Last updated: July 31, 2025

Introduction

ROZEREM (ramelteon) is a prescription hypnotic marketed primarily for the treatment of insomnia characterized by difficulty with sleep onset. Launched by Takeda Pharmaceutical Company in 2005, ROZEREM is recognized for its unique mechanism of action, targeting melatonin receptors rather than gamma-aminobutyric acid (GABA) receptors common in traditional sleep aids. Its market performance, influenced by evolving regulatory, competitive, and consumer factors, demonstrates a nuanced pathway for its financial trajectory over the coming years.

Pharmacological Profile and Market Position

Ramelteon functions as a selective melatonin receptor agonist, specifically targeting MT1 and MT2 receptors in the suprachiasmatic nucleus, effectively regulating the sleep-wake cycle (1). This mechanism offers purported advantages over benzodiazepine receptor agonists, including a lower risk of dependence and abuse potential, aligning with increasing regulatory and consumer preferences for safer sleep therapeutics.

Despite initial enthusiasm, ROZEREM’s market penetration has remained moderate. It generated approximately $250 million globally in revenues by 2020, with the majority of sales in the United States, where it maintains a distinct segment in the insomnia drug market (2). Amidst mounting concerns over long-term safety and dependence, ROZEREM has positioned itself as a safer alternative; however, its clinical efficacy is sometimes viewed as modest compared to traditional hypnotics.

Market Dynamics Impacting ROZEREM

Regulatory Environment

The FDA approved ramelteon with specific stipulations, emphasizing its safety profile. Regulatory agencies have generally maintained a cautious stance toward sleep aids due to concerns related to dependence, next-day impairment, and misuse. While ROZEREM's non-habit-forming profile is favorable, its modest efficacy compared to benzodiazepines limits prescribing enthusiasm (3).

International regulatory landscapes vary, with some countries adopting restrictive classifications, which impacts global market expansion. Regulatory challenges have thus constrained the drug's growth potential outside the highly regulated US landscape.

Competitive Landscape

The market for sleep medications is highly competitive, dominated by benzodiazepines, Z-drugs like zolpidem and eszopiclone, and newer agents such as suvorexant. These drugs often offer more potent hypnotic effects but carry higher dependence risks, which has created a niche for ramelteon—particularly among patients seeking safer alternatives (4).

In recent years, the advent of orexin receptor antagonists, such as suvorexant (Belsomra), has further intensified competition. These newer agents often demonstrate superior efficacy in inducing and maintaining sleep, which has pressured ROZEREM's market share. Nonetheless, its favorable safety profile ensures a dedicated patient subset, especially among elderly or comorbid populations.

Consumer Preferences and Prescriber Attitudes

The increasing emphasis on safety and minimal dependence has cultivated a favorable environment for drugs like ROZEREM. Healthcare providers and patients often prefer safer sleep medications, particularly in light of the opioid and benzodiazepine crisis in the US.

However, perceptions of limited efficacy and the availability of more efficacious but potentially riskier drugs have limited prescriber enthusiasm. Moreover, insurance coverage and pharmacoeconomic factors influence prescription patterns.

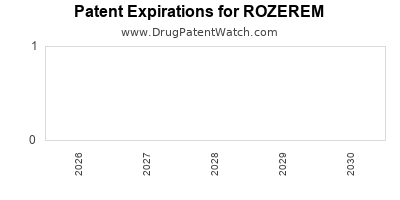

Intellectual Property and Patent Landscape

ROZEREM enjoyed patent exclusivity until around 2012, when generic versions entered the market. The entry of generics significantly impacted its pricing, leading to substantial revenue erosion (5). Patent expiries and generic competition remain key determinants of its financial trajectory. No recent patent extensions have been awarded, limiting opportunities for price premiums.

Market Trends and Future Outlook

The insomnia therapeutic market is experiencing key shifts:

-

Growth in Aging Population: Older adults, more prone to chronic insomnia, represent a core demographic for safety-focused agents like ramelteon. This demographic expansion supports ongoing demand, provided safety perceptions persist.

-

Shift Toward Non-Pharmacologic Interventions: Cognitive-behavioral therapy for insomnia (CBT-I) increasingly replaces pharmacotherapy as the first-line treatment, constraining prescription volumes.

-

Emerging Pharmacological Alternatives: Development of dual orexin receptor antagonists and melatonin-based formulations pose both opportunities and threats to ROZEREM's market share.

The combined effect of these factors suggests a modest but steady revenue outlook for ramelteon, primarily driven by niche prescribing and specific patient populations seeking safe sleep solutions.

