Last updated: August 25, 2025

Introduction

Daiichi Sankyo Inc., a subsidiary of Japan’s Daiichi Sankyo Company Ltd, stands as a significant player within the global pharmaceutical sector. Known for its innovative oncology products, cardiovascular therapies, and pipeline development, Daiichi Sankyo has positioned itself as a robust competitor in the highly saturated and dynamically evolving pharmaceutical market. This analysis evaluates the company's current market standing, core strengths, strategic initiatives, and future outlook within the competitive landscape.

Market Position of Daiichi Sankyo Inc.

Daiichi Sankyo Inc. operates as a critical arm of its parent company, primarily focusing on North American markets. With a strategic emphasis on specialty pharmaceuticals, it has expanded its footprint via a combination of organic growth and strategic acquisitions. As of 2023, its revenue streams are predominantly derived from its oncology portfolio, including flagship products such as ENHERTU (enchabotuzumab vedotin), and cardiovascular medications, underpinning its reputation as an innovation-driven enterprise.

The company's market share is notable within niche therapeutic areas, particularly in targeted oncology treatments. According to industry reports, Daiichi Sankyo holds approximately 3-4% of the global pharmaceutical market share [1], with a localized dominance in specific sectors like breast cancer and addressing unmet medical needs in hematologic and solid tumors.

In the competitive landscape, Daiichi Sankyo contends with major pharmaceutical giants such as Roche, Pfizer, and Novartis—each focusing heavily on oncology segments. Despite fierce competition, its reliance on innovative antibody-drug conjugates (ADCs) and targeted therapies has bolstered its market presence despite its comparatively modest overall market share.

Core Strengths of Daiichi Sankyo Inc.

1. Robust Oncology Pipeline and Innovative Products

Daiichi Sankyo’s strategic focus on oncology has yielded significant clinical and commercial successes. The flagship ADC, ENHERTU (trastuzumab deruxtecan), exemplifies its advanced R&D capabilities—combining targeted monoclonal antibodies with potent cytotoxins. ENHERTU’s FDA approval for HER2-expressing metastatic breast cancer significantly strengthened its oncology portfolio, establishing the company as a reputable innovator in precision oncology [2].

Its pipeline includes promising candidates in lymphoma, lung cancer, and other solid tumors, positioning Daiichi Sankyo at the forefront of emerging therapies.

2. Strategic Collaborations and Licensing Agreements

Daiichi Sankyo benefits immensely from collaborations with biotech firms and licensing deals. Notable partnerships include its alliance with AstraZeneca, notably in the development and commercialization of ENHERTU, which leverages AstraZeneca’s global reach. These alliances expand product access, accelerate R&D efforts, and mitigate risks associated with drug development.

3. Focused R&D and Investment in Innovation

The company allocates substantial resources toward R&D, with over $1.2 billion invested annually in innovation [3]. Its commitment to advancing ADC technology and immuno-oncology ensures a continuous pipeline to sustain long-term growth.

4. Adaptation to Market Needs and Regulatory Confidence

Daiichi Sankyo demonstrates an adept regulatory strategy, gaining approvals across major markets with a track record of navigating complex registration processes. Its ability to adapt drugs across geographies enhances revenue potential and global competitiveness.

5. Market Penetration in Niche Therapeutic Areas

Its specialization in targeted therapies, especially in HER2-positive cancers, gives Daiichi Sankyo a competitive advantage in serving niche markets underserved by larger, more diversified firms.

Strategic Insights: Opportunities and Challenges

Opportunities

- Expansion in Emerging Markets: Rapid growth in Asia, Latin America, and Africa presents opportunities to expand access and market share, particularly as healthcare infrastructure improves.

- Development of Next-Generation ADCs and Immunotherapies: Continuous innovation in ADC technology and immune checkpoint inhibitors can help Daiichi Sankyo address broader oncological indications and resistance challenges.

