SAVAYSA Drug Patent Profile

✉ Email this page to a colleague

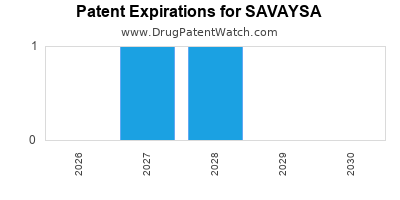

When do Savaysa patents expire, and when can generic versions of Savaysa launch?

Savaysa is a drug marketed by Daiichi Sankyo Inc and is included in one NDA. There are two patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and one patent family members in thirty-four countries.

The generic ingredient in SAVAYSA is edoxaban tosylate. There are four drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the edoxaban tosylate profile page.

DrugPatentWatch® Generic Entry Outlook for Savaysa

Savaysa was eligible for patent challenges on January 8, 2019.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be March 28, 2028. This may change due to patent challenges or generic licensing.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for SAVAYSA?

- What are the global sales for SAVAYSA?

- What is Average Wholesale Price for SAVAYSA?

Summary for SAVAYSA

| International Patents: | 101 |

| US Patents: | 2 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 11 |

| Patent Applications: | 358 |

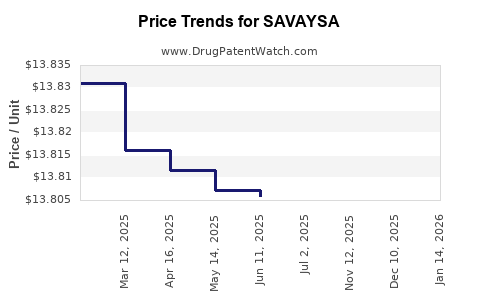

| Drug Prices: | Drug price information for SAVAYSA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for SAVAYSA |

| What excipients (inactive ingredients) are in SAVAYSA? | SAVAYSA excipients list |

| DailyMed Link: | SAVAYSA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for SAVAYSA

Generic Entry Date for SAVAYSA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for SAVAYSA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Population Health Research Institute | Phase 3 |

| University Hospital Plymouth NHS Trust | Phase 3 |

| Wuerzburg University Hospital | Phase 3 |

Pharmacology for SAVAYSA

| Drug Class | Factor Xa Inhibitor |

| Mechanism of Action | Factor Xa Inhibitors |

Paragraph IV (Patent) Challenges for SAVAYSA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| SAVAYSA | Tablets | edoxaban tosylate | 15 mg, 30 mg and 60 mg | 206316 | 1 | 2019-01-28 |

US Patents and Regulatory Information for SAVAYSA

SAVAYSA is protected by two US patents and one FDA Regulatory Exclusivity.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of SAVAYSA is ⤷ Get Started Free.

This potential generic entry date is based on patent 9,149,532.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Daiichi Sankyo Inc | SAVAYSA | edoxaban tosylate | TABLET;ORAL | 206316-001 | Jan 8, 2015 | RX | Yes | No | 7,365,205 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Daiichi Sankyo Inc | SAVAYSA | edoxaban tosylate | TABLET;ORAL | 206316-003 | Jan 8, 2015 | RX | Yes | Yes | 9,149,532 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Daiichi Sankyo Inc | SAVAYSA | edoxaban tosylate | TABLET;ORAL | 206316-002 | Jan 8, 2015 | RX | Yes | No | 9,149,532 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Daiichi Sankyo Inc | SAVAYSA | edoxaban tosylate | TABLET;ORAL | 206316-003 | Jan 8, 2015 | RX | Yes | Yes | 7,365,205 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Daiichi Sankyo Inc | SAVAYSA | edoxaban tosylate | TABLET;ORAL | 206316-001 | Jan 8, 2015 | RX | Yes | No | 9,149,532 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for SAVAYSA

When does loss-of-exclusivity occur for SAVAYSA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 08241982

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0809205

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 80039

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1652139

Estimated Expiration: ⤷ Get Started Free

Patent: 4324015

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 20955

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0171384

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 19377

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 40867

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 40867

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 40867

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 35990

Estimated Expiration: ⤷ Get Started Free

Patent: 800007

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 0790

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 2008129846

Estimated Expiration: ⤷ Get Started Free

Patent: 63875

Estimated Expiration: ⤷ Get Started Free

Patent: 10090168

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 140867

Estimated Expiration: ⤷ Get Started Free

Patent: 2018005

Estimated Expiration: ⤷ Get Started Free

Patent: 40867

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 9356

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 1987

Patent: COMPOSICION FARMACEUTICA. (PHARMACEUTICAL COMPOSITION.)

Estimated Expiration: ⤷ Get Started Free

Patent: 09010474

Patent: COMPOSICION FARMACEUTICA. (PHARMACEUTICAL COMPOSITION.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 9725

Patent: Tablet composition having improved dissolution property

Estimated Expiration: ⤷ Get Started Free

Patent: 7109

Patent: Tablet composition having favorable dissolution property useful as an anticoagulant

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 093008

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 012500410

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 40867

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 40867

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 70637

Patent: ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ (PHARMACEUTICAL COMPOSITION)

Estimated Expiration: ⤷ Get Started Free

Patent: 09139917

Patent: ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 9497

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 40867

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0906182

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

Patent: 1005906

Patent: PHARMACEUTICAL COMPOSITION

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1424843

Estimated Expiration: ⤷ Get Started Free

Patent: 090122950

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 44803

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 09064

Estimated Expiration: ⤷ Get Started Free

Patent: 0845972

Patent: Pharmaceutical composition

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering SAVAYSA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| South Korea | 20040029322 | ⤷ Get Started Free | |

| European Patent Office | 1405852 | DERIVES DE DIAMINE (DIAMINE DERIVATIVES) | ⤷ Get Started Free |

| Taiwan | I409064 | ⤷ Get Started Free | |

| Japan | WO2003000680 | ジアミン誘導体 | ⤷ Get Started Free |

| Denmark | 1405852 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for SAVAYSA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1405852 | C01405852/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: EDOXABAN; REGISTRATION NO/DATE: SWISSMEDIC 65149 31.03.2015 |

| 1405852 | 1590052-5 | Sweden | ⤷ Get Started Free | PRODUCT NAME: EDOXABAN, A SALT THEREOF, A SOLVATE THEREOF, IN PARTICULAR EDOXABAN TOSYLATE.; REG. NO/DATE: EU/1/15/993/001-028 20150623 |

| 1405852 | 300760 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: EDOXABAN, EEN ZOUT DAARVAN, EEN SOLVAAT DAARVAAN OF EEN N-OXIDE DAARVAN, IN HET BIJZONDER EDOXABAN TOSYLAAT; REGISTRATION NO/DATE: EU/1/15/993 20150619 |

| 2140867 | PA2018005,C2140867 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: EDOKSABANAS, JO FARMACINIU POZIURIU PRIIMTINA DRUSKA, ARBA BET KURIO IS JU HIDRATAS, YPAC EDOKSABANO P-TOLUENSULFONATO MONOHIDRATAS; REGISTRATION NO/DATE: EU/1/15/993/001-028 20150619 |

| 1405852 | CA 2015 00052 | Denmark | ⤷ Get Started Free | PRODUCT NAME: EDOXABAN, HERUNDER EDOXABAN TOSILATE; REG. NO/DATE: EU/1/15/993/001-028 20150623 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for SAVAYSA (Eptanezumab)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.