Last updated: July 27, 2025

Introduction

SAPHRIS (asenapine) is an antipsychotic medication developed by AstraZeneca, primarily approved for the treatment of schizophrenia and bipolar I disorder. Its unique pharmacological profile and evolving market landscape influence its financial performance and strategic positioning within the pharmaceutical industry. This report delivers a comprehensive analysis of SAPHRIS’s market dynamics, competitive landscape, regulatory environment, and revenue trajectory, providing stakeholders with actionable insights for decision-making.

Pharmacological Profile and Therapeutic Positioning

As an atypical antipsychotic, SAPHRIS offers a distinctive combination of pharmacodynamics that aims to improve efficacy while minimizing adverse effects associated with traditional antipsychotics. It is administered sublingually, enabling rapid absorption and potential benefits in patient adherence. Its approval in multiple markets, including the U.S. and Europe, positions SAPHRIS as a key player within second-generation antipsychotics (SGAs), strategic for treating schizophrenia and bipolar I disorder.

Its narrow indication scope limits its direct competition but heightens the importance of market penetration within those areas. Its clinical advantages, such as reduced metabolic side effects compared to competitors like olanzapine, could sustain its therapeutic appeal—assuming the drug maintains or advances its health outcome profile.

Market Landscape and Competitor Overview

Key Competitors

SAPHRIS faces competition primarily from other SGAs, including risperidone, quetiapine, aripiprazole, and newer agents like lumateperone. Market penetration is heavily influenced by factors such as efficacy, side-effect profile, patient compliance, and formulary access.

Notably, the competitive advantage of SAPHRIS hinges on its sublingual delivery, which offers rapid onset and reduces swallowing issues prevalent with oral formulations. Yet, the route of administration can be a double-edged sword, as injectable formats dominate in certain institutional settings, while oral antipsychotics are preferred for outpatient management.

Market Penetration and Adoption Trends

Despite being approved since 2009, SAPHRIS’s market share remains modest compared to monopolistic giants like Abilify (aripiprazole). However, the drug’s positioning benefits from its lower metabolic risk, which appeals to a subset of clinicians prioritizing side-effect management, especially for long-term therapy in schizophrenia patients.

Furthermore, it has experienced limited geographic expansion beyond North America, constraining revenue growth potential. The slow adoption can be attributed to prescriber familiarity, formulary restrictions, and insurance coverage limitations.

Regulatory and Reimbursement Environment

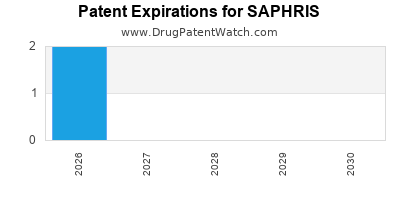

Regulatory approvals for SAPHRIS remain steady in mature markets, but aging patent protections and generic competition threaten revenue streams. Insurance formulary preferences and prior authorization processes also influence prescribing patterns, often favoring established brands with wider approval and support.

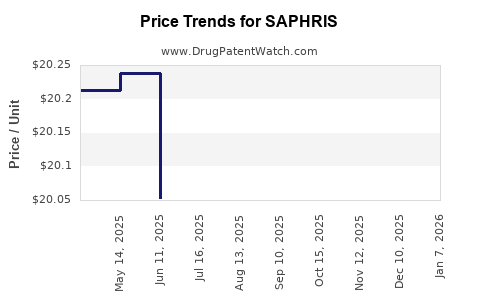

Pricing strategies and reimbursement negotiations substantially impact market access. Rapidly evolving healthcare policies prioritizing cost-effectiveness elevate the importance of demonstrating both clinical superiority and economic value.

Financial Trajectory Analysis

Historical Performance

Since its market launch, SAPHRIS's revenue trajectory has been characterized by modest growth, reflecting niche positioning within the antipsychotic segment. According to AstraZeneca's reports, the drug contributed a small but stable revenue segment within its overall CNS portfolio, with revenues fluctuating based on competitive pressures and generics impacts.