- Personalized Medicine Trends: The company's expertise in targeted therapies positions it favorably to capitalize on personalized medicine trends, driven by genomic profiling.

- Pipeline Diversification: Expanding beyond oncology and cardiovascular therapies into autoimmune and rare diseases could diversify revenue streams.

Challenges

- Intense Competition: Dominance of large pharmaceutical companies with broader portfolios poses a persistent threat. Roche’s and Novartis' substantial oncology pipelines and marketing resources overshadow smaller players.

- Pricing Pressures and Regulatory Hurdles: Increasing scrutiny over drug pricing, especially in the US, and complex regulatory environments can impede product launches and profitability.

- Pipeline Risks: High attrition rates in clinical development mean that promising candidates may fail to reach commercialization, risking pipeline depletion.

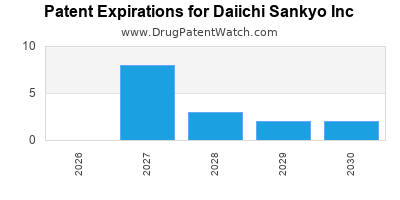

- Patent Expirations and Generic Competition: Although a focus on patents and exclusivities is essential, inevitable patent cliffs threaten revenue stability.

Strategic Recommendations

To reinforce its market position, Daiichi Sankyo should prioritize:

- Diversification of Portfolio: Expanding into autoimmune, infectious diseases, or rare genetic disorders can buffer against oncology-specific risks.

- Leveraging Digital Health and Data Science: Incorporating digital tools to enhance R&D efficiency and personalized treatment pathways.

- Global Strategic Alliances: Forming collaborations with biotech firms and academic institutions worldwide to foster innovation and widen geographic access.

- Lifecycle Management of Existing Products: Implementing strategies like combination therapies and new indications to prolong exclusivity and expand market potential.

Conclusion

Daiichi Sankyo Inc. commands a respectable position within the competitive pharmaceutical landscape, largely driven by its focus on targeted oncology therapies and strategic collaborations. Its strengths in innovative R&D and niche market penetration position it well for future growth, despite ongoing challenges such as stiff competition and regulatory complexities. Strategic diversification, accelerated pipeline development, and market expansion stand as vital pathways to sustain its competitive edge.

Key Takeaways

- Daiichi Sankyo’s market positioning hinges on its innovative oncology pipeline, especially ADCs like ENHERTU.

- Strategic alliances with partners such as AstraZeneca amplify its product reach and R&D capabilities.

- The firm has opportunities to expand into emerging markets and next-generation personalized therapies.

- Challenges include fierce competition, regulatory hurdles, patent expirations, and pipeline risks.

- Focused diversification and digital transformation will reinforce its competitive advantage moving forward.

FAQs

1. What are Daiichi Sankyo’s flagship products, and how do they influence its market position?

Its primary flagship is ENHERTU, a targeted antibody-drug conjugate for HER2-positive cancers, which significantly boosts the company's oncology presence and reputation for innovation.

2. How does Daiichi Sankyo differentiate itself from other pharmaceutical competitors?

Through its focus on advanced ADC technology, targeted therapies, and strategic collaborations, especially in niche oncology indications.

3. What are the main growth opportunities for Daiichi Sankyo in the next five years?

Expansion into emerging markets, development of next-generation immunotherapies, pipeline diversification, and leveraging digital health initiatives.

4. What are the primary challenges facing Daiichi Sankyo in maintaining its competitive edge?

Intense competition, regulatory pressures, patent expirations, pipeline uncertainties, and pricing policies.

5. How important are strategic collaborations for Daiichi Sankyo’s growth?

They are crucial, enabling broader market access, innovative R&D, risk mitigation, and international expansion.

Sources:

[1] IQVIA. "Global Pharmaceutical Market Share Report," 2023.

[2] U.S. Food and Drug Administration. "ENHERTU (trastuzumab deruxtecan)" approval documentation, 2019.

[3] Daiichi Sankyo Annual Report, 2022.