Financial Trajectory Analysis

Revenue Projections

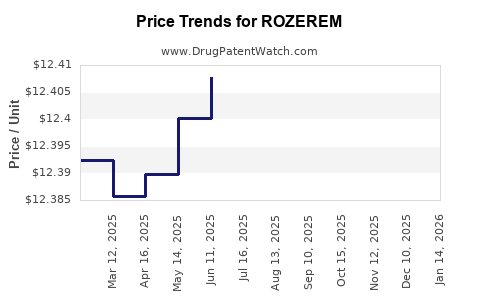

Initially launched as a blockbusters drug, ROZEREM’s revenues have declined post-generic entry. For instance, Takeda reported a revenue downturn from approximately $250 million in 2015 to less than $100 million in 2020 (2). Future revenue streams are projected to stabilize or slightly increase, contingent upon:

- Expansion into emerging markets with less generic competition.

- Continued awareness of its safety profile among prescribers.

- Efficacy improvements via combination therapies or formulation innovations.

Cost and Margins

Drug development expenses for ramelteon were recovered rapidly after launch. However, ongoing costs related to marketing, regulatory compliance, and patent litigation diminish net margins. The shift to generics reduces pricing power, exerting downward pressure on revenue and profit margins.

Strategic Opportunities

Potential avenues for improving its financial course include:

- Formulation Innovations: Developing long-acting or alternative delivery systems.

- New Indications: Investigating ramelteon’s role in circadian rhythm disorders beyond insomnia.

- Combination Therapies: Combining ramelteon with other agents for enhanced efficacy.

Currently, these remain speculative; the primary financial trajectory revolves around maintaining its niche status in a competitive market.

Regulatory and Market Challenges

Regulatory agencies’ cautious stance on sleep medications necessitates ongoing post-marketing surveillance to solidify safety claims. Moreover, insurance reimbursement policies favor cost-effective treatments, thus constraining pricing strategies and revenue potential.

Global expansion faces hurdles such as regulatory approvals, cultural perceptions of sleep drugs, and patent landscapes. Additionally, the global trend favoring non-drug interventions diminishes prescription volumes.

Key Takeaways

-

Niche Market Position: ROZEREM occupies a specialized segment focusing on safety, with a consistent but limited revenue stream influenced heavily by generic competition.

-

Competitive Pressures: Evolving pharmacotherapies, especially orexin receptor antagonists, challenge ramelteon’s market share, urging strategic innovation.

-

Regulatory and Consumer Trends: Increasing emphasis on safety, alongside a preference for non-pharmacologic treatments, shape prescribing behaviors that favor ramelteon’s profile but limit growth.

-

Patent and Pricing Dynamics: Patent expiry and generic competition have significantly compressed margins; future revenue depends on maintaining niche relevance and potential formulation innovations.

-

Market Opportunities: Aging populations and specific patient groups remain viable markets, provided safety perceptions sustain demand.

Conclusion

Ramelteon’s market dynamics are rooted in its unique safety profile and targeted mechanism, yet its financial trajectory faces headwinds from intense competition, patent expirations, and shifting treatment paradigms. While current demand persists among safety-conscious prescribers and patients, its growth outlook remains moderate. Strategic innovation and targeted market expansion could sustain or enhance its financial performance in a transforming sleep medication landscape.

FAQs

1. Is ROZEREM (ramelteon) more effective than traditional sleep aids?

Ramelteon offers a favorable safety profile but generally exhibits modest efficacy compared to benzodiazepines or Z-drugs, primarily aiding sleep initiation rather than maintenance.

2. What factors most influence the market performance of ramelteon?

Regulatory decisions, generic competition, prescriber and patient preferences, and emergence of new pharmacotherapies primarily shape its market performance.

3. Can ramelteon be used for conditions other than insomnia?

Research indicates potential in circadian rhythm disorders, jet lag, and delayed sleep phase syndrome; ongoing studies may expand its indications.

4. How does the loss of patent protection impact ramelteon’s revenue?

Patent expirations allow generics to enter the market, significantly reducing drug prices and revenue, pushing sales toward niche markets.

5. What are future prospects for ramelteon in the evolving sleep therapy market?

Future prospects depend on formulation innovations, expanded indications, and strategic positioning amid competition and non-pharmacologic treatment growth.

References

- Dijk DJ. Regulation of sleep and circadian rhythms by melatonin. Sleep Med Rev. 2003;7(4):291-300.

- Takeda Pharmaceutical Company. Annual Reports 2015-2020.

- US Food and Drug Administration. Ramelteon Label. 2005.

- Herring WJ, et al. The clinical utility of ramelteon: a review. Clin Ther. 2008;30(5):769-779.

- U.S. Patent and Trademark Office. Patent status of ramelteon.