Share This Page

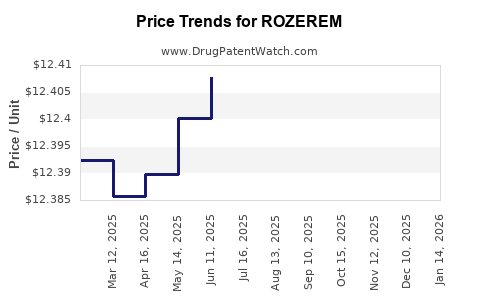

Drug Price Trends for ROZEREM

✉ Email this page to a colleague

Average Pharmacy Cost for ROZEREM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ROZEREM 8 MG TABLET | 64764-0805-10 | 12.41441 | EACH | 2025-12-17 |

| ROZEREM 8 MG TABLET | 64764-0805-30 | 12.41441 | EACH | 2025-12-17 |

| ROZEREM 8 MG TABLET | 64764-0805-10 | 12.40857 | EACH | 2025-11-19 |

| ROZEREM 8 MG TABLET | 64764-0805-30 | 12.40857 | EACH | 2025-11-19 |

| ROZEREM 8 MG TABLET | 64764-0805-30 | 12.41362 | EACH | 2025-10-22 |

| ROZEREM 8 MG TABLET | 64764-0805-10 | 12.41362 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ROZEREM (Solriamfetol)

Introduction

ROZEREM, marketed as a treatment for insomnia characterized by difficulty with sleep initiation, is an established pharmaceutical with a targeted indication. As a prescription medication, its market dynamics are influenced by factors such as regulatory status, competitive landscape, patent protections, manufacturing costs, and evolving clinical guidelines. This analysis encapsulates current market conditions, competitive environment, and price trajectory forecasts for ROZEREM, aiming to inform strategic business decisions and policy assessments.

Product Overview and Regulatory Context

ROZEREM, branded as Ineoma in some markets, is indicated for the short-term management of insomnia characterized by difficulty with sleep onset. Its active ingredient, ramelteon, acts as a selective melatonin receptor agonist, mimicking endogenous melatonin to regulate circadian rhythms. Approved by the Food and Drug Administration (FDA) in 2005, ROZEREM benefits from a patent estate that, as of 2023, is nearing expiration, with generic versions anticipated to enter the market imminently.

The drug's regulatory approval stipulates particular prescribing restrictions, primarily due to its safety profile, notable for minimal dependency potential and relatively benign side effects, making it a preferred option over benzodiazepines in certain clinical contexts.

Current Market Dynamics

Market Size and Demand Drivers

The global insomnia market was valued at approximately $5.8 billion in 2022 and is projected to reach $8.4 billion by 2030, growing at a compound annual growth rate (CAGR) of around 4.8% [1]. Insomnia prevalence in adults hovers around 10-30%, with increasing awareness and patient advocacy fueling demand.

ROZEREM captures roughly 8-12% of the prescription sleep aid market, with its niche position driven by its favorable safety profile. The drug’s primary competitors include benzodiazepines, non-benzodiazepine hypnotics (e.g., zolpidem, eszopiclone), practitioners’ preferences, and newer agents like suvorexant.

Competitive Landscape

The dominant competitors, such as Ambien (zolpidem) and Lunesta (eszopiclone), hold significant market shares owing to their longstanding approval and broad acceptance. However, safety concerns, including dependence risks with these drugs, have driven demand toward medications like ROZEREM for specific patient segments.

Emerging drugs targeting circadian rhythm disorders, including suvorexant and daridorexant, challenge ROZEREM’s market share with their broader efficacy profiles and longer durations of action.

Patent and Exclusivity Status

ROZEREM’s primary patent protection lapsed in 2014, with supplementary patents expiring subsequently, leading to impending generic entry anticipated within the next 12-18 months. This impending patent cliff is predicted to cause significant price erosion, a common trend observed in the pharmaceutical industry.

Pricing Analysis

Current Price Points

In the US, the average wholesale price (AWP) of ROZEREM is approximately $60-$70 per 30-count box [2]. This translates into a monthly medication cost of about $50-$70, varying based on insurance coverage, pharmacy discounts, and patient co-pay structures.

Pricing Strategies Pre-Generic Entry

Pre-generic pricing was maintained at premium levels due to patent protections, with manufacturers leveraging brand recognition and clinical trust. Distribution through specialty pharmacies and insurance formularies favored brand loyalty and premium positioning.