Forecasted Growth Drivers

- Market Expansion: Expanding into emerging markets could deliver increased revenues, contingent on regulatory approval and pricing negotiations.

- Line Extensions: Development of new formulations (e.g., long-acting injectables) or novel indications could renew growth momentum.

- Clinical Trials and Evidence: Demonstrating superior efficacy or safety in head-to-head studies could enhance prescriber confidence, supporting sustained or increased market share.

Challenges and Risks

- Patent Expiry and Generics: Patent expiration earmarks significant revenue erosion, with generic asenapine already available in several markets, putting downward pressure on prices.

- Competitive Innovation: Newer agents with better safety profiles or broader indications can erode SAPHRIS’s market share.

- Market Dynamics: The trend toward personalized medicine and precision psychiatry might favor newer, targeted therapies over broader-spectrum antipsychotics.

Revenue Projection Outlook

Based on current trends, SAPHRIS’s revenues are projected to decline modestly over the next 3-5 years unless strategic initiatives are implemented. Growth opportunities remain limited but could be realized via market expansion and enhanced clinical positioning. Overall, without significant innovation or diversification, SAPHRIS's financial trajectory is likely characterized by plateauing revenues and gradual decline due to patent expiry and market saturation.

Strategic Considerations for Stakeholders

- Optimization of Market Penetration: Focused efforts on key markets with favorable reimbursement policies could stabilize revenues.

- Enhanced Clinical Differentiation: Supporting clinical evidence demonstrating benefits over competitors can justify premium pricing.

- Pipeline and Formulation Development: Investing in long-acting injectables and additional indications may extend the product lifecycle and revenue potential.

- Partnerships and Licensing: Strategic collaborations for geographic expansion or device integration could unlock new revenue streams.

Conclusion

SAPHRIS remains a relevant but niche drug within the second-generation antipsychotic landscape. Its market dynamics are shaped by intense competition, patent expiration, and evolving clinical preferences. While current financial performance reflects steady but limited revenue contribution, targeted strategic initiatives focusing on market expansion, innovation, and clinical differentiation could alter its financial trajectory favorably.

Key Takeaways

- SAPHRIS’s niche positioning and unique administration route confer specific advantages, but market penetration remains constrained.

- Patent expiration and generic competition threaten future revenues, necessitating proactive strategies.

- Clinical differentiation and evidence-based positioning are vital to sustain market relevance.

- Expansion into emerging markets and development of formulations like long-acting injectables could bolster revenues.

- Long-term viability depends on diversification, innovation, and strategic collaborations to extend product lifecycle.

FAQs

1. What are the main challenges faced by SAPHRIS in maintaining market share?

The principal challenges include patent expiration leading to generic competition, limited geographic expansion, prescriber familiarity with established drugs, and formulary restrictions favoring cheaper alternatives.

2. How does SAPHRIS’s pharmacological profile compare to competitors?

SAPHRIS offers rapid sublingual absorption and a favorable metabolic side-effect profile, which can be advantageous over some oral SGAs. However, injectable formulations by competitors provide alternative delivery methods, affecting its competitive position.

3. What strategic options exist to extend SAPHRIS’s market life?

Options include developing long-acting injectable formulations, pursuing additional therapeutic indications, expanding into emerging markets, and generating robust clinical data emphasizing its safety profile.

4. How do reimbursement policies impact SAPHRIS’s revenue trajectory?

Reimbursement trends heavily influence access and sales volume. Favorable policies can boost adoption, while restrictive policies or high out-of-pocket costs can diminish prescriptions.

5. What is the potential impact of emerging therapies on SAPHRIS?

Novel antipsychotics with improved safety profiles, personalized medicine approaches, and targeted therapies could reduce SAPHRIS’s market share unless it differentiates itself through innovation and clinical superiority.

Sources:

[1] AstraZeneca Annual Reports and Financial Disclosures.

[2] FDA Drug Approvals Database.

[3] MarketResearch.com Reports on Antipsychotic Market.

[4] Peer-reviewed Clinical Pharmacology Literature.