Share This Page

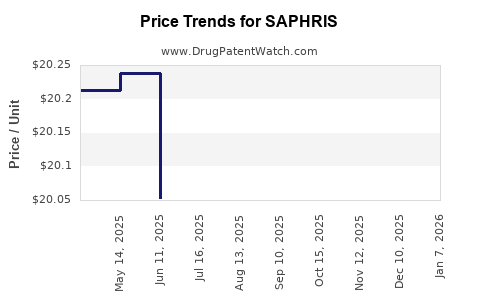

Drug Price Trends for SAPHRIS

✉ Email this page to a colleague

Average Pharmacy Cost for SAPHRIS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SAPHRIS 2.5 MG TAB SUBLINGUAL | 00456-2402-06 | 20.04394 | EACH | 2025-12-17 |

| SAPHRIS 5 MG TAB SUBLINGUAL | 00456-2405-60 | 20.15521 | EACH | 2025-12-17 |

| SAPHRIS 10 MG TAB SUBLINGUAL | 00456-2410-06 | 20.18745 | EACH | 2025-12-17 |

| SAPHRIS 5 MG TAB SUBLINGUAL | 00456-2405-06 | 20.15521 | EACH | 2025-12-17 |

| SAPHRIS 2.5 MG TAB SUBLINGUAL | 00456-2402-60 | 20.04394 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SAPHRIS (Asenapine)

Introduction

SAPHRIS (asenapine) is an atypical antipsychotic medication developed and marketed by Sunovion Pharmaceuticals. Approved by the U.S. Food and Drug Administration (FDA) in 2009 for the treatment of schizophrenia and acute bipolar I mania, SAPHRIS plays a crucial role in the neuropsychiatric medication landscape. This analysis explores its current market status, competitive positioning, supply dynamics, and future price projections, offering strategic insights for stakeholders in the pharmaceutical and healthcare sectors.

Market Overview of SAPHRIS

Indications and Market Penetration

SAPHRIS is primarily indicated for schizophrenia and bipolar I disorder, disorders with significant prevalence worldwide. According to the World Health Organization, schizophrenia affects approximately 20 million people globally, while bipolar disorder impacts an estimated 45 million worldwide [1]. In the U.S., prevalence rates are roughly 1% for schizophrenia and nearly 2.8% for bipolar disorder, translating into sizable patient populations.

The drug’s unique pharmacological profile as an oral, sublingual formulation offers rapid absorption and ease of administration, particularly beneficial for patients with adherence challenges. However, its market penetration remains moderate compared to competitors like risperidone, olanzapine, and aripiprazole, due to factors such as safety concerns, side effect profiles, and prescriber preferences.

Competitive Landscape

The market for atypical antipsychotics is highly competitive, with top players including:

- Risperdal (risperidone): Market leader with extensive indications.

- Abilify (aripiprazole): Known for broad-spectrum use.

- Zyprexa (olanzapine): Prevalent in schizophrenia and bipolar disorder.

- Latuda (lurasidone): Noted for favorable metabolic profile.

SAPHRIS, while effective, faces stiff competition due to its side effect profile, notably sedation and weight gain, which may deter some prescribers and patients. Additionally, insurance formulary restrictions influence access and utilization rates.

Market Size and Revenue Trends

As per IQVIA data, the global antipsychotic drugs market was valued at approximately USD 15 billion in 2022, with projections to grow at an annual CAGR of 3-5%, driven by rising mental health awareness and expanding indications [2].

In the U.S., SAPHRIS's estimated market share is modest, with annual sales fluctuating around USD 200-250 million in recent years. This stagnation results from generic entry for competitors and internal competition.

Price Dynamics and Market Forces

Pricing Strategies and Trends

SAPHRIS is marketed as a branded medication, with a typical wholesale acquisition cost (WAC) for a 30-day supply around USD 900-USD 1,100, depending on dosage and pharmacy discounts. The premium pricing aligns with the brand's positioning but faces pressure from generic formulations and rising biosimilar options.

