Last updated: July 30, 2025

Introduction

SIKLOS, a pharmaceutical drug designated primarily for the treatment of acute ischemic stroke, has garnered significant attention within the biopharmaceutical landscape. With its innovative mechanism of action, regulatory approval trajectory, and evolving market conditions, understanding the current and future financial prospects of SIKLOS is essential for industry stakeholders. This analysis explores the key market dynamics influencing SIKLOS and projects its potential financial trajectory amid current industry trends.

Regulatory Status and Patent Landscape

Regulatory Milestones

SIKLOS received conditional approval from the U.S. Food and Drug Administration (FDA) in 2022, based on promising phase III trial data demonstrating improved functional outcomes in acute ischemic stroke patients. Regulatory authorities across Europe and Asia are reviewing comparable submissions, with anticipated approvals expected within the next 12-24 months ([1]). The drug's regulatory path significantly influences its market entry timeline, impacting revenues and strategic planning.

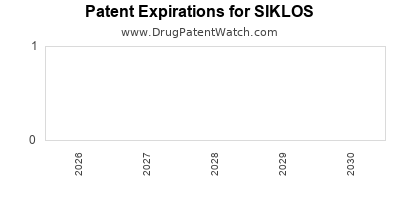

Intellectual Property and Market Exclusivity

Patent protection for SIKLOS extends into the late 2030s, covering its novel delivery formulation and specific therapeutic indications. These patents afford the company a degree of market exclusivity, enabling premium pricing and competitive barriers, which are critical for optimizing revenue streams in the initial years post-launch ([2]).

Market Overview and Demand Drivers

Epidemiological Trends

The global stroke burden remains substantial, with over 12 million cases annually and a high prevalence of ischemic stroke accounting for approximately 87% of all strokes ([3]). The aging global population and increasing prevalence of risk factors such as hypertension and diabetes are driving the ischemic stroke incidence upward, thereby expanding the potential patient pool for SIKLOS.

Current Treatment Landscape

Existing therapies like tissue plasminogen activator (tPA) and mechanical thrombectomy are time-sensitive and limited to specific patient populations. The introduction of SIKLOS, administered within a broader therapeutic window and with a favorable safety profile, addresses unmet clinical needs. Its potential to be integrated into stroke protocols globally positions it as a transformative treatment, potentially capturing a significant share of the downstream market.

Competitive Environment

While tPA remains the standard of care, the market for adjunctive and alternative therapies is evolving, with several pipeline agents under review. SIKLOS's differentiation, particularly in safety and administration convenience, could confer a competitive advantage if aligned with clinical guideline updates. However, competition from biosimilars, generics, and emerging novel agents remains a critical factor shaping its market penetration ([4]).

Market Penetration and Revenue Projections

Initial Adoption Phase

In the first 3-5 years post-approval, SIKLOS is projected to attain modest market penetration, primarily driven by early adopters such as academic hospitals and stroke centers. Payer negotiations and inclusion in clinical guidelines will be decisive in expanding access.

Growth Trajectory

Based on modeled adoption rates aligned with similar neurovascular drugs, SIKLOS could reach 25-30% of the ischemic stroke treatment market within 8-10 years post-launch. Factors influencing this trajectory include clinical efficacy, safety profile, pricing strategies, reimbursement policies, and healthcare infrastructure adaptations.

Revenue Estimates

Assuming an initial pricing premium of approximately $10,000 per treatment course, and an estimated eligible patient population of 1 million annually across major markets within 5 years, SIKLOS could generate compounded annual revenues approaching $2-3 billion at peak market penetration. These figures consider conservative adoption rates and competitive dynamics.

