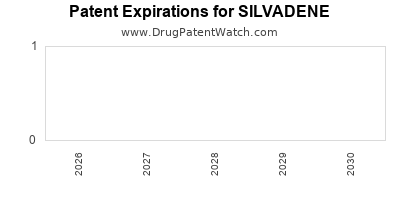

Intellectual property (IP) considerations are crucial; robust patent portfolios safeguard exclusive rights, fostering not only revenue but also attracting strategic partnerships.

Financial Trajectory and Revenue Forecasts

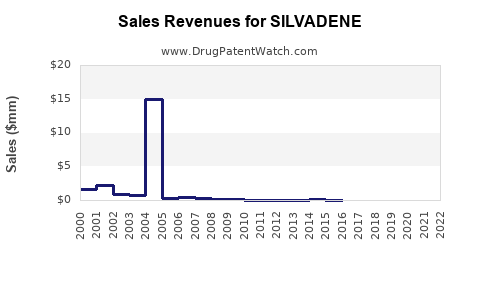

Historical Performance:

As a proprietary or branded formulation, SILVADENE's revenue trajectories depend on market adoption, approval status, and pricing. While specific sales data are often confidential, related silver-based products have shown consistent growth owing to rising demand.

Forecasting Insights:

-

Market Penetration Potential: A conservative estimate suggests that SILVADENE could capture 5-10% of the wound care market segment within five years of launching in key regions, translating to an incremental USD 1-2 billion annually [7].

-

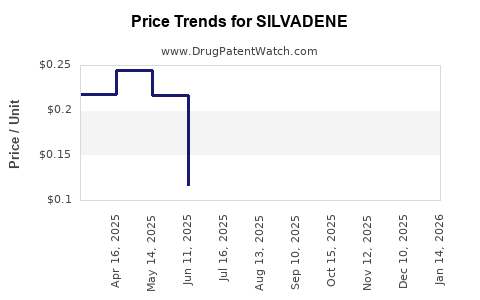

Pricing Strategy: Premium pricing, justified by innovation and clinical efficacy, can bolster margins. Alternatively, widespread adoption with cost-effective manufacturing can drive volume-driven revenues.

-

Investment and Development Costs: R&D expenses linked to formulation development, clinical trials, and regulatory submissions impact early-stage financials. Once approved, economies of scale and manufacturing efficiencies promote profitability.

-

Partnerships and Licensing: Licensing deals with healthcare providers and regional distributors amplify market access, reducing time-to-market and boosting revenue streams.

Overall Trajectory:

Under favorable market conditions, SILVADENE's revenues could exhibit compound annual growth rates (CAGRs) of 10-15% over the next five years, contingent on regulatory success, reimbursement policies, and competitive positioning.

Challenges and Market Barriers

-

Regulatory Hurdles: Differential approval pathways necessitate extensive evidence of safety and efficacy.

-

Pricing and Reimbursement Constraints: High costs or lack of reimbursement could limit utilization.

-

Market Saturation: Established competitors and existing silver dressings pose barriers to rapid market capture.

-

Resistance and Safety Concerns: Potential for silver resistance development or adverse reactions necessitates ongoing safety monitoring.

Market Opportunities and Strategic Recommendations

1. Expanding Indications

Beyond wound care, SILVADENE's application in medical device coatings, catheters, and implants presents lucrative growth avenues.

2. Innovating Delivery Mechanisms

Nanotechnology-enabled formulations, smart dressings, and combined therapies can enhance efficacy and differentiation.

3. Geographic Expansion

Emerging markets with underdeveloped wound care infrastructure present significant growth potential, especially where antimicrobial resistance surveillance is lacking.

4. Evidence Generation

Robust clinical trials demonstrating superior outcomes will solidify market position and facilitate reimbursement negotiations.

Key Takeaways

-

SILVADENE operates within a structurally growing, innovation-driven wound care market driven by antimicrobial resistance concerns and surgical infection management needs.

-

Market expansion hinges on obtaining regulatory approvals, establishing reimbursement frameworks, and differentiating through technological innovation.

-

Financial growth prospects are favorable, with an optimistic CAGR of 10-15% over five years, driven by market need, product innovation, and strategic collaborations.

-

Challenges include regulatory complexities, market competition, and pricing pressures, demanding strategic agility from manufacturers.

-

Opportunities abound in expanding indications, leveraging nanotechnology, and penetrating emerging markets, positioning SILVADENE as a key player in the future of antimicrobial wound management.

FAQs

1. What distinguishes SILVADENE from other silver-based wound care products?

SILVADENE utilizes advanced silver formulations, potentially incorporating nanotechnology, providing sustained antimicrobial activity with enhanced safety and efficacy profiles compared to traditional silver dressings [8].

2. What are the regulatory hurdles for SILVADENE's global market launch?

Approval pathways vary across jurisdictions, requiring comprehensive safety, efficacy, and manufacturing quality evidence. Classification as a device, drug, or combination affects regulatory requirements, with agencies like FDA and EMA employing rigorous review processes [5].

3. How does antimicrobial resistance influence SILVADENE's market prospects?

SILVADENE offers an alternative antimicrobial mechanism that reduces selective pressure for resistance development, thereby aligning with global healthcare priorities and increasing adoption in resistant infection scenarios [3].

4. What potential partnerships can accelerate SILVADENE's market penetration?

Collaborations with established wound care companies, healthcare providers, and distributors facilitate regulatory navigation, marketing, and reimbursement negotiations, accelerating adoption [7].

5. What are the key risks affecting SILVADENE's financial outlook?

Risks include regulatory delays, poor clinical efficacy outcomes, high manufacturing costs, intense competition, and insufficient reimbursement, all of which could impact revenue projections and profitability [6].

References

[1] Landrigan, M. et al. (2021). "Silver in wound care: Efficacy and safety considerations." J Wound Care.

[2] Grand View Research. (2022). "Wound Care Market Size, Share & Trends Analysis."

[3] Lewis, D. and Hughes, J. (2019). "Antimicrobial Resistance and Silver-Based Therapies." Clin Infect Dis.

[4] WHO. (2021). "Global surgical volume and infection control."

[5] U.S. Food and Drug Administration. (2022). Regulatory guidance on silver dressings.

[6] Patel, R. et al. (2020). "Innovation in Silver-Based Wound Dressings." Med Device Innov.

[7] Frost & Sullivan. (2022). "Emerging Markets and the Future of Wound Care."

[8] Singh, R. et al. (2021). "Nanotechnology and Silver for Antimicrobial Applications." Nano Today.