Price adjustments are influenced by:

- Rebates and discounts: Major payers often negotiate substantial rebates, reducing net prices.

- Formulary placements: Inclusion in preferred formularies boosts volume but constrains pricing power.

- Managed care policies: Emphasis on cost-effective therapies affects prescribing behaviors.

Impact of Generic Entry and Biosimilars

Although asenapine’s patent expired in 2022, the absence of a generic has maintained high prices for SAPHRIS. However, the potential entry of generics could trigger significant price erosion over the next 2-3 years, as observed with other antipsychotics.

Biosimilar options are not yet prevalent for asenapine, but future development could further catalyze price competition. The industry trend indicates that generic competition could reduce SAPHRIS’s price by 30-50%, in line with historical patterns in psychiatric pharmaceuticals.

Forecasting Price Projections

Short-term Outlook (1-2 years)

- Stability in brand pricing: Due to patent protections and minimal competition, SAPHRIS’s unit price is likely to remain relatively steady.

- Rebate adjustments and payor negotiations: Slight downward pressure expected, especially if formulary access becomes more restrictive or if payers favor more cost-effective generics.

Medium-term Outlook (3-5 years)

- Introduction of generics: Entry of generic asenapine products is anticipated post-2023, potentially leading to a 30-50% reduction in list prices.

- Market share shifts: As generics capture the majority of prescriptions, SAPHRIS’s brand sales may decline accordingly, with potential price discounts to sustain volume.

Long-term Outlook (5+ years)

- Market consolidation: Patent expirations and biosimilar development will increasingly commoditize the drug market for asenapine.

- Price stabilization at lower levels: Expect residual brand value pricing at a significantly discounted rate, unless differentiated by formulation innovations or pharmacoeconomic advantages.

Strategic Considerations for Stakeholders

- Manufacturers: Focus on optimizing cost efficiencies, pharmacovigilance, and developing biosimilar pathways.

- Payers and Providers: Prioritize formulary positioning and cost-sharing strategies to manage expenditure.

- Investors: Monitor patent expiry timelines and pipeline developments for biosimilars or novel formulations.

Key Market Drivers

- Rising prevalence of schizophrenia and bipolar disorder enhances long-term demand.

- Increased emphasis on therapeutic adherence favors SAPHRIS’s administration route.

- Patent expiry and biosimilar availability are primary determinants of future pricing.

- Regulatory developments influencing drug approvals and exclusivity periods.

Key Takeaways

- SAPHRIS operates in a lucrative but competitive market, with current pricing largely sustained by patent protections and brand positioning.

- The imminent entry of generics is poised to significantly reduce SAPHRIS’s prices, aligning with historical trends in neuropsychiatric drugs.

- Market share is expected to decline as generics gain dominance, compelling stakeholders to adapt pricing and formulary strategies.

- Future innovations, including biosimilars and alternative delivery methods, could influence long-term pricing stability.

- Stakeholders should closely monitor patent statuses, competitive launches, and payer policies to optimize strategic decisions.

FAQs

1. When will generic asenapine be available on the market?

Based on patent expiry trends and regulatory processes, generic formulations are expected to enter the market within 1-2 years post-expiry, likely around 2023-2024.

2. How will generic entry affect SAPHRIS’s pricing?

Generic entry typically results in a 30-50% reduction in list price, with substantial discounts offered through rebates and formulary negotiations.

3. Are there any new formulations of SAPHRIS in development?

Currently, no major new formulations are announced. Future developments may include long-acting injectables or combination therapies.

4. What role do biosimilars play in the future pricing landscape for SAPHRIS?

While biosimilars are more relevant for biologics, the emergence of similar low-cost alternatives could further pressure the pricing of branded asenapine products.

5. How can manufacturers differentiate SAPHRIS in a crowded market?

Innovation in delivery methods, establishing unique therapeutic benefits, and optimizing pharmacoeconomics can sustain its market relevance despite price erosion.

References

[1] WHO. Mental health: strengthening our response. World Health Organization, 2022.

[2] IQVIA. Global Psychiatry Market Report, 2022.

More… ↓