Last updated: July 27, 2025

Introduction

Riluzole remains a landmark in neurodegenerative disease therapeutics, primarily approved for the management of amyotrophic lateral sclerosis (ALS). Since its initial approval by the U.S. Food and Drug Administration (FDA) in 1995, riluzole's market presence has been shaped by evolving clinical insights, regulatory landscapes, and competitive pressures. This analysis explores the dynamic market environment for riluzole, projecting its financial trajectory and identifying key factors influencing its commercial prospects.

Market Overview and Clinical Indication

Riluzole is a neuroprotective agent that modulates glutamate activity, delaying disease progression in ALS patients. ALS is an incurable, rapidly progressive neurodegenerative disorder affecting motor neurons, with an estimated prevalence of 5 in 100,000 globally. Despite its limited efficacy—extending median survival by merely 2-3 months—riluzole has retained its position as a standard-of-care treatment, owing to its unique mechanism of action and regulatory approval status.

The current global ALS market was valued at approximately USD 130 million in 2022, with riluzole accounting for the majority share, especially in North America and Europe [1].

Market Dynamics

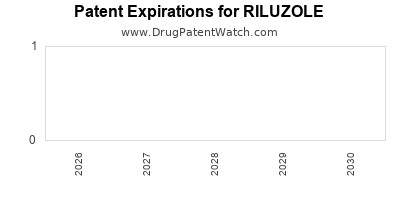

Regulatory Landscape and Patent Considerations

Initially developed by Sanofi, riluzole's patent has long expired, opening the door for generic formulations. This patent expiry has precipitated a decline in branded sales and increased price competition, thereby constraining revenue growth. However, regulatory data exclusivity in certain regions temporarily delayed generic entry, but most markets now feature multiple versions of riluzole at significantly reduced prices.

The absence of patent protection has incentivized off-label uses and formulation innovations, including sustained-release versions, which may extend the product lifecycle marginally. Regulatory agencies continue to scrutinize off-label prescribing, but genuine updates and indications could provide incremental revenue streams [2].

Market Penetration and Prescriber Preferences

Riluzole's prescribing remains entrenched due to clinical familiarity, albeit challenged by newer therapies under development. Clinicians weigh its modest survival benefit against cost and side-effect profiles. Increasing awareness about early diagnosis of ALS and supportive care strategies may sustain demand, especially in regions with established healthcare infrastructure. Conversely, in emerging markets, affordability and regulatory barriers limit its penetration.

Competitive Landscape

While riluzole monopolized ALS treatment for decades, recent entrants include other neuroprotective agents, combination therapies, and gene-based interventions, albeit none yet approved for widespread use. Experimental drugs targeting underlying disease mechanisms—such as Tofersen (sod1 antisense oligonucleotide)—are poised to supplement or replace riluzole as more efficacious options emerge. The introduction of such therapies could redefine market dynamics, exerting downward pressure on riluzole's revenue.

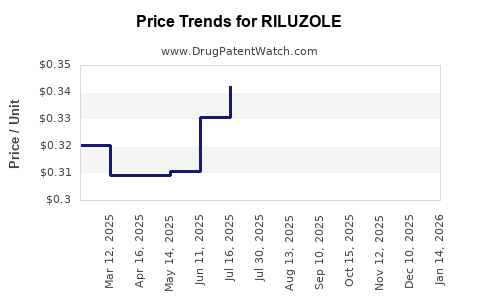

Pricing and Reimbursement

Post-patent expiry, pricing has plummeted. In the U.S., generic riluzole tablets are priced at approximately USD 0.50–1.00 per tablet, leading to low out-of-pocket costs for patients covered by insurance. Price sensitivity in developing countries and limited reimbursement frameworks restrain revenue growth globally. Coverage policies can significantly influence dispensed quantities, affecting overall sales.

R&D and Pipeline Developments

Research into new indications and delivery methods sustains some market interest. Trials focusing on neurodegenerative disorders beyond ALS—such as Parkinson’s disease—have been inconclusive or halted, limiting off-label expansion prospects. Nonetheless, pipeline drugs mimicking riluzole’s mechanism or enhancing its efficacy might influence future market dynamics.

Financial Trajectory Analysis

Historical Sales Performance

Following initial revenues of roughly USD 150 million in the late 1990s, sales peaked at approximately USD 180 million in 2005. Since then, sales have plateaued or declined marginally, predominantly due to generic competition. Recent estimates indicate global sales hovering around USD 80–90 million in 2022 [1].

