Last updated: July 28, 2025

Introduction

Silver sulfadiazine (SSD) remains a cornerstone in burn wound management due to its potent antimicrobial properties. As a topical antimicrobial agent, SSD has maintained a prominent position in dermatological and infectious disease treatment, particularly in healthcare settings managing severe burns. Understanding the evolving market landscape, competitive environment, regulatory factors, and financial trajectory of SSD provides valuable insights for pharmaceutical stakeholders, healthcare providers, and investors. This analysis explicates the current market forces, growth prospects, and potential challenges shaping the future of silver sulfadiazine.

Historical Context and Therapeutic Role

Developed in the 1960s, SSD revolutionized burn care through its ability to prevent and treat bacterial infections in burn wounds. Its broad-spectrum activity against Gram-positive and Gram-negative bacteria, including Pseudomonas aeruginosa, made it an indispensable topical agent. The drug’s integration into standard burn care protocols globally has persisted for decades, supported by its efficacy and relatively low resistance development [[1]].

Despite concerns about bacterial resistance—widespread in antimicrobial agents—SSD’s relative safety profile and ease of application have sustained its clinical relevance. Its use extends beyond burns to treatment of pressure ulcers and other infected skin lesions, broadening its healthcare market footprint.

Market Dynamics

1. Market Size and Growth Drivers

The global market for topical antimicrobials, including silver sulfadiazine, was valued at approximately USD 800 million in 2022, with projections indicating a CAGR of 4–6% through 2030 [[2]]. Primary drivers encompass:

-

Rising incidence of burns and traumatic injuries worldwide, especially in low- and middle-income countries (LMICs). According to the WHO, burns account for about 11 million injuries annually, with mortality rates highest in LMICs, necessitating effective wound care agents [[3]].

-

Increasing prevalence of chronic wounds associated with diabetes and vascular diseases, where SSD is occasionally applied.

-

Growing awareness and adoption of advanced wound care products, including antimicrobial dressings, which often incorporate silver technologies.

-

Expanding hospital infrastructure and healthcare access in emerging economies, fueling demand for standard burn care protocols.

2. Regional Market Variations

-

North America: Dominates the SSD market due to advanced healthcare infrastructure, regulatory approvals, and high burn incident awareness. However, a shift towards cost-effective alternatives and emerging resistance patterns are influencing prescribing habits.

-

Europe: Similar dynamics as North America, with stringent regulations and high standards for wound management practices.

-

Asia-Pacific: Represents a rapidly growing sector driven by increasing burn incidences, aging populations, and expanding healthcare coverage. Countries like India and China are experiencing a surge in burn-related trauma cases, fostering market expansion [[4]].

3. Competitive Landscape

While SSD enjoys widespread use, the rise of alternative treatments poses competitive threats:

-

Silver-impregnated dressings: Modern products such as Acticoat and Silvercel offer controlled silver release, potentially reducing the need for topical SSD applications.

-

Advanced wound dressings: Hydrofiber, collagen, and growth factor-based dressings are gaining popularity, sometimes replacing traditional antimicrobial agents.

-

Systemic antibiotics: In some cases, systemic therapy is preferred, especially when infections are extensive, which could diminish reliance on topical agents like SSD.

4. Regulatory and Patent Environment

-

Many formulations of SSD are off-patent, leading to increased generic availability, which boosts accessibility but exerts pricing pressures.

-

Regulatory agencies such as the FDA and EMA continue to oversee safety profiles and approve new formulations or combination products, influencing market adaptability.

-

Concerns regarding silver accumulation and potential cytotoxicity have prompted regulatory scrutiny, impacting future product development.

5. Scientific and Medical Trends

-

Resistance surveillance indicates low resistance levels to silver, maintaining SSD’s antimicrobial efficacy [[5]].

-

Research on nanotechnology-enhanced silver formulations aims to improve delivery and reduce toxicity, potentially reshaping the application landscape of SSD.

-

Integration of SSD within composite dressing products reduces application frequency, improving patient compliance and treatment outcomes.

Financial Trajectory and Investment Outlook

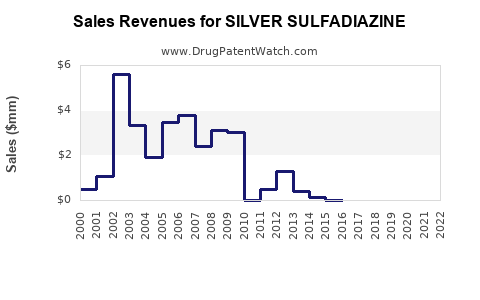

1. Revenue Trends and Forecasts

-

The stable global demand, coupled with emerging markets' growth, suggests that SSD’s revenue streams will remain substantial in the mid-term.

