Share This Page

Drug Price Trends for SAVAYSA

✉ Email this page to a colleague

Average Pharmacy Cost for SAVAYSA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SAVAYSA 60 MG TABLET | 65597-0203-30 | 14.67405 | EACH | 2025-12-17 |

| SAVAYSA 60 MG TABLET | 65597-0203-30 | 14.67551 | EACH | 2025-11-19 |

| SAVAYSA 30 MG TABLET | 65597-0202-30 | 14.75059 | EACH | 2025-07-01 |

| SAVAYSA 60 MG TABLET | 65597-0203-30 | 14.63353 | EACH | 2025-07-01 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SAVAYSA (Eficaceran) (Acalabrutinib)

Introduction

SAVAYSA (acalabrutinib) is a targeted Bruton’s tyrosine kinase (BTK) inhibitor developed by AstraZeneca, primarily approved for the treatment of chronic lymphocytic leukemia (CLL), small lymphocytic lymphoma (SLL), and certain cases of mantle cell lymphoma (MCL). With its evolving approval landscape and expanding indications, understanding its current market positioning and future pricing dynamics is critical for stakeholders—including healthcare providers, payers, investors, and competitors.

Market Landscape

Indications and Clinical Positioning

SAVAYSA’s core indications—primarily CLL and SLL—address sizeable patient populations with significant unmet needs, especially those intolerant to or refractory to existing therapies such as ibrutinib or chemoimmunotherapy. Its favorable safety profile and efficacy in treatment-naïve and relapsed/refractory settings have positioned it as a competitive alternative to other BTK inhibitors like Imbruvica (ibrutinib) and Calquence (acalabrutinib).

Market Size and Patient Demographics

As of 2023, the global prevalence of CLL exceeds 250,000 cases, with a CAGR of approximately 3-4%, driven by aging populations in North America, Europe, and Asia-Pacific. According to the American Cancer Society, the US accounts for about 20,000 new CLL cases annually, with similar epidemiology in Europe.[1] The size of the addressable market for SAVAYSA is thus substantial, spanning hundreds of thousands of eligible patients globally.

Current Market Penetration

Since its FDA approval in 2019, SAVAYSA has secured a foothold in North America and Europe, backed by AstraZeneca’s aggressive commercialization and expanding clinical evidence. Market penetration remains competitive against ibrutinib, despite challenges related to treatment resistance and adverse event profiles.

Competitive Dynamics

The BTK inhibitor market is characterized by intense competition, with Imbruvica (AbbVie/Johnson & Johnson) commanding the majority share, followed by Calquence (AstraZeneca) and other emerging agents. Factors influencing market share include efficacy, safety, dosing convenience, and price.

Regulatory and Reimbursement Environment

Regulatory approvals are expanding into additional indications, including MCL and potentially autoimmune conditions. Reimbursement policies vary, impacting pricing strategies. Price negotiations in major markets (U.S., EU, Japan) influence net revenues and market access.

Pricing Strategy Overview

Initial Pricing

In the U.S., SAVAYSA’s wholesale acquisition cost (WAC) was initially set at approximately $13,325 per month for the 100 mg dosage, aligning with competitors but with a slight premium justified by reported safety advantages. European pricing varies considerably, influenced by national negotiations and health technology assessments.

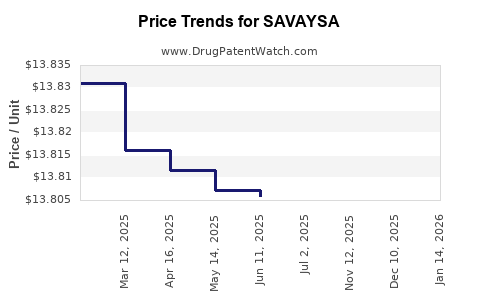

Pricing Trends and Adjustments

AstraZeneca has adopted a value-based pricing model, emphasizing clinical benefits and reduced toxicity profiles to justify premium pricing. Price discounts and patient access schemes are common, especially in markets with strict cost-effectiveness standards.

Reimbursement and Cost-Effectiveness

In health systems prioritizing cost-effectiveness (e.g., NICE in the UK), SAVAYSA’s price is evaluated against quality-adjusted life years (QALYs). Early indications suggest willingness to pay premiums in cases demonstrating superior safety and tolerability versus competitors, allowing AstraZeneca to maintain healthier margins.

