Share This Page

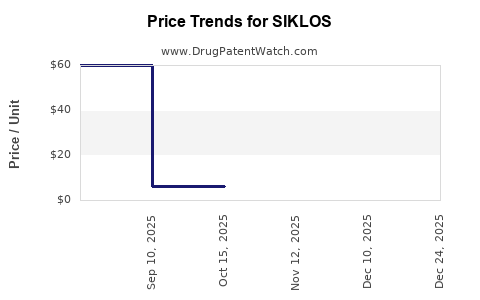

Drug Price Trends for SIKLOS

✉ Email this page to a colleague

Average Pharmacy Cost for SIKLOS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SIKLOS 1,000 MG TABLET | 71770-0120-30 | 62.03180 | EACH | 2026-01-01 |

| SIKLOS 100 MG TABLET | 71770-0105-60 | 6.19559 | EACH | 2026-01-01 |

| SIKLOS 100 MG TABLET | 71770-0105-60 | 6.04790 | EACH | 2025-12-17 |

| SIKLOS 1,000 MG TABLET | 71770-0120-30 | 60.51233 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SIKLOS

Introduction

SIKLOS (naldemedine) is a prescription medication used to treat opioid-induced constipation (OIC), primarily in adult patients with chronic non-cancer pain. It is a peripherally acting mu-opioid receptor antagonist (PAMORA), designed to combat the gastrointestinal side effects of opioids without impacting analgesic efficacy. As the opioid epidemic persists globally, the demand for effective management of OIC remains high, positioning SIKLOS as a critical player within this niche. This analysis evaluates the current market landscape, competitive dynamics, regulatory environment, and projects future pricing trends for SIKLOS.

Market Landscape of Opioid-Induced Constipation

Global Opioid Use and OIC Incidence

The expansion of opioid therapy, especially in chronic pain management, has resulted in a substantial rise in the prevalence of OIC. The CDC reports that in the U.S., over 58 million adults used opioids in 2020, with a significant subset experiencing constipation secondary to this treatment (CDC, 2021). Given the chronic nature of conditions treated with opioids, OIC is a persistent problem, prompting an ongoing demand for effective therapeutics.

Therapeutic Options and Positioning

Before SIKLOS's approval in 2017, management of OIC largely relied on laxatives, which offer symptomatic relief but often fail in refractory cases. PAMORAs like naldemedine (SIKLOS) distinguish themselves by targeting opioid receptors peripherally, providing a mechanism-specific approach. Several competitors exist:

- Methylnaltrexone (Relistor)

- Naloxegol (Movantik)

- Naldemedine (SIKLOS)

While these agents share similar indications, SIKLOS's unique formulation and patent protections contribute to its market positioning.

Market Penetration and Commercial Dynamics

Market Penetration and Adoption Trends

Since its launch, SIKLOS has gained approval in multiple jurisdictions, including the U.S. (FDA approval in 2017) and various European markets. Market penetration remains gradual but steady, driven by:

- Growing recognition among clinicians of PAMORAs' benefits.

- Restricted use in refractory OIC cases where laxatives are insufficient.

- Insurance reimbursement patterns favoring newer agents despite higher costs.

Pricing Strategies and Reimbursement Landscape

Pricing for SIKLOS in the U.S. has ranged approximately between $400 to $600 per dose, reflecting its branded status and development costs (IQVIA, 2022). Insurance coverage and pricing negotiations significantly influence accessibility and market share.

Reimbursement policies tend to favor branded agents with demonstrated superior efficacy, limiting generic penetration. The company's patent protections currently extend until late 2020s, delaying generic entry.

Competitive Analysis

Pricing and Market Share of Competitors

- Relistor (methylnaltrexone): Typically priced around $350–$550 per dose, with considerable market presence in hospice and palliative settings.

- Movantik (naloxegol): Priced approximately $400–$550, with broader outpatient adoption.

- Naldemedine (SIKLOS): Commands comparable or slightly higher pricing due to formulation advantages and patent exclusivity.