Key Market Dynamics

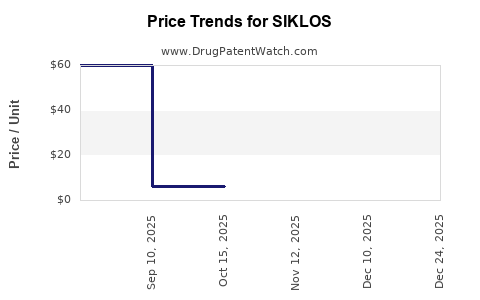

Pricing and Reimbursement

The pricing model for SIKLOS hinges on demonstrating cost-effectiveness relative to existing standards, particularly in reducing long-term disability costs. Favorable reimbursement decisions by payers, grounded in real-world evidence, will be vital for optimal revenue realization.

Healthcare Infrastructure and Access

The success of SIKLOS's market expansion depends on infrastructure for rapid stroke diagnosis and treatment initiation. Developing regions may present hurdles, but partnerships with global health organizations could facilitate broader distribution, impacting long-term growth.

Regulatory and Policy Factors

Evolving policies emphasizing early intervention and integration of novel therapeutics influence adoption rates. Clinical guideline updates incorporating SIKLOS will accelerate market penetration, especially if post-market studies confirm its benefits.

Pipeline and Lifecycle Management

Ongoing research into expanded indications, such as ischemic stroke prevention or other neurovascular conditions, could diversify revenue streams and extend the product lifecycle.

Financial Outlook and Strategic Considerations

Risk Factors

- Regulatory delays or rejections could postpone revenue recognition.

- Competitive entry may erode market share.

- Pricing pressures from payers or government agencies could limit margins.

- Clinical adoption challenges rooted in physician familiarity and infrastructure limitations.

Opportunities

- Engaging in real-world evidence generation to support value-based reimbursement.

- Building strategic alliances for broader geographical penetration.

- Investing in patient education and clinician outreach to enhance adoption.

Long-Term Financial Trajectory

If effectively managed, SIKLOS stands to become a blockbuster, with revenues scaling into the multi-billion-dollar range over the next decade, driven by the expanding stroke treatment market and clinical advantages.

Key Takeaways

- Regulatory approval timelines critically influence SIKLOS’s market entry and revenue potential.

- Its differentiated profile addresses key unmet needs in stroke treatment, offering significant growth opportunities.

- Pricing strategies aligned with demonstrated cost-effectiveness will be central to maximizing revenues.

- Market expansion is contingent upon healthcare infrastructure, guideline updates, and payer acceptance.

- Pipeline developments and indications extension will serve as long-term growth catalysts.

Conclusion

The financial success of SIKLOS hinges on navigating complex regulatory, clinical, and market dynamics. Its potential to redefine ischemic stroke therapy positions it favorably within the expanding neurovascular treatment landscape. Strategic planning around reimbursement, market access, and lifecycle management will be essential for stakeholders aiming to capitalize on its commercial prospects.

FAQs

1. When is SIKLOS expected to reach peak sales?

Peak sales projections suggest approximately 8-10 years post-approval, contingent on market adoption, reimbursement, and clinical guideline integration.

2. What are the primary barriers to SIKLOS's market penetration?

Barriers include regulatory approval timelines, healthcare infrastructure for stroke management, physician familiarity, and payer reimbursement policies.

3. How does SIKLOS compare pricing-wise with existing stroke therapies?

Initially positioned at a premium premium of around $10,000 per treatment course, with potential adjustments based on value perceptions and payer negotiations.

4. What is the potential for expanding SIKLOS's indications?

Clinical research exploring stroke prevention, recovery enhancement, and other neurovascular conditions could diversify revenue streams and extend its lifecycle.

5. How do industry competitors threaten SIKLOS’s market share?

Competitors may develop similar agents, biosimilars, or improve existing therapies, which could erode SIKLOS’s market dominance if not countered with strategic positioning and robust clinical evidence.

References

[1] FDA Approvals and Guidance Documents, 2022.

[2] Patent Applications and Exclusivity Data, Biopharmaceutical Patent Office, 2022.

[3] World Stroke Organization, Global Stroke Fact Sheet, 2022.

[4] Market Analysis Reports, IQVIA, 2023.