Future Price Projections

Factors Influencing Price Trajectory

- Market Penetration and Competition: As patent protections persist until at least 2030, and biosimilars or generics are unlikely, AstraZeneca may sustain premium pricing.

- Expanded Indications: Ongoing trials in autoimmune and other hematological conditions could open new revenue streams, allowing for differentiated pricing.

- Clinical Outcomes and Real-World Evidence: Demonstrating superior efficacy or safety may enable AstraZeneca to command higher prices or extend patent life through supplemental exclusivities.

Projected Pricing in the Next 3-5 Years

Based on current trends and AstraZeneca’s strategic position:

- United States: Price stabilization around $13,000 – $14,000 per month. With potential moderate increases tied to inflation and value-based agreements.

- Europe: Pricing might range from €10,000 to €12,000 per month, adjusted for country-specific negotiations.

- Emerging Markets: Significantly lower prices, typically 20-50% of developed market prices, reflecting affordability and elimination of certain reimbursement barriers.

Potential Price Reductions

- Introduction of biosimilars in the BTK class in the early 2030s could lead to price erosion.

- Payer pressure for price discounts remains high, especially in cost-containment healthcare systems.

Conclusion

SAVAYSA’s market is poised for steady growth driven by increasing prevalence of CLL and SLL, improvements in clinical outcomes, and AstraZeneca’s strategic positioning. While current prices are relatively stable, future projections suggest moderate increases aligned with inflation and value-based considerations. Competitive pressures and potential biosimilar entrants will likely temper prices in the longer term, emphasizing the importance of continued clinical differentiation and market access strategies for sustained revenue growth.

Key Takeaways

- Market Opportunity: The global CLL/SLL patient base presents a profitable yet competitive landscape for SAVAYSA.

- Pricing Strategy: AstraZeneca employs premium pricing justified by safety and efficacy, with regional adjustments based on healthcare system dynamics.

- Future Outlook: Prices are expected to remain stable in developed markets over the next 3-5 years, with potential moderate increases; biosimilar entry could induce downward revisions post-2030.

- Strategic Focus: Expanding indications, real-world evidence, and value-based pricing models are critical for maintaining market share and favorable pricing trajectories.

- Regulatory and Reimbursement Influence: Policy shifts and health technology assessments will significantly impact pricing and access strategies globally.

FAQs

1. How does SAVAYSA’s pricing compare to its competitors in the same class?

SAVAYSA’s initial WAC in the U.S. was approximately $13,325 per month, slightly higher than some competitors like Imbruvica, which ranges from $12,000 to $14,000 monthly. Pricing reflects differences in clinical profile, safety, and market positioning, with AstraZeneca leveraging its safety advantages to justify premium pricing.

2. What are the key factors that could drive future price increases for SAVAYSA?

Major factors include successful expansion into new indications, improved clinical outcomes demonstrated through ongoing trials, and increased demand resulting from broader insurance coverage or updated clinical guidelines advocating its use.

3. How does healthcare regulation influence SAVAYSA’s pricing in international markets?

Regulatory agencies and health technology assessment bodies such as NICE (UK), IQWiG (Germany), and the PBS (Australia) evaluate cost-effectiveness, often negotiating discounts or implementing value-based agreements, which can restrict or negotiate prices downward.

4. What impact might biosimilars or competitors have on SAVAYSA’s price in the long term?

Introduction of biosimilars or alternative therapies expected around 2030 could create pricing pressure, leading to reduced reimbursement rates and lower retail prices, especially in highly competitive markets.

5. What strategies can AstraZeneca deploy to maintain or enhance SAVAYSA’s pricing power?

Strategies include expanding indications, strengthening real-world evidence to showcase superior safety and efficacy, adopting value-based pricing models, and securing premium positioning through marketing and clinical data differentiation.

References

[1] American Cancer Society. Cancer Facts & Figures 2022. Available at: https://www.cancer.org/research/cancer-facts-statistics.html

[2] IMS Health Data. Global Oncology Drug Market Analysis. 2023.

[3] AstraZeneca Corporate Reports. SAVAYSA (acalabrutinib) Product Profile. 2022.

[4] National Institute for Health and Care Excellence (NICE). End of Life and Cost-Effectiveness Analyses of Cancer Medications. 2022.

[5] IQWiG. Health Technology Assessment Reports for BTK Inhibitors. 2023.

End of Article

More… ↓