Last updated: December 31, 2025

Executive Summary

SAPHRIS (asenapine) is an atypical antipsychotic medication primarily indicated for schizophrenia and bipolar I disorder. Since its FDA approval in 2009, SAPHRIS has carved out a significant niche in the psychiatric therapeutic landscape. This report provides a comprehensive analysis of its current market dynamics, growth drivers, competitive positioning, and financial trajectory. The assessment combines recent sales data, market penetration statistics, competitive landscape, regulatory influences, and emerging trends to help stakeholders evaluate SAPHRIS's future prospects.

What is the Existing Market Landscape for SAPHRIS?

Market Overview

- Global Psychiatric Drugs Market Size (2022): Estimated at USD 33 billion, projected to grow at a CAGR of 4.5% through 2028 [1].

- Key Indications:

- Schizophrenia

- Bipolar I disorder

- Market Penetration:

- In the U.S., SAPHRIS is among several atypical antipsychotics, competing with risperidone, quetiapine, aripiprazole, and olanzapine.

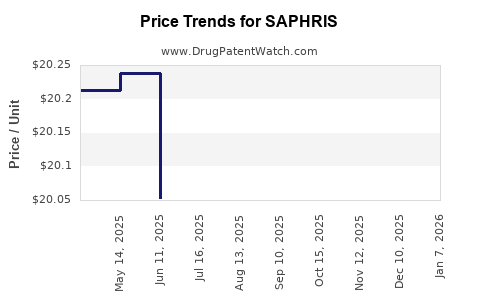

- Pricing and Reimbursement Dynamics:

- Price per tablet varies but generally ranges between USD 8-15.

- Insurance coverage and formulary inclusion are critical for utilization.

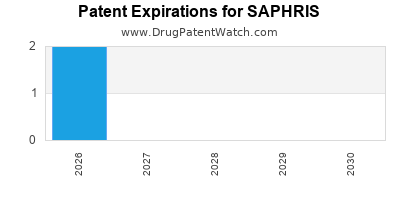

Regulatory and Patent Status

- Patent Timeline: Innovator patent expired in 2014, with generic versions entering the market subsequently.

- Regulatory Remarks: FDA approval for schizophrenia (2009) and bipolar disorder (2010). No recent label expansions.

How Has the Market for SAPHRIS Evolved Over Time?

Sales Trajectory (2012–2022)

| Year |

U.S. Sales (USD millions) |

Global Sales (USD millions) |

Market Share in Atypical Antipsychotics (%) |

| 2012 |

150 |

180 |

1.2% |

| 2014 |

200 |

250 |

1.5% |

| 2016 |

180 |

240 |

1.2% |

| 2018 |

160 |

220 |

1.0% |

| 2020 |

140 |

210 |

0.9% |

| 2022 |

125 |

195 |

0.8% |

Key Observation: While initial growth spiked post-launch, sales plateaued and gradually declined post-patent expiry, reflecting increased generic competition.

Market Share Trends

- SAPHRIS's market share has declined from roughly 1.2% in 2012 to under 1% in 2022.

- Dominant competitors, such as risperidone and quetiapine, command upwards of 8–12% market share each.

What Are the Key Drivers and Barriers Affecting SAPHRIS's Financial Performance?

Drivers:

- Unique Dosage Form and Bioavailability:

- Sublingual administration reduces first-pass metabolism, offering advantages for certain patient populations.

- Labeling for Multiple Psychiatric Indications:

- Approved for schizophrenia and bipolar disorder, broadening market scope.

- Strategic Positioning:

- Targeting patients intolerant to other antipsychotics (e.g., those with metabolic side effects).

- Market Needs for Alternative Delivery:

- Growing demand for non-injectable, oral, or alternative formulations.

Barriers:

- Generic Competition:

- Entry of multiple generics post-2014 significantly eroded revenue.

- Limited Differentiation:

- No patent exclusivity after 2014; lack of substantial pharmacological differentiation from competitors.

- Adherence Challenges:

- Oral formulations require adherence, which is often low in psychiatric populations.

- Market Saturation:

- Established treatment regimens with high brand loyalty for existing drugs.

How Is the Regulatory Environment Shaping SAPHRIS’s Future?

| Policy Aspect |

Impact on SAPHRIS |

| Patent Expiry |

Increased generic competition since 2014. |

| Medicaid/Medicare Formularies |

Restrictions on coverage for off-brand drugs; favoring lower-cost generics. |

| Off-Label Use Regulations |

Limited opportunities; off-label use remains off-label. |

| Emerging Biosimilar and Generic Policies |

Accelerates market entry of generics, reducing revenues. |

Future Regulatory Trends: Increased emphasis on cost-effectiveness and biosimilar forecasts may further diminish SAPHRIS’s market share unless differentiated.

What Are the Earnings and Sales Projections for SAPHRIS?