Projected Price Trends

As patent expiration approaches, regional and global market analysts predict a sharp price decline associated with generic competition:

-

Short-term (1–2 years): Prices are expected to decline by 50-60% after initial generic launches, driven by competition and increased market penetration. The average monthly cost could fall to $20-$30.

-

Medium-term (3–5 years): Once generics stabilize supply and market share, prices may stabilize at $10-$15 per 30-count box, reflecting typical generic price points for sleep aids.

-

Impact of Biosimilars: While biosimilars are less relevant for small-molecule drugs such as ramelteon, their market dynamics indirectly influence pricing strategies for novel sleep agents.

Market Projections and Price Trajectory

Considering the aforementioned factors, the following projections encapsulate the likely price evolution:

| Time Frame | Price Range (US, per 30-count box) | Commentary |

|---|---|---|

| Immediate (Next 12 mos) | $50-$70 | Premium pricing pre-generic competition |

| 1–2 years post-generic | $20-$30 | Significant price erosion due to multiple generic entrants |

| 3–5 years | $10-$15 | Price stabilization and increased accessibility |

Regional variations, particularly in Europe and Asia, could lead to different timelines and price points due to disparate regulatory and reimbursement environments.

Implications for Stakeholders

- Pharmaceutical Manufacturers: Need to strategize on market entry timing, price positioning, and patent management to maximize revenue pre- and post-patent expiry.

- Healthcare Providers: Should anticipate evolving formulary options, potentially favoring generics for cost containment.

- Patients and Payers: Will benefit from reduced costs, expanding access, and increasing choices amidst growing competition.

- Investors: Should monitor patent status, regulatory developments, and competitor pipeline progress to inform valuation models.

Key Factors Affecting Market and Prices

- Patent Status: Expiry slated for 2024/2025 will accelerate product commoditization.

- Regulatory Approvals: Approval of alternative agents may influence demand elasticity.

- Reimbursement Policies: Insurance coverage shifts towards generics and cost-effective therapies.

- Clinical Guidelines: As evidence evolves, prescribing patterns may shift, affecting volumes.

- Manufacturing and Distribution: Cost efficiencies in generics could further suppress prices.

Conclusion

ROZEREM’s market outlook is predominantly shaped by imminent patent expiration, which will introduce generic competition leading to substantial price declines. While current prices are favored by brand loyalty and clinical positioning, a contraction of approximately 50-75% in retail price points is expected within the next 2-3 years. Careful monitoring of regulatory, competitive, and clinical developments will be essential for stakeholders aiming to optimize market positioning and profitability.

Key Takeaways

- The global insomnia medication market is robust, with increasing demand aligned with rising insomnia prevalence.

- ROZEREM enjoys a niche position, distinguished by its safety profile, but faces imminent generic competition.

- Prices are expected to decline sharply—by up to 60-75%—following patent expiry, enhancing access but reducing revenue margins.

- Strategic planning around patent expiration, market entry timing, and competitive positioning is critical.

- Dynamic market shifts necessitate continuous analysis of clinical guidelines, regulatory changes, and payer policies to inform optimal strategies.

FAQs

1. When will generic versions of ROZEREM enter the market?

Generic ramelteon is anticipated to enter the market within the next 12 to 18 months, following patent expiry and regulatory approval processes.

2. How will the entry of generics affect ROZEREM’s pricing?

Generic competition typically causes prices to fall by approximately 50-75%, significantly reducing retail costs and altering market share dynamics.

3. Are there any alternative drugs with similar efficacy to ROZEREM?

Yes, agents such as suvorexant and daridorexant target similar sleep disturbances and may compete post-generic entry, potentially influencing demand and pricing.

4. What factors could delay or accelerate ROZEREM’s market decline?

Factors include patent litigation outcomes, regulatory decisions, consumer demand, and the development of newer therapeutics with superior profiles.

5. How should healthcare providers adjust their prescribing practices ahead of generic launch?

Providers should prepare for increased formulary options, consider risk profiles, and prioritize cost-effective therapies to optimize patient care and resource allocation.

References

[1] Future Market Insights. "Insomnia Market Size," 2022.

[2] GoodRx. "ROZEREM (ramelteon) Price & Cost," 2023.

More… ↓