Projected Revenue Trends

Forecasts suggest a continued decline in riluzole's revenues over the next five years, with compounded annual growth rates (CAGR) of approximately -4% to -6%. Such decline is attributed to:

- Market saturation.

- Off-label competition.

- Introduction of novel therapies.

However, revenue stabilization is possible if regulators approve new formulations, or if rare indications or combination therapies gain acceptance. The emergence of Alzheimer’s disease clinical trials and neurodegeneration studies presents an ancillary opportunity, albeit speculative at this stage [3].

Emerging Market Opportunities

Growing healthcare infrastructure and increasing neurologist awareness in Asia-Pacific and Latin America could expand riluzole’s usage, especially if prices remain low. Strategic partnerships and licensing agreements could bolster sales, particularly in regions where disease awareness campaigns are emerging.

Impact of Biosimilars and Generics

The proliferation of generic riluzole formulations has significantly diminished healthcare costs but challenged branded manufacturers’ profitability. Investments in pharmacovigilance, formulation improvements, and value-added indications are potential strategies to sustain revenues amidst generic competition.

Strategic Considerations for Stakeholders

- Pharmaceutical Developers: Focus on improving delivery mechanisms or developing combination products to differentiate from generics.

- Investors: Monitor regulatory approvals for new formulations, label expansions, or combination therapies that can extend market life.

- Healthcare Payers: Evaluate cost-effectiveness in light of limited clinical benefit; consider formulary restrictions to manage expenditures.

- Regulatory Bodies: Balance timely approval of innovative treatments against rigorous efficacy and safety assessments.

Key Market Challenges and Opportunities

| Challenges |

Opportunities |

| Patent expiration leading to generic competition |

Development of new formulations or delivery systems |

| Modest clinical benefits limiting demand |

Expansion into other neurodegenerative diseases |

| Competitive emergence of novel therapies |

Strategic regional expansion in underserved markets |

| Limited reimbursement and affordability |

Price reductions increasing access in emerging markets |

Conclusion

The market for riluzole faces significant headwinds due to patent expiry, modest clinical benefits, and competitive innovation. Its financial trajectory is predominantly bearish in the near to medium term, with expected declines compounded by generics and evolving treatment paradigms. Nonetheless, strategic adaptation—through formulation advances, regional expansion, and exploring new indications—may mitigate revenue erosion and sustain its place within the neurodegenerative therapeutic landscape.

Key Takeaways

- Market Saturation: Riluzole’s revenues are declining due to patent expiration and generic competition, with a forecasted CAGR of approximately -5% over the next five years.

- Clinical Limitations: The drug's limited efficacy constrains growth, emphasizing the need for innovative formulations or combination therapies.

- Emerging Opportunities: Opportunities exist in regional expansion and new indications, particularly in neurodegenerative diseases beyond ALS.

- Competitive Dynamics: The development of newer therapies and gene-based interventions could further displace riluzole’s market share.

- Strategic Focus: Stakeholders should prioritize formulations enhancement, geographic diversification, and pipeline development to prolong market relevance.

FAQs

1. What are the primary drivers influencing riluzole’s market decline?

Patent expiry, availability of generic formulations, modest clinical efficacy, and competition from emerging therapies are principal factors.

2. Are there any new formulations or delivery methods for riluzole in development?

While some sustained-release and alternative delivery systems have been explored, no major new formulations have received recent regulatory approval. Ongoing research focuses on improving bioavailability and tolerability.

3. Can riluzole be used for conditions beyond ALS?

Current evidence limits riluzole’s approved use to ALS. Investigations into other neurodegenerative diseases show limited success; future approvals are unlikely without compelling clinical data.

4. How does pricing impact riluzole’s market dynamics?

Post-generic entry, prices have significantly decreased, limiting revenue potential but improving patient access. Price sensitivity varies regionally, influencing sales volumes.

5. Will the emergence of gene therapies replace riluzole entirely?

Gene therapies targeting underlying disease mechanisms are promising but remain in early stages. They could eventually displace riluzole if proven safe and effective, but currently serve as complementary or alternative options rather than outright replacements.

References

[1] GlobalData. "ALS Market Analysis," 2022.

[2] FDA Regulatory Filings. "Riluzole Approvals and Patent Data," 2023.

[3] ClinicalTrials.gov. "Neurodegeneration Therapeutics Pipeline," 2023.