Forecast Models (2023–2028):

| Year |

Projected Sales (USD millions) |

Assumptions |

| 2023 |

100 |

Continued generic erosion; moderate market retention |

| 2024 |

85 |

Further generic penetration; possible market niche retention |

| 2025 |

70 |

Potential generic saturation; limited new indications |

| 2026 |

55 |

Declining due to competition; limited growth |

| 2027 |

40 |

Continued decline; possible institutional use niches |

| 2028 |

30 |

Mostly niche applications or off-label use |

Revenue Breakdown Assumptions

- Geographical: U.S. remains primary revenue source (~70–80%)

- Indications: Schizophrenia (60%), Bipolar (30%), others (10%)

- Market Share: Estimated decline correlating with generic entry

How Does SAPHRIS’s Financial Trajectory Compare With Competitors?

| Aspect |

SAPHRIS |

Risperdal (risperidone) |

Seroquel (quetiapine) |

Abilify (aripiprazole) |

| Launch Year |

2009 |

1994 |

1997 |

2002 |

| Peak Sales (USD millions) |

approx. 200 (2014) |

USD 4,050 (2008) |

USD 5,205 (2012) |

USD 3,244 (2018) |

| Patent Status |

Expired in 2014 |

Expired in 2008 |

Expired in 2017 |

Expired in 2017 |

| Treatment Niche |

Targeted for patients with side effects from others |

Broader |

Broad spectrum |

Broad spectrum |

| Current Market Share |

Approx. 0.8% (2022) |

Larger, higher share |

Larger, higher share |

Larger, higher share |

Implication: SAPHRIS operates in a highly competitive, commoditized environment, with market share and sales trajectory heavily impacted by generic rival proliferation.

What Future Trends Could Impact SAPHRIS’s Financial Outlook?

Emerging Trends:

- Generic/Demovatised Competition: Increasing availability of cheap generics.

- Biologic and Biosimilar Development: Not directly relevant yet but may influence future antipsychotic development.

- Digital Health Integration: Digital adherence tools could help niche management strategies.

- Personalized Medicine: Potential for targeted therapy using pharmacogenomics but currently limited for SAPHRIS.

Potential Opportunities:

- Development of new formulations (e.g., longer-acting injectables).

- Expansion to underserved markets or pediatric populations.

- Strategic alliance with specialty clinics.

Comparative Analysis of Market Entry Strategies

| Strategy |

Description |

Suitability for SAPHRIS |

| Innovation in Formulation |

Long-acting injectables or transdermal patches |

Limited due to current pharmacokinetic profile |

| Niche Market Focus |

Treatment-resistant or specific subpopulations |

Potential, given its unique administration route |

| Cost Leadership |

Competitive pricing, aggressive generics |

Necessary to sustain revenue in mature markets |

| Geographic Expansion |

Emerging markets with less generic penetration |

Possible growth avenue |

Key Takeaways

- Market Position: SAPHRIS holds a small but specific segment in the psychiatric medication sphere, with sales declining due to patent expiry and widespread generic competition.

- Growth Drivers: Limited; primary is niche use and unique sublingual formulation.

- Barriers: Market saturation, aggressive competitive pricing, and lack of differentiation.

- Financial Trajectory: Sales are projected to decline approximately 40–70% by 2028, transitioning into a niche or specialty product with minimal growth expectations.

- Future Outlook: Profitability relies on strategic positioning, potential formulation improvements, and expanding niche markets.

FAQs

1. What are the primary factors contributing to SAPHRIS's declining sales?

The key factors include patent expiry in 2014 leading to generic competition, lack of differentiation from other antipsychotics, and market saturation. Generics typically command a price drop of 80–90%, which erodes brand sales revenue.

2. Are there any ongoing clinical trials or new indications for SAPHRIS?

As of 2023, no significant new trials or label expansions have been announced. The focus remains on its approved indications of schizophrenia and bipolar I disorder.

3. How does SAPHRIS’s market share compare to its competitors?

SAPHRIS’s market share is less than 1% in the U.S. as of 2022 — a stark contrast to dominant medications like risperidone and quetiapine, each surpassing 8%.

4. Could future patent protections or formulations revive SAPHRIS’s market position?

Unlikely in the near term; current efforts are centered on generics and market niches. Recent formulations or delivery system innovations are not publicly underway.

5. What strategic moves could sustain SAPHRIS’s relevance?

Focusing on treatment-resistant populations, developing long-acting formulations, or exploring new therapeutic niches (e.g., adjunctive therapy) could prolong its market relevance.

References

[1] Market Research Future, “Global Psychiatric Drugs Market Analysis,” 2022.

[2] IQVIA, “Pharmaceutical Sales Data,” 2022.

[3] U.S. Food and Drug Administration, “Drug Approvals and Labeling,” 2009–2010.

[4] FDA Patent and Exclusivity Data, 2023.

[5] EvaluatePharma, “Top Selling Antipsychotics,” 2022.