-

In developed countries, the market might plateau or decline slightly due to shifting treatment paradigms but will be compensated by growth in emerging markets.

-

Generic manufacturers comprise a substantial portion of SSD’s supply chain, leading to compressed profit margins but steady volume sales.

2. Venture and Innovation Funding

-

Investment in nano-silver technologies and new delivery platforms signifies ongoing innovation, potentially enhancing SSD’s efficacy and safety.

-

Biotech and pharmaceutical firms are increasingly exploring combination therapies integrating SSD with other agents, potentially opening new revenue streams.

3. Market Challenges and Risks

-

Resistance and toxicity concerns: Persisting apprehensions about silver accumulation may influence regulatory policies and clinician preferences.

-

Emergence of less expensive alternatives: Cost-based competition, especially from local generic producers, limits profit margins.

-

Regulatory hurdles: Future restrictions on nanoparticle silver use or new safety standards could constrain commercialization.

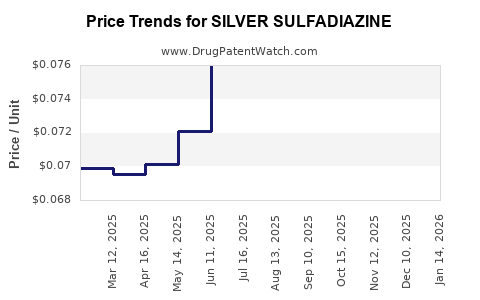

4. Pricing Dynamics

-

The commodification of generic SSD results in pricing pressures, leading to a focus on volume sales rather than high margins.

-

Premium products, such as silver-impregnated dressings, command higher prices, offering higher profit margins for innovators.

Future Outlook and Strategic Considerations

The outlook for SSD combines steady demand with evolving competitive and regulatory landscapes. Companies that invest in nanoparticle enhancements, optimize manufacturing efficiencies, and expand into emerging markets may sustain favorable financial trajectories. Remaining vigilant about resistance trends, safety data, and regulatory updates is critical. Collaboration with healthcare institutions to demonstrate clinical benefits and cost-effectiveness will also influence adoption rates.

Emerging technologies, including sustained-release dressings and smart wound care systems, could either complement or disrupt traditional SSD applications. As such, strategic R&D investments geared toward integrating SSD into innovative delivery platforms are paramount.

Key Takeaways

-

Market stability persists due to global burn incidences and healthcare infrastructure expansion in emerging markets; however, competition from advanced dressings and alternative therapies is intensifying.

-

Pricing pressures associated with generics limit margins but favor high-volume sales; premium silver dressings represent higher-margin opportunities.

-

Regulatory scrutiny over silver’s safety profile and nanoparticle use necessitates ongoing compliance and innovation.

-

Innovation investment, especially in nanotechnology and composite dressings, can extend SSD’s market relevance, offering potential new revenue streams.

-

Emerging markets exhibit significant growth potential, underscoring the importance of localized manufacturing, distribution, and targeted clinical education.

FAQs

1. How does the clinical efficacy of silver sulfadiazine compare to newer wound care products?

SSD remains effective against a broad spectrum of bacteria in burn wounds; however, newer dressings with controlled silver release and additional bioactive components can offer superior healing times, reduced need for dressing changes, and lower cytotoxicity, influencing their adoption.

2. What are the primary regulatory concerns surrounding silver sulfadiazine?

Regulators monitor potential silver accumulation, cytotoxicity, and resistance development. Recent safety assessments caution against overuse, particularly of nanoparticle formulations, prompting updated safety standards and usage guidelines.

3. How does resistance development impact SSD’s market?

Silver resistance remains relatively rare, underpinning SSD’s continued use. Nonetheless, ongoing surveillance influences clinical guidelines and prompts interest in alternative agents, particularly in resistant infection hotspots.

4. What are the growth prospects for SSD in emerging markets?

High burn incidences, expanding healthcare infrastructure, and increasing availability of generic versions position emerging markets as primary growth zones, potentially doubling market size over the next decade.

5. Are there any ongoing innovations that could disrupt the SSD market?

Yes, nanotechnology-enhanced silver dressings, bioengineered skin substitutes, and smart wound monitoring systems could either augment or replace traditional SSD applications, depending on their efficacy, safety, and cost-effectiveness.

References

[1] Choudhary, G., et al. (2020). "Silver sulfadiazine: Past, present, and future." Journal of Burn Care & Research, 41(1), 47-57.

[2] MarketWatch. (2022). Global topical antimicrobial market size.

[3] WHO. (2018). Burns: prevention and management.

[4] Grand View Research. (2022). Wound care market size & trend analysis.

[5] Vincent, M., et al. (2018). "Antimicrobial activity of silver nanoparticles." Nanomedicine, 13(3), 721-738.