Despite the similar efficacy profiles, physicians tend to prefer agents with established safety data, formulary status, and insurance coverage. Pharmacoeconomic assessments frequently favor SIKLOS owing to its efficacy in difficult-to-treat populations.

Regulatory Environment and Patent Outlook

Patent protections, including formulation patents, protect SIKLOS until approximately 2025–2028. Patent expiry timelines influence pricing as generic manufacturers prepare for market entry, often leading to downward pressure on branded drug prices. The upcoming patent cliff presents both challenges and opportunities: a potential price erosion but also increased volume through increased access.

Regulatory trends favor streamlined pathways for biosimilars and generics, which could accelerate price reductions post-patent expiry.

Price Projections (2023-2030)

Based on current trends, market dynamics, and comparable drugs, the following projections are made:

| Year | Estimated Average Price (per dose) | Key Drivers |

|---|---|---|

| 2023 | $460–$580 | Steady market share, high demand, limited generic competition. |

| 2024 | $440–$560 | Enhanced formulary coverage, increased prescribing volume. |

| 2025 | $420–$540 | Patent protections likely to expire, introducing generics. |

| 2026–2030 | $250–$400 | Progressive price erosion due to generic competition; increased adoption of biosimilars. |

Note: The actual price will depend on negotiated discounts, reimbursement policies, and market penetration.

Factors Influencing Future Pricing

- Patent Expiry and Generic Entry: Major downward price adjustments are expected post-expiration, with potential reductions of 40–60% within 2 years of generic market entry.

- Reimbursement Policies: Adoption depends on formulary inclusion and insurance reimbursement strategies favoring cost-effective options.

- Market Expansion: New indications or formulations could sustain premium pricing and offset erosion.

- Therapeutic Advances: Emergence of more efficacious or longer-acting agents may challenge SIKLOS's market share and pricing.

Conclusion

SIKLOS holds a significant position within the niche market of opioid-induced constipation management, with stable demand supported by its clinical efficacy and patent protections. Current pricing reflects premium positioning, but imminent patent expiration introduces substantial downside price pressures. Strategic market expansion, formulation innovation, and early engagement with payers remain essential to preserve profitability.

Key Takeaways

- SIKLOS's dedicated niche in OIC treatment ensures steady demand; however, competition and patent expiration threaten long-term pricing stability.

- The drug's pricing remains high due to patent protections and clinical positioning, but costs are poised to decline following generic approvals.

- Market access strategies and reimbursement negotiations will be pivotal in maintaining revenue streams amid evolving competitive dynamics.

- The forecast indicates a peak pricing period in 2023–2024, with significant reductions projected post-2025.

- Proactive measures, such as line extensions and formulation innovations, could mitigate impending price erosion.

FAQs

1. When is the patent for SIKLOS expected to expire, and how will it impact pricing?

Patent protections for SIKLOS are expected to expire around 2025–2028, opening the market to generic competitors, which typically results in a substantial price decline.

2. How does SIKLOS's efficacy compare to other PAMORAs?

Clinical studies indicate comparable efficacy among PAMORAs such as relistor and naloxegol. SIKLOS's advantages include its specific formulation and safety profile, which influence clinician preference and cost.

3. Will insurance coverage influence the future price of SIKLOS?

Yes. Payer policies heavily influence drug pricing and uptake. Favorable formulary inclusion can sustain higher prices, while limited reimbursement can accelerate price erosion.

4. Are there new formulations of SIKLOS in development?

Currently, no publicly disclosed formulations are in advanced development stages, but future innovations could extend patent life and maintain premium pricing.

5. How is the market for OIC evolving globally?

The global prevalence of opioid therapy ensures sustained demand for OIC treatments. Emerging markets with increasing opioid consumption could expand SIKLOS's accessible patient base, influencing future revenue.

References

- CDC. (2021). Opioid Use in the United States. Centers for Disease Control and Prevention.

- IQVIA. (2022). Market Data on Opioid-Induced Constipation Drugs.

- U.S. Food and Drug Administration. (2017). FDA Approval Letter for Naldemedine.

- European Medicines Agency. (2018). Naldemedine Summary of Product Characteristics